Bitcoin needs a purge to bounce back

0

0

The price of Bitcoin has dropped by 13% since the SEC approved the first spot ETF in early January. Nevertheless, some analysts believe that the worst is yet to come for the flagship cryptocurrency before it can bounce back.

Ripe Conditions for a Bitcoin Capitulation

Since the peak in early January, the price of Bitcoin has only fallen. However, according to MAC_D, an analyst at CryptoQuant, this downward trend could continue.

“To end the current bearish trend, a capitulation event needs to occur, involving the massive liquidation of leveraged long positions”, he explains.

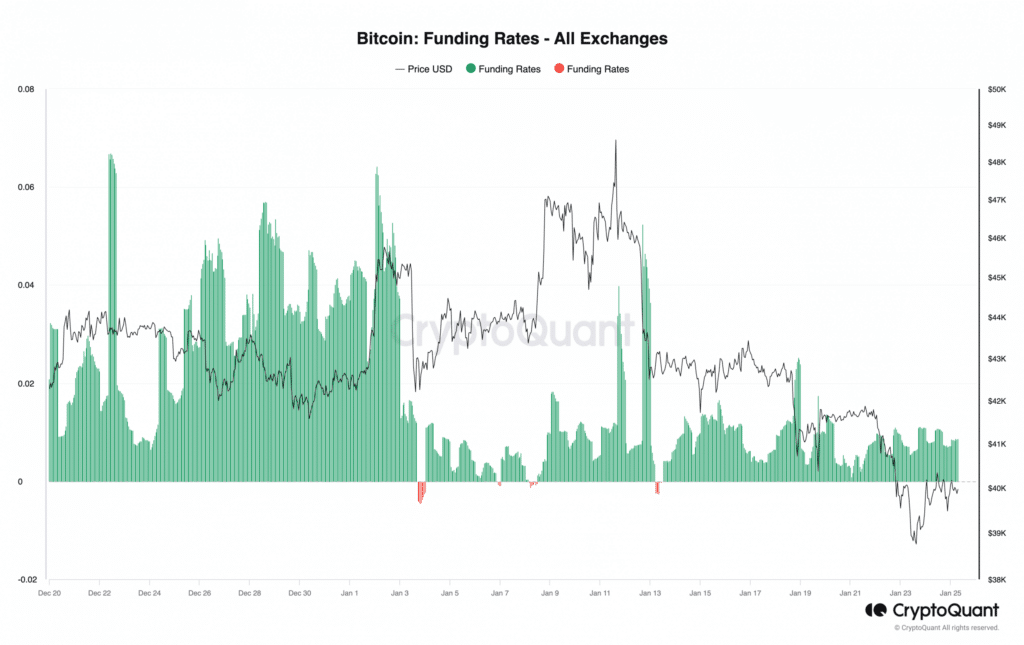

Indeed, on January 2nd, the hourly funding rate for Bitcoin had reached 0.049%, reflecting the accumulation of very speculative and risky long positions.

A purge of these excessive positions through a sharp decline in prices thus seems necessary to cleanse the market. It would likely be accompanied by a fall in the hourly funding rate, potentially into negative territory.

A Buying Opportunity to Seize

While a massive capitulation equates to extreme pessimism in the market, MAC_D thinks that it could represent an opportunity for long-term investors.

“If prices drop sharply and the funding ratio becomes negative on the hourly chart, this could indicate that leveraged traders are overly pessimistic about the market, which could be a good opportunity to buy back bitcoin”, the analyst asserts.

Therefore, if this scenario materializes, it will be important to monitor certain technical indicators and market sentiment measures to detect the bottom and the best moment to reposition for buying.

Indeed, the BTC exchange reserve has increased by 0.47% since the approval of the spot ETF while the rate of Bitcoin outflows from platforms has slowed by 10%.

An excessive correction would thus purge the market before a potential bullish rebound on sounder footing. Long-term investors could then take advantage of this excess pessimism to rebuild their positions.

0

0