Litecoin Price Drops 7% as the SEC Delays Canary Funds’ LTC ETF

0

0

Highlights:

- Litecoin price has decreased 7% to $81, as the bearish sentiment builds.

- This drop comes as the SEC delays Canary Fund’s proposal to list and trade the LTC ETF.

- LTC traders go long, betting on price increases, potentially clearing the $83 and $98 barriers.

The Litecoin price has dropped 7.94% to exchange hands at $81.87, as the crypto market wobbles. Despite the drop, its daily trading volume has spiked about 40% to $566M. This suggests that there are intense trading activities, hence increasing investor confidence.

Meanwhile, the crypto market has dwindled like a dead weight in the air, led by the Bitcoin price hovering around the $94K level. On the other hand, Ethereum is weakening and has breached the $1800 mark, as the cross-border payment token (XRP) loses key support at the 50-day SMA. The recent drop in LTC price comes following the SEC’s delay on the Canary Funds proposal to list and trade the LTC ETF.

The U.S. Securities and Exchange Commission has again delayed a proposal from @CanaryFunds to list and trade a spot Litecoin exchange-traded fund and is asking for public input.https://t.co/5bYUgEwb7d pic.twitter.com/fBYBS8hx0S

— Litecoin Foundation

(@LTCFoundation) May 5, 2025

Litecoin Price Outlook

A quick look at the LTC market shows that the Litecoin price is struggling below key moving averages, which are acting as immediate resistance for the market. For instance, the 50-day and 200-day MAs at $83 and $98 are curtailing the bulls against further upside. However, if the bulls gain strength and push toward the $83 mark, they will rekindle a short-term rally. However, for a bullish grip to be validated in the LTC market, the bulls must overcome the $98 barrier, calling for further upside.

The LTC technical indicators, including the Relative Strength Index, indicate some bearish prospects. This is evident as the RSI sits below the 50-mean level at 46.22. However, if the selling momentum soars, the RSI could keep falling towards the undervalued region and vice versa.

The Litecoin Moving Average Convergence Divergence (MACD) still upholds a bullish signal, as it sits in positive territory. Moreover, the green histograms are increasing, indicating growing buying pressure. With the buy signal evident in the market, the bulls could ignite a buy-back strategy, obliterating the $83 barrier in the short term.

The Litecoin price could sway in either direction, with the technical indicators showing mixed signals. On the downside, LTC could hit the $77 support area if the bears keep exerting pressure. In a highly bearish case, the $73 and $69 support areas will help the bulls regain momentum. However, if the bulls capitalize on the buy signal from the MACD indicator, the Litecoin price could flip the $83 resistance mark into support, igniting a short-term rally.

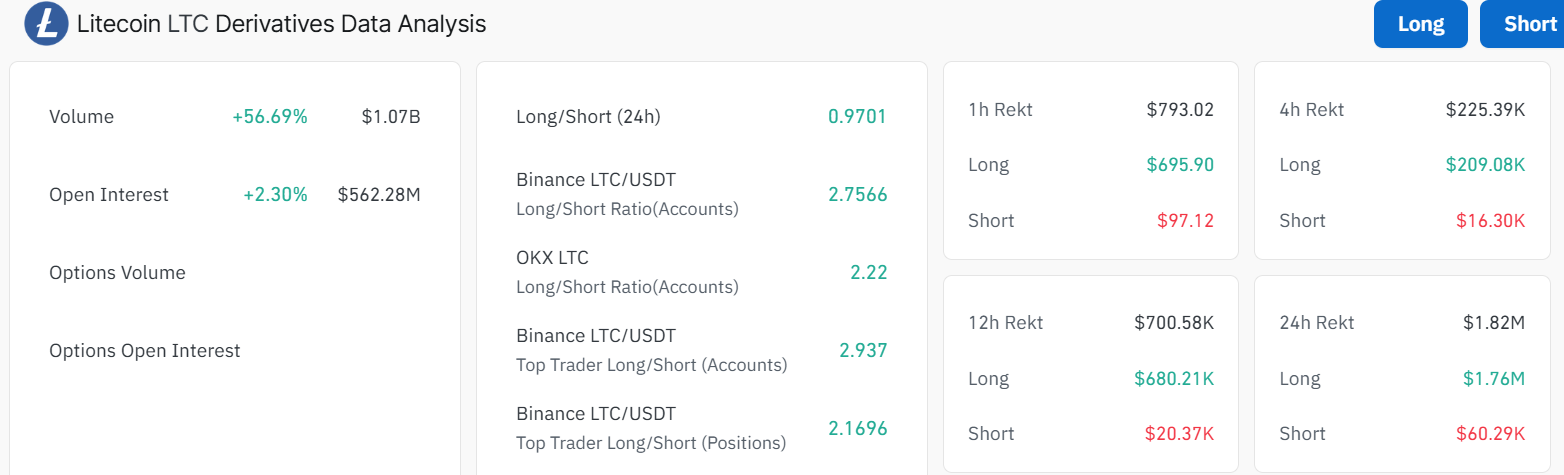

LTC Derivatives Analysis

The Litecoin derivatives data shows a surge in volume by about 57% to $1.07B, indicating intense market activity. On the other hand, open interest has soared 2% to $563M. A spike in volume and open interest shows that traders and investors are optimistic about the Litecoin price surge, as new money flows into the market.

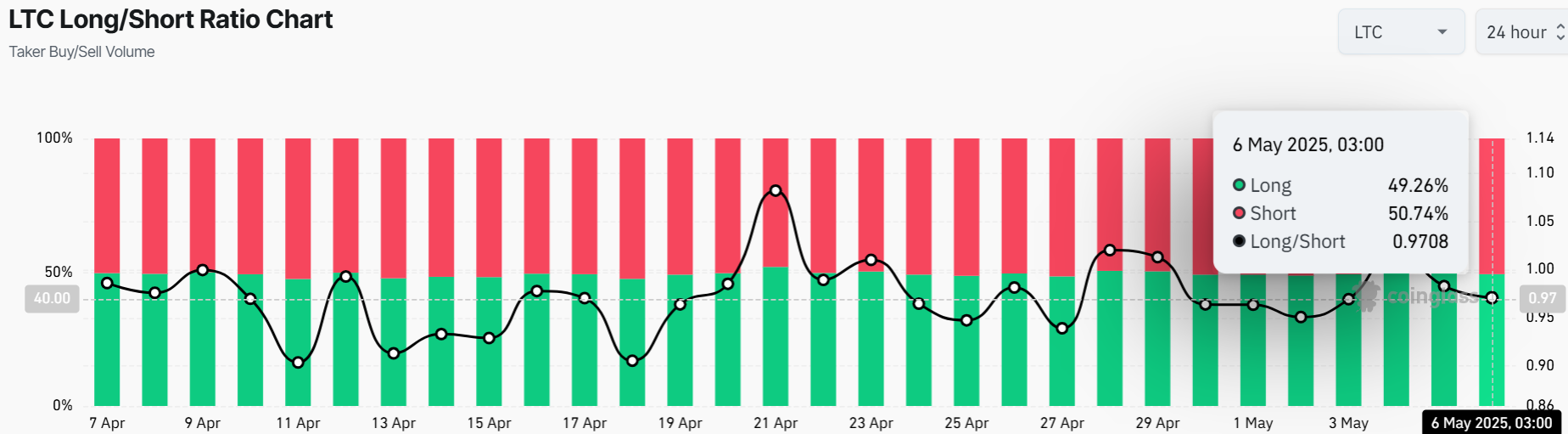

The long liquidations have surpassed the short ones, supporting the potential rally. This indicates that traders are betting on price increases in the LTC market soon. Meanwhile, the long/short ratio sits slightly below 1 at 0.9708.

If the bulls increase their buying appetite at this level and the long/short ratio soars to 1 or above, the Litecoin market will turn bullish. Until then, traders and investors should carefully monitor the technical indicators and resistance marks to determine the next move in LTC.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.