Bitcoin’s Latest Market Correction: Insights from Glassnode

0

0

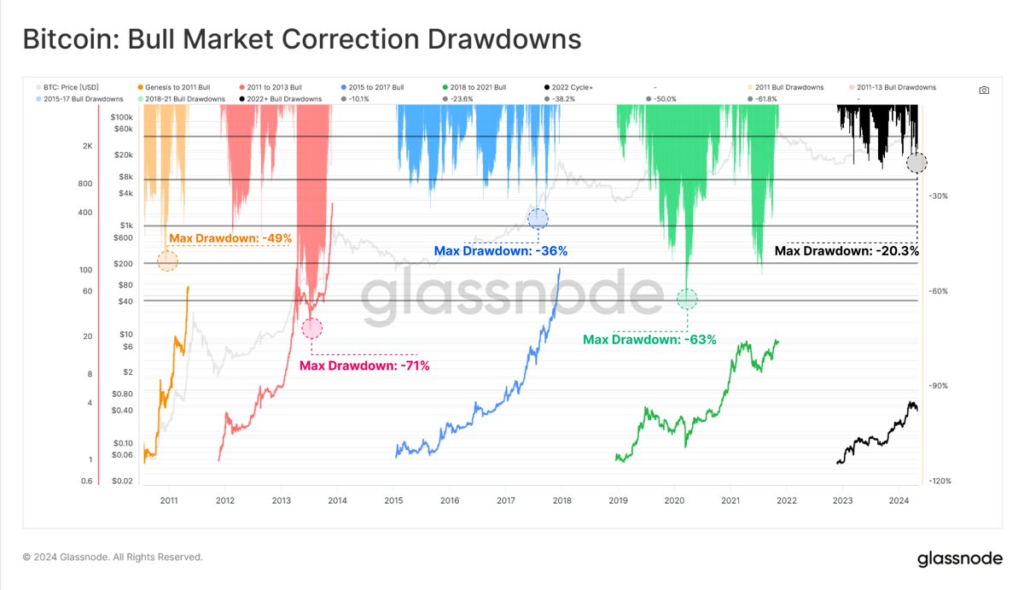

The cryptocurrency market has experienced its fair share of fluctuations, and Bitcoin, the leading digital currency, has recently undergone a notable price correction. According to a report from analytics firm Glassnode, Bitcoin’s price has retreated from its all-time high (ATH) of $73,000, marking a significant downturn in its market value.

This decline represents the most substantial correction since the lows experienced in November 2022, following the collapse of the FTX exchange.

Despite this downturn, the broader trend for Bitcoin remains notably robust compared to historical performances. The recent corrections are less severe than those observed in past cycles, suggesting a resilience in the macro uptrend. This resilience indicates that while the market faces downward pressure, the underlying momentum for Bitcoin could still be strong, pointing towards a potential recovery.

Assessing the Depth of the Correction

Glassnode’s analysis highlighted that from the $73,000 peak, Bitcoin’s price corrected by approximately 20.3%, marking the deepest decline on a closing basis observed since the aftermath of the FTX crisis. This significant drop brings into focus the volatility inherent in the cryptocurrency markets and the rapid changes in investor sentiment that can occur.

The comparison with the post-FTX period is particularly poignant, as it was one of the most turbulent phases for Bitcoin, with the market grappling with heightened regulatory scrutiny and investor wariness.

Despite these challenges, the current market behavior demonstrates a certain degree of resilience. The corrections, though sharp, have not spiraled into longer-term bear markets as seen in previous cycles. This suggests that investors might still have confidence in the potential of Bitcoin to rebound and continue its growth trajectory.

Looking Forward: The Resilience of Bitcoin’s Macro Uptrend

The resilience of Bitcoin’s macro uptrend is a critical aspect of Glassnode’s report. Despite the 20.3% correction, the overall upward trend since the lows of November 2022 has been more stable than in many previous periods. This stability is significant, indicating that the market could be maturing, with fewer extreme dips and more gradual adjustments.

Moreover, the current corrections being shallower than in previous cycles could suggest that Bitcoin is entering a phase where its value is not solely driven by speculative trading but is starting to reflect more foundational aspects, such as institutional adoption, technological advancements, and broader economic factors. This change could lead to more sustainable growth patterns and less dramatic corrections.

0

0