Open-source CoinOptimus trading bot updated to v2.0.0

1

0

We prepared a huge update for CoinOptimus, a self-hosted cryptocurrency trade bot designed specifically with non-professional traders in mind.

ADAMANT CoinOptimus repository: https://github.com/Adamant-im/adamant-coinoptimus

Release: v2.0.0

New commands

The update includes refactoring, bug fixes and five new commands:

- /fill

- /stats

- /deposit

- /account

- /info

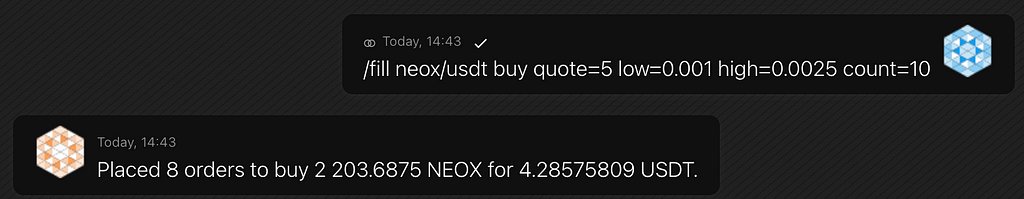

Filling the order book

The bot can fill order books with a series of orders in a single command:

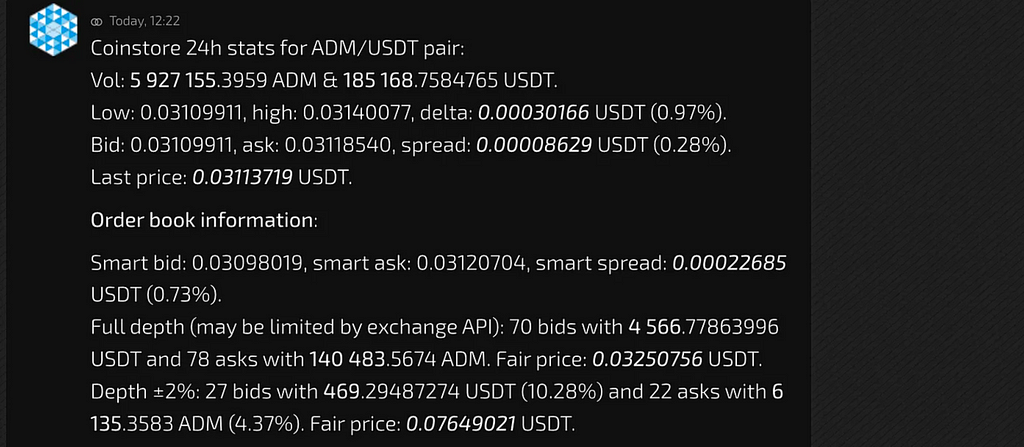

Getting stats

The command /stats shows trading pair statistics:

- Trade pair prices, lows and highs, trading volume

- Order book’s highest bid, lowest ask and spread

- Order book liquidity

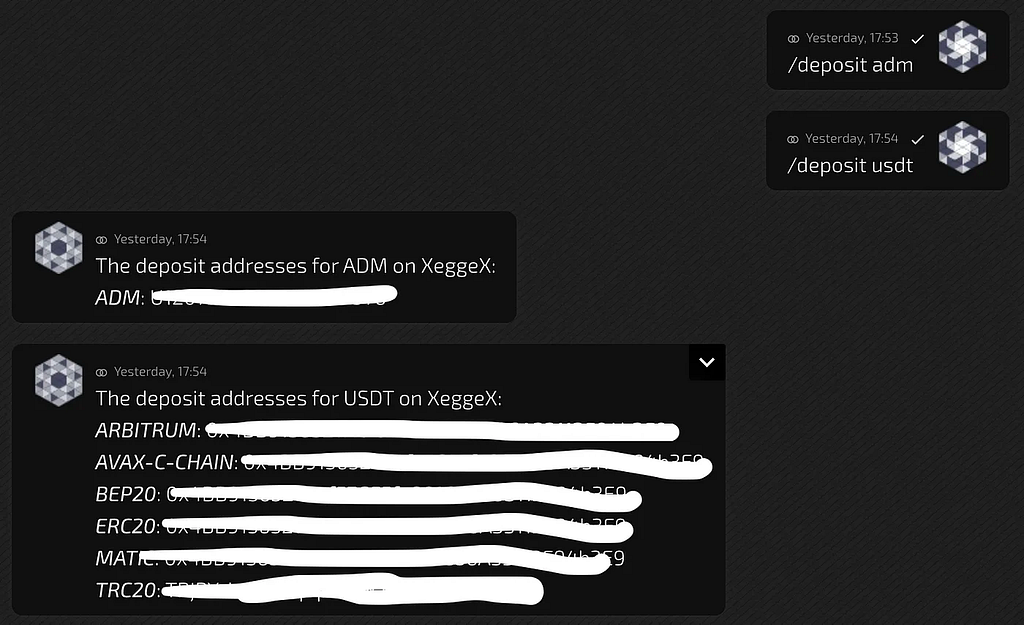

Get deposit addresses for different chains

Receive an address to top up an exchange account with the /deposit command:

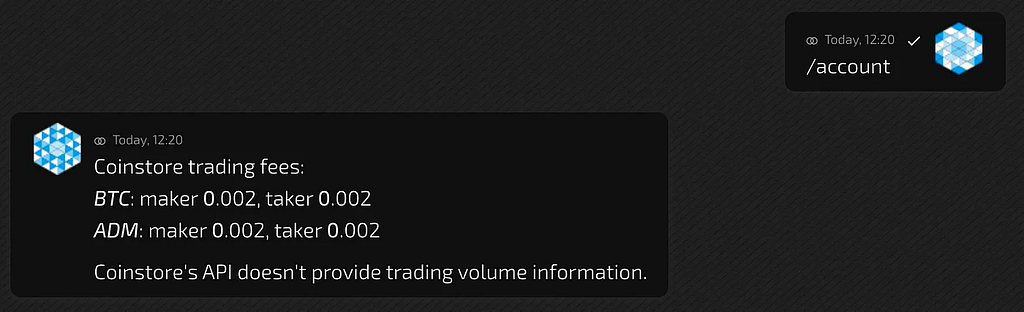

Account info

The command shows trading fees and monthly trading volume for the bot’s account, if available.

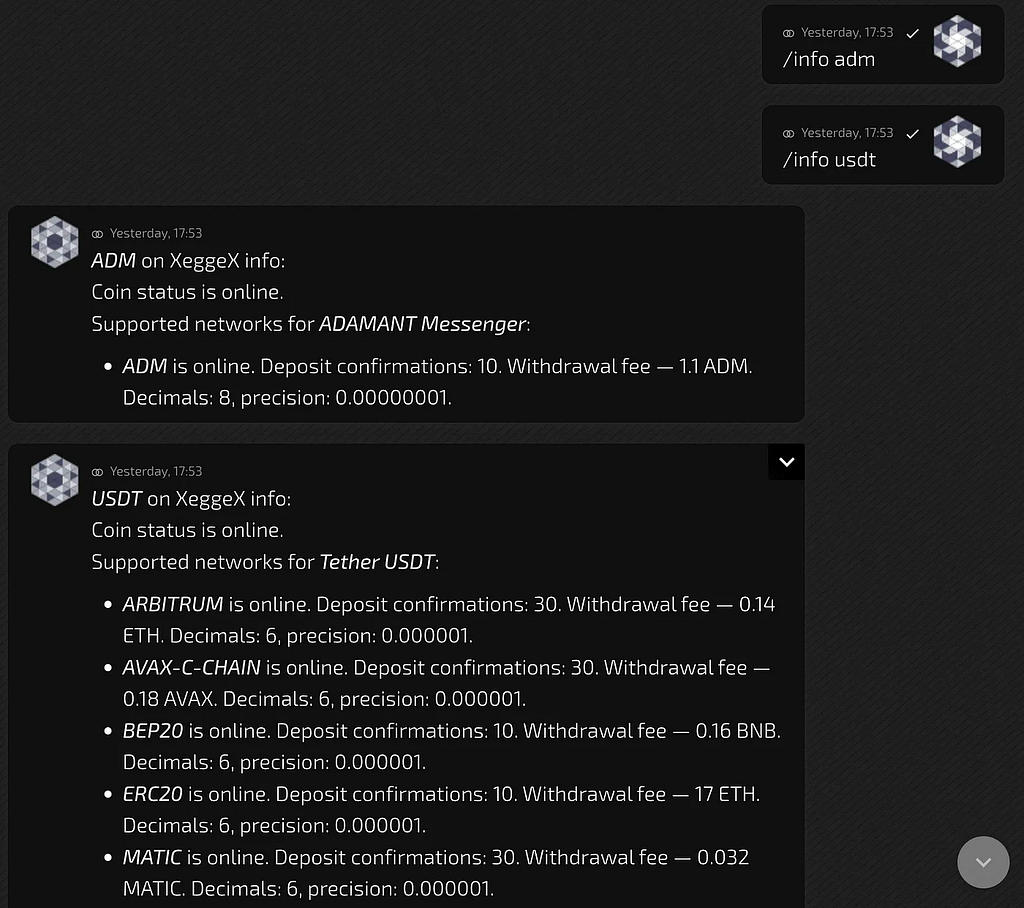

Show coin and chain info

With the new /info command, you can see all available info for the specific coin.

How CoinOptimus Works

CoinOptimus operates using Node.js and runs continuously on your server/VPS. Initially, you set up a config specifying the exchange and the pair you want to trade. CoinOptimus uses API keys obtained from your crypto exchange and your crypto balances on your exchange account. To manage the bot, you send commands via ADAMANT Messenger, and it responds accordingly, running your trading strategy and placing orders.

See the setup instructions.

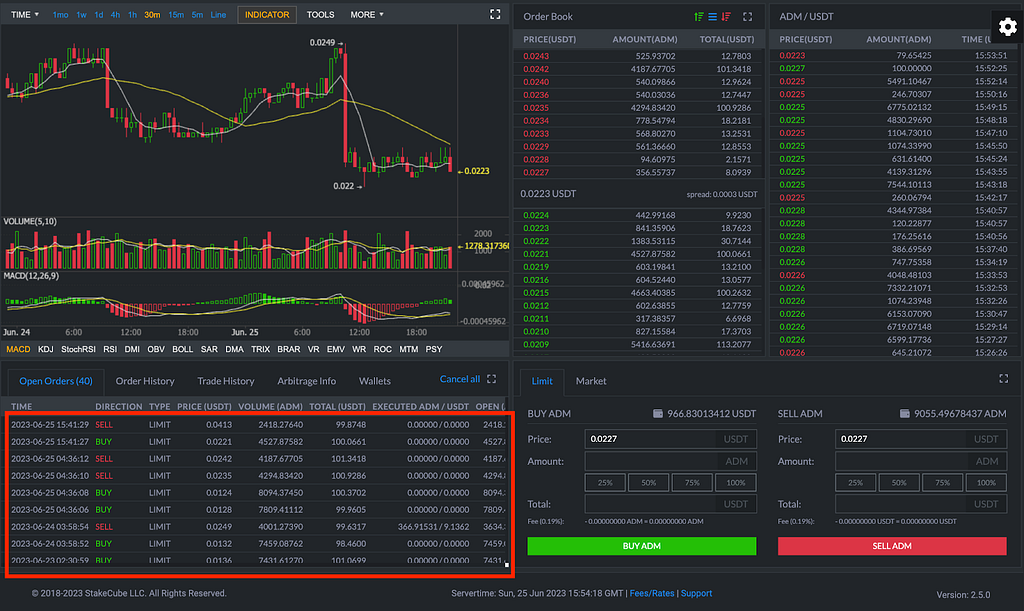

CoinOptimus primarily employs the Optimal Ladder/Grid Trade Strategy. In this approach, the bot places multiple orders to buy and sell tokens, with prices starting from the spread.

You can see orders placed and maintained with the Ladder strategy:

Once the closest order to the spread gets filled, the bot adds a similar order on the opposite side, following the principle “buy lower than you sell, and sell higher than you buy”. This strategy is especially effective in a volatile market. See trades history example:

Disclaimer

CoinOptimus is NOT a sure-fire profit machine. Use it AT YOUR OWN RISK.

Open-source CoinOptimus trading bot updated to v2.0.0 was originally published in ADAMANT on Medium, where people are continuing the conversation by highlighting and responding to this story.

1

0