XRP Price Recovers as XRPL Ledger Explodes with $131.6M in RWA – Analyst Eyes $3.70

0

0

Highlights:

- The XRP price shows signs of life, rebounding about 1% to $2.82.

- XRPL Ledger has recorded a whopping $131.6M in tokenized real-world assets (RWA) in Q2.

- Ali Martinez foresees a rally to $3.70 if the $2.90 key is broken.

The XRP price is showing signs of a potential rebound, as it is up almost 1% after a red weekend. After plummeting by about 21% to $2.72, XRP appears poised to bounce back, following strong fundamentals. To start with, the daily trading volume has increased 86% to $6.03 billion, indicating growing investor confidence. On the other hand, the XRP Ledger (XRPL) has recently reached a historic milestone, issuing the largest amount of tokenised real-world assets (RWAs) in Q2, totalling $131.6 million. This expansion signifies a rise in the popularity of XRPL in the digital asset sector.

XRPL RECORDS HIGHEST RWA ISSUANCE#XRPLedger just closed Q2 2025 with $131.6M in tokenized real-world assets (RWA)—its highest ever.

Fueled by new issuances announced at #XRPL Apex Singapore, adoption is accelerating fast!

pic.twitter.com/kzT8pC1yuk

— Coin Bureau (@coinbureau) August 31, 2025

The increase in RWAs is an indication of the growing number of uses of the XRP ecosystem and its increasing acceptance across both businesses and users. The rising transaction volume and growing demand for XRP-based digital assets are driving this upward trend. As the XRP ecosystem continues to grow at an impressive pace, market analysts are predicting additional bullish bias in the market.

XRP Price Eyes Recovery

As the chart below indicates, the market cap of XRP and transaction fees have been gradually increasing over time. This suggests that XRP has gained more influence in the cryptocurrency market. It highlights how the XRPL has been increasingly adopted and embraced in various industries, which have contributed to its growing market worth and volume.

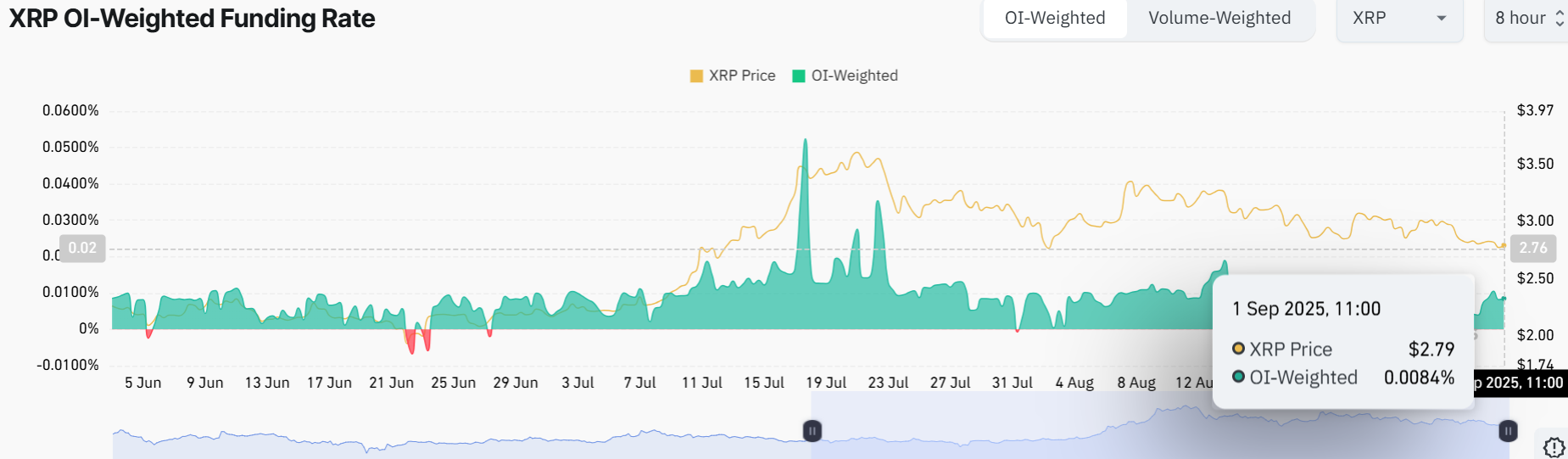

XRP has experienced significant volatility, particularly in the summer of 2025. The OI-weighted funding rate chart of XRP shows that the price surged during June and July, with a peak in mid-July. Currently, it sits at 0.0084%, indicating that the longs have the upper hand in the market.

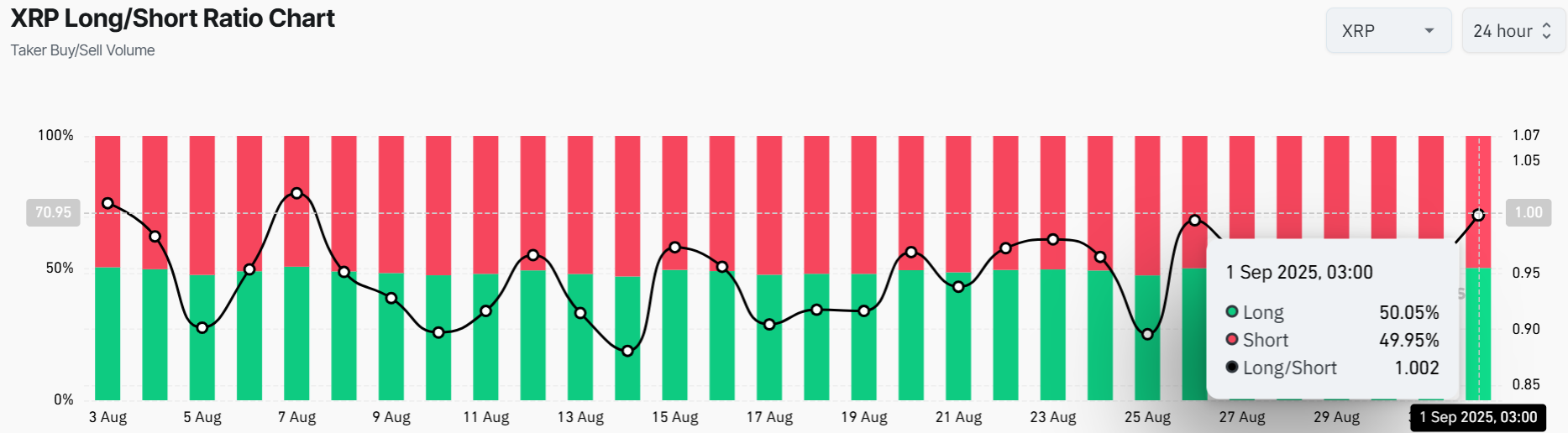

Apart from the Weighted funding rate, the XRP Long/Short Ratio reveals a varying market sentiment. The long-short ratio is 1:1 as of September 1, 2025, indicating a neutral market, as all traders are equally split on the near-term price outlook of XRP. This equilibrium may mark a critical period where market participants are waiting for new catalysts, but the odds tend to lean more to the upside.

The latest XRP/USD chart suggests that further bullish momentum is possible, as the price is rebounding. Currently, the $2.48 mark is boasting a strong support as bulls target the immediate resistance at $3.09 level. A close above this area will see XRP price target $3.30 mark and beyond.

Notably, the Relative Strength Index (RSI) and MACD indicate that the market is entering a consolidation phase. This trend is being closely followed by traders and investors, and may indicate an imminent breakout to the $4 mark.

XRP Poised for a Rally to $3.70

Currently, the structure is a classic breakout pattern. The consolidation provides a strong base, and the surge shows clear buying pressure. Now, the market is watching to see whether the XRP price can build enough strength to push past the $2.90 resistance. For traders, ”a breakout above $2.90 could signal the start of a stronger uptrend towards $3.70,” according to Ali Martinez.

Bullish path for $XRP:

– defend $2.70,

– break $2.90,

– then target $3.70. pic.twitter.com/eZbNh3ZP5C— Ali (@ali_charts) September 1, 2025

Conversely, if the $3.09 resistance proves too strong, the cross-border payment token may drop towards $2.72-$2.70 support zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.