Dogecoin Accumulation Grows as $1.63M Liquidity Forms Near $0.11

0

0

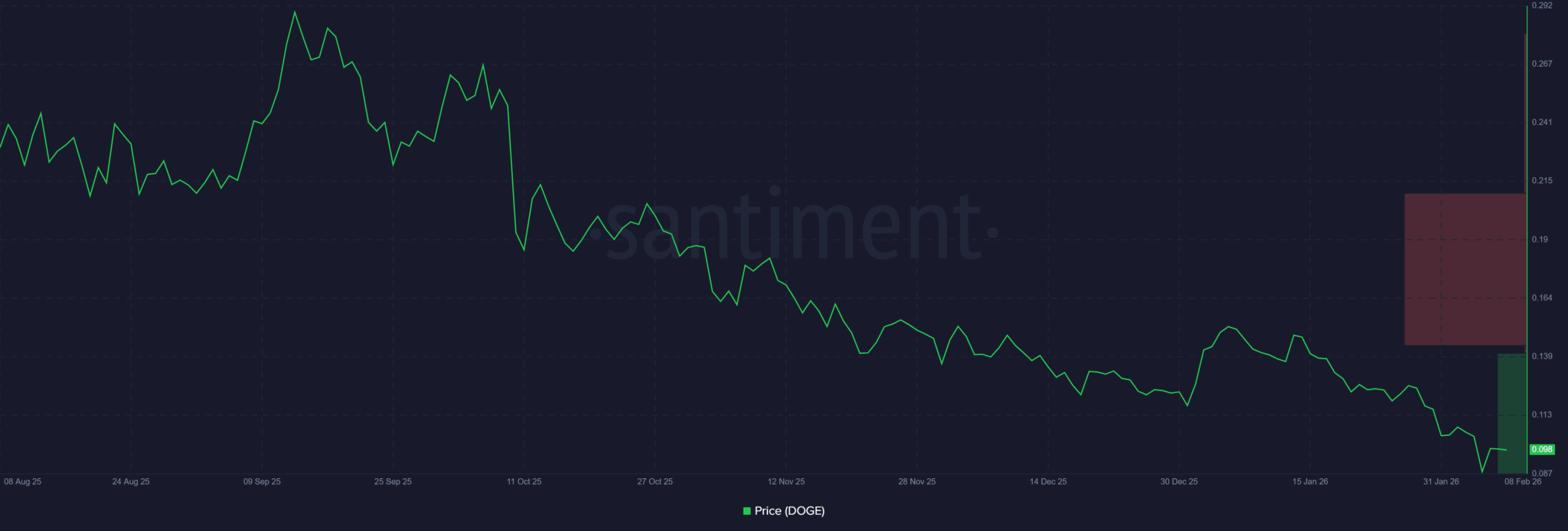

This article was first published on The Bit Journal. Dogecoin (DOGE) is entering a potentially pivotal phase as its realized acquisition cost drops to the lowest level seen in months, reshaping the token’s short-term risk-reward outlook and drawing attention to renewed Dogecoin accumulation trends.

Lower Prices Spark Renewed Dogecoin Accumulation

The recent price drop has seen DOGE cheaper to accumulate at the current market prices, which historically accompanies the accumulation of Dogecoin as buried capital seeks entry value points. Simultaneously, on chain information indicates that current holders are not in a hurry to dispose of positions. Rather, sentiment is quite steady, despite the larger crypto market suffering a downturn.

On-chain metrics show that the realized acquisition cost of DOGE has turned into a local low, which in the past coincided with periods of transition that have usually been characterized by an increase in Dogecoin accumulation. These stages are likely to occur when buyers value and sellers hesitate to sell the product, decreasing the pressure to sell a product. As the memecoin industry undergoes disruption due to the broader market downturn, Dogecoin can now be in a position to enter such a transition period.

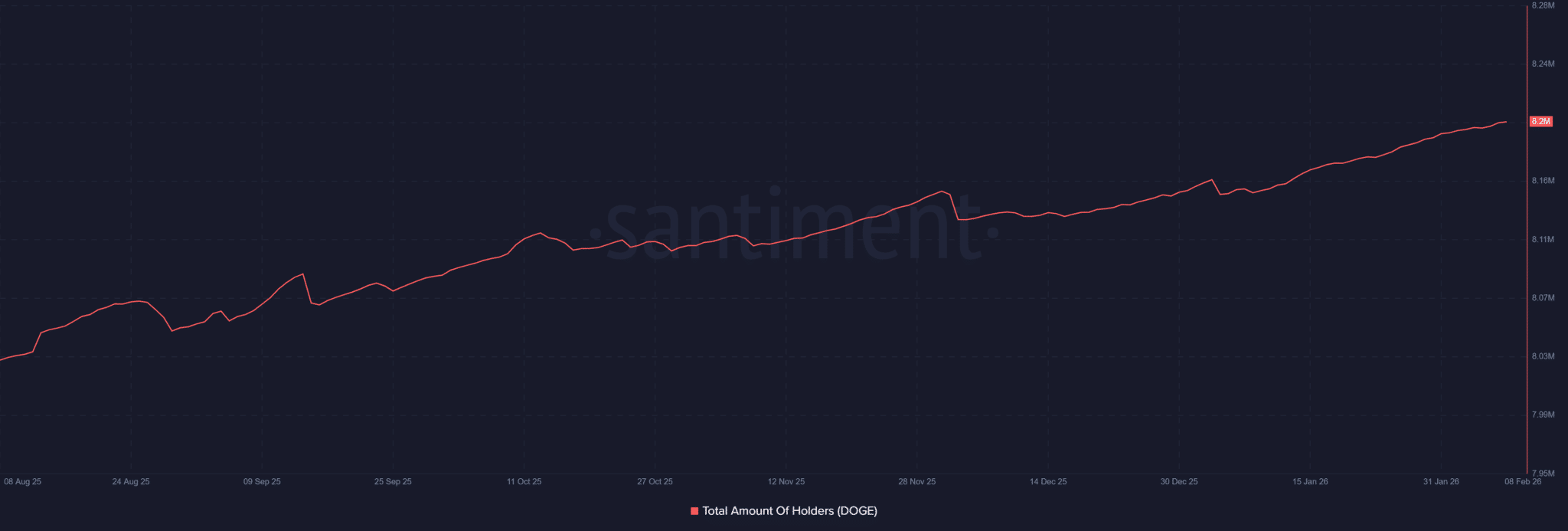

Rising Holder Base Supports Price Stability

Another significant trend of this stance is the fact that the DOGE holders are on the steady rise. Statistics indicate that the number of holders has increased by about 8.2 million and is on a steady upward trend even after being volatile recently. This growing base then offers a structural support that tends to support temporary Dogecoin accumulation during the periods of consolidation.

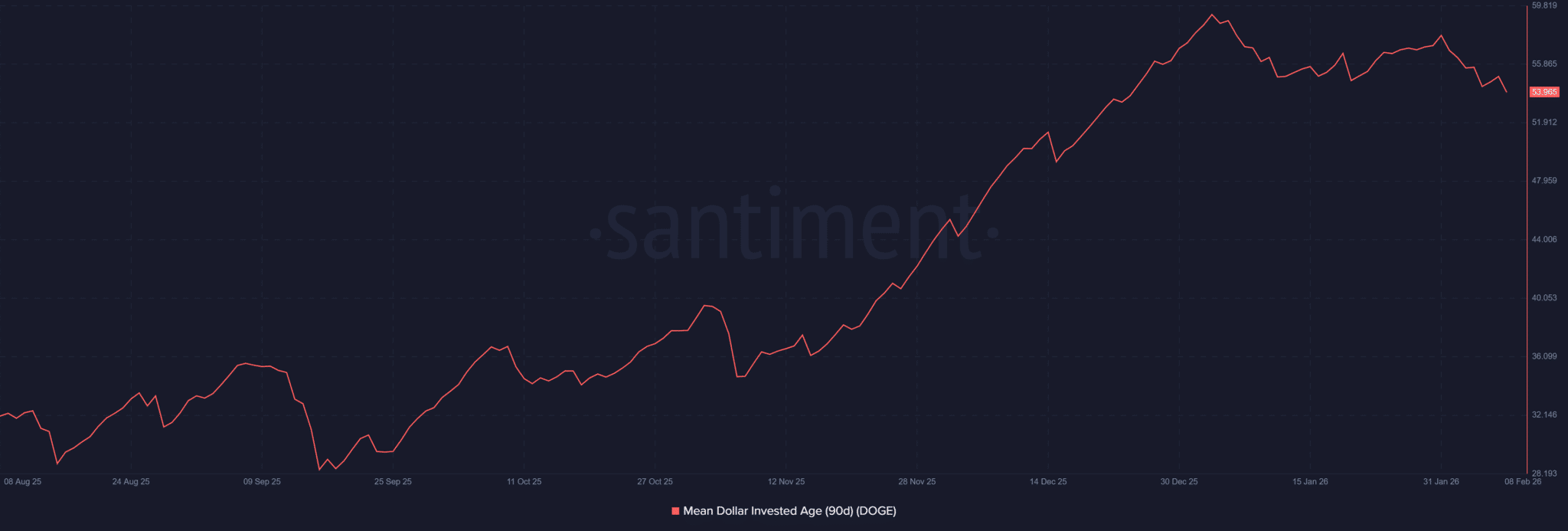

The long-term holder behavior also indicates conviction, as opposed to panic. The Mean Dollar Invested Age (MDIA) was already 53 as of writing, so coins are not circulating aggressively. This trend indicates that long-term investors are remaining in place as the Dogecoin accumulation among new market participants quietly gathers strength. The downside pressure tends to diminish whenever the holders do not desire to sell at lower prices.

Flag Pattern Supports Dogecoin Accumulation Phase

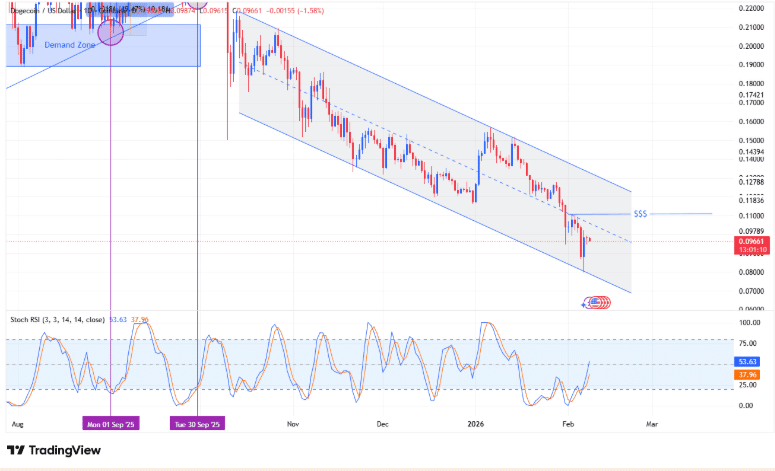

Technically, Dogecoin is still consolidated in a flag formation, and the price moves have narrowed down as the previous bullish trends were indicated to decelerate.

Although such consolidation indicates a short-term lack of decisiveness, it also puts in place a situation that tends to support gradual accumulation of Dogecoin before major directional accumulations. Momentum indicators suggest that the larger trend might not be tapped out with the Stochastic RSI showing a recent recovery after hitting an oversold zone.

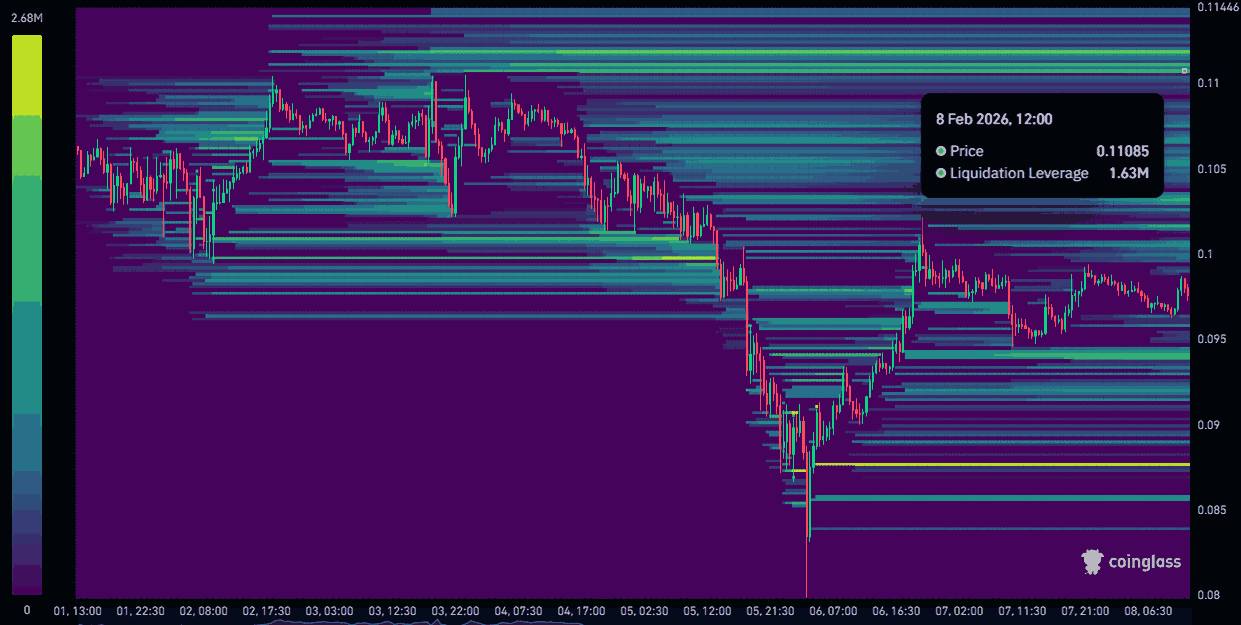

The derivatives statistics also emphasize a possible short-term target. The liquidation heatmap analysis indicates that there is a significant liquidity cluster of about 1.63 million at the approximate level of 0.11. Such zones are often attracted to the markets and a continuous Dogecoin accumulation may enhance the possibility of price getting pulled to this level.

Liquidity Pull May Drive DOGE Higher

In case fresh capital is still flowing into DOGE, the price action may be drawn towards this pool of liquidity. Any shift to 0.11 would be beyond just a typical bounce because that would put the existing supply zone into invalidity and would indicate that Dogecoin accumulation is now shifting into a breakout stage.

In the meantime, the structure of Dogecoin seems to be less hype-driven and focused on the dynamics of liquidity. As the acquisition prices are low, the holder conviction is stable, and there are indications that the Dogecoin could continue to be accumulated, things are slowly falling into place. Whether the buyers intervene with enough conviction can be the factor that helps DOGE to break its range and seize a new directional shift.

Conclusion

Dogecoin accumulation seems to be silently gaining ground with its acquisition low, holder belief intact and clearly defined liquidity target overhead. With a decisive inflow of fresh capital, the $0.11 level would also serve as a catalyst, which would likely disrupt the existing consolidation process, and the new bullish phase may begin.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Dogecoin’s acquisition cost hits a local low, encouraging accumulation while holders remain steady.

- DOGE holders rise by 8.2 million, with long-term holders showing strong conviction.

- Technically, DOGE consolidates in a flag pattern; Stochastic RSI hints at bullish potential.

- $0.11 liquidity cluster may act as a near-term target, possibly triggering a breakout.

Glossary of Key Terms

Dogecoin Accumulation: Gradually buying and holding DOGE at low prices.

Acquisition Cost: Price at which DOGE was purchased.

Realized Acquisition Cost: Average cost all holders paid for DOGE.

MDIA (Mean Dollar Invested Age): Average time coins have been held.

Flag Pattern: Consolidation chart formation indicating trend continuation.

On-Chain Metrics: Blockchain data showing holder and coin activity.

Derivatives Statistics: Data from DOGE futures, options, and derivatives.

Consolidation: Period of narrow price movement.

Liquidity Pull: Price drawn toward concentrated liquidity zones.

Frequently Asked Questions about Dogecoin Accumulation

1. Why is DOGE cheaper now?

Acquisition costs hit a local low, making DOGE cheaper to accumulate.

2. How many DOGE holders exist?

Holder count rose by about 8.2 million, supporting accumulation.

3. What do technical signals show?

DOGE consolidates in a flag pattern; Stochastic RSI hints at bullish momentum.

4. Why is $0.11 important?

A $1.63M liquidity cluster there could trigger a breakout.

References

Read More: Dogecoin Accumulation Grows as $1.63M Liquidity Forms Near $0.11">Dogecoin Accumulation Grows as $1.63M Liquidity Forms Near $0.11

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.