CME Group Plans Spot Bitcoin Trading Launch to Meet Wall Street Demand

0

0

CME Group, the world’s largest futures exchange, will introduce spot Bitcoin trading, as reported by the Financial Times on Thursday.

This move aims to meet the growing demand from Wall Street money managers for cryptocurrency exposure.

CME Group Plans Bitcoin Spot Trading

The Chicago-based exchange has been in discussions with traders seeking a regulated marketplace for Bitcoin transactions. While the plan isn’t finalized, it marks a significant step in integrating traditional finance with digital assets.

Read more: What Are Bitcoin Futures?

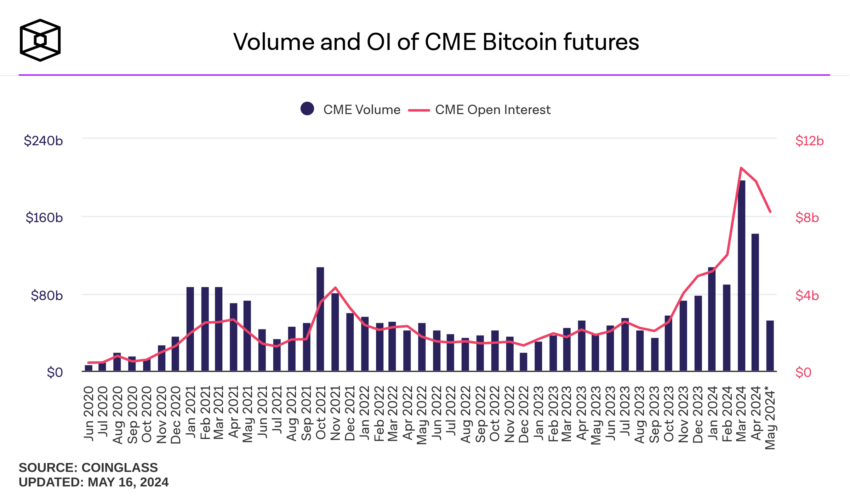

The CME is currently the leading BTC futures exchange by open interest, while Binance dominates the spot market. Though still under consideration, a spot trading offering on CME would allow Wall Street to take a bigger punt on Bitcoin outside ETFs.

Spot Trading Operations

Volume and OI of CME Bitcoin future. Source: The block

Volume and OI of CME Bitcoin future. Source: The block

CME’s potential spot trading business will operate through Switzerland’s EBS currency trading venue. This venue has stringent regulations for trading and storing crypto assets. However, there are questions about whether CME can achieve significant market share with operations split between Chicago and Switzerland.

“I struggle to see how they would get all the efficiencies available to them”, one crypto trading executive told FT.

Meanwhile, Markus Thielen, founder of 10x Research, suggests that crypto exchanges might lose business if CME enters the spot market. This shift could attract institutions to prefer regulated trading platforms. The future of Bitcoin trading on CME could pave the way for further mainstream acceptance and integration of cryptocurrencies.

Bitcoin’s resurgence from its 2022 low to a record high earlier this year has fueled institutional interest. Despite losing one-fifth of its value since its March peak above $73,000, BTC remains a hot commodity, and exchange-traded funds linked to Bitcoin have become the fastest-growing ETFs ever.

Hedge funds like Bracebridge Capital and pension funds like the Wisconsin Investment Board are among the large investors in Bitcoin. These institutions have invested over $10 billion in vehicles managed by firms like BlackRock, Fidelity, and Ark.

0

0