$80K Bitcoin Becomes the Most Popular Bet, but Will the BTC Price Crash?

0

0

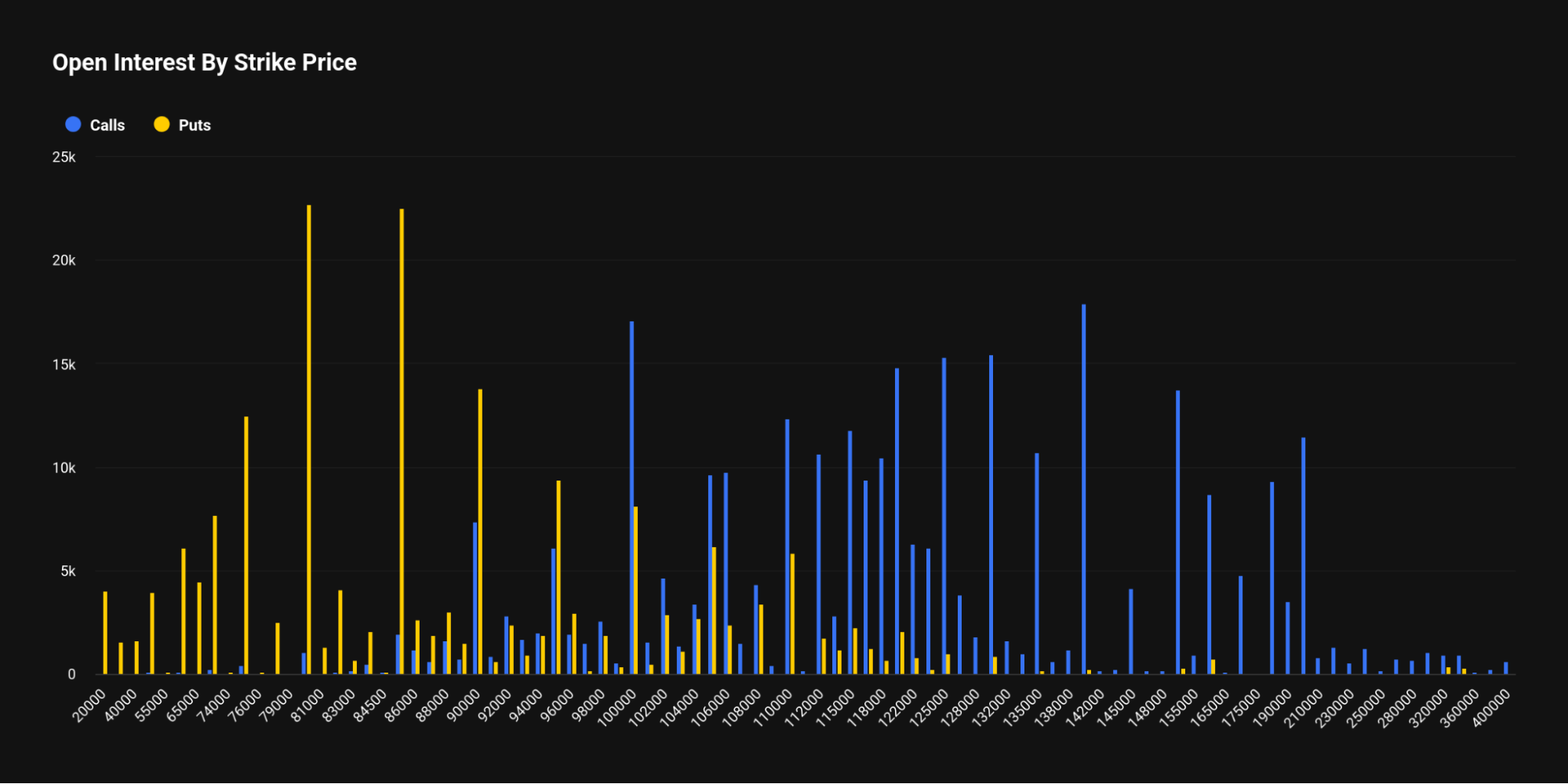

Bitcoin’s BTC $86 057 24h volatility: 0.8% Market cap: $1.72 T Vol. 24h: $69.56 B options market is swinging heavily toward bears, with the $80,000 put now emerging as the most popular contract on Deribit.

The put option holds over $2 billion in open interest, surpassing the $85,000 put at $1.97 billion.

The once-dominant $140,000 call has seen its open interest drop to $1.56 billion, as per Deribit data. The rise in put demand indicates that investors expect Bitcoin to crash below $80,000.

Stronger Setup for a Rally

On-chain data from CryptoQuant shows clear capitulation among short-term holders. If this is a standard correction, current levels could form a bottom.

However, if a bear cycle is beginning, the decline may continue. The critical level remains $80,000 and falling below it increases the chances of a crypto winter.

Swissblock added that, historically, Bitcoin tends to experience another momentum-driven drop to clear liquidity pockets in the $80,000 to $82,000 region.

They argue that such a move would create the strongest setup for a larger push upward.

Historically speaking, we would expect another lower momentum drop to take out the $80 to $82k liquidity clusters.

This will be the strongest setup for a larger move up. https://t.co/SVJRTjFs0W

— Swissblock (@swissblock__) November 24, 2025

Meanwhile, analyst Ted Pillows warned that failure to reclaim the $88,000 to $90,000 range soon may open the door to fresh monthly lows.

On the other hand, CryptoQuant analysts revealed that the sSOPR metric has been forming a nearly two-year convergence, now rebounding off its lower boundary.

$BTC got rejected from its resistance level.

If Bitcoin doesn't reclaim the $88,000-$90,000 level soon, it could drop towards a new monthly low. pic.twitter.com/jLLy82OSL6

— Ted (@TedPillows) November 24, 2025

They note that Bitcoin has not yet experienced a true bullish rally in this cycle due to ETF-driven delays and large-scale accumulation.

With that accumulation phase nearing its end, they believe a new uptrend is beginning to take shape.

Although the market remains in the state of “Extreme Fear” with Fear and Greed Index reading 12, analysts also agree that a catastrophic drop of 70% or more seen in previous bear markets is unlikely to happen this cycle.

ETF Capitulation Intensifies Market Stress

The 11 US-listed spot Bitcoin ETFs processed more than $40.32 billion in cumulative volume last week.

BlackRock’s IBIT accounted for nearly 70% of the total, with $27.79 billion traded during the week and $8 billion on Friday alone.

At the same time, Bitcoin has dropped 23% in the past month to $86,700, briefly falling to nearly $80,000 on some exchanges.

The post $80K Bitcoin Becomes the Most Popular Bet, but Will the BTC Price Crash? appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.