Breakthrough in Lab-Made Gold Could Drive Bitcoin Demand | US Crypto News

0

0

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for an intriguing read of how science has become the biggest threat to gold’s market value, a move that could inadvertently bode well for Bitcoin’s hedge status.

Crypto News of the Day: Gold Faces Major Threat from Science, Bitcoin to $1 Million By 2028?

Reports, citing lab work at CERN, suggest that scientists could soon be able to recreate gold in the lab. As it happened, scientists at Europe’s Large Hadron Collider (LHC) managed to transform lead into gold, producing 89,000 atoms per second.

Using the LHC, a giant particle accelerator capable of smashing atoms together at super-high speeds, scientists knocked three positively charged ions or particles (protons) out of lead atoms, turning them into gold atoms.

Powerful electromagnetic fields around the atoms caused them to change into different elements upon smashing. The team that made this discovery, dubbed the ALICE Collaboration, has effectively threatened gold’s value, with the potential to reduce its scarcity.

Notably, however, this remains a theory at best, as the gold broke apart almost immediately. This means they were not able to collect any of the gold. Nonetheless, as science has proven in the past, ongoing research could present a breakthrough.

“This is REALLY bad for GOLD. Scientists can literally recreate Gold in a lab, and this makes Gold no longer scarce,” wrote Ran Neuner, crypto analyst, founder, and host of Crypto Banter.

According to Neuner, lab-generated gold is almost indistinguishable from mined gold, so its perceived market value (1% of the original) could bode well for the Bitcoin price.

“Neither the human eye nor with a mag glass can tell the difference, and the cost is about 1% of the original. Once people realize this, there will be a huge shift into Bitcoin,” he added.

He makes this assumption based on history, where diamonds’ value tumbled after scientists achieved lab-grown diamonds. If the same happens for gold over time and its scarcity value diminishes, investors may shift to Bitcoin as a store of value.

However, Bitcoin faces a major risk, quantum computing, which could threaten its security. BeInCrypto reported BlackRock’s fears that, should quantum technology evolve far beyond its current state, it could render the cryptographic algorithms used by Bitcoin obsolete.

Notably, a recent US Crypto News publication indicated why Bitcoin might not be ready to replace gold just yet.

JPMorgan Predicts Bitcoin to Outpace Gold in 2025

Elsewhere, amid rising institutional adoption, JPMorgan analysts predict Bitcoin could outpace gold within the year. The analysts cited growing corporate treasury allocations, aligning with BeInCrypto’s report that TradFi companies are building their Bitcoin war chests.

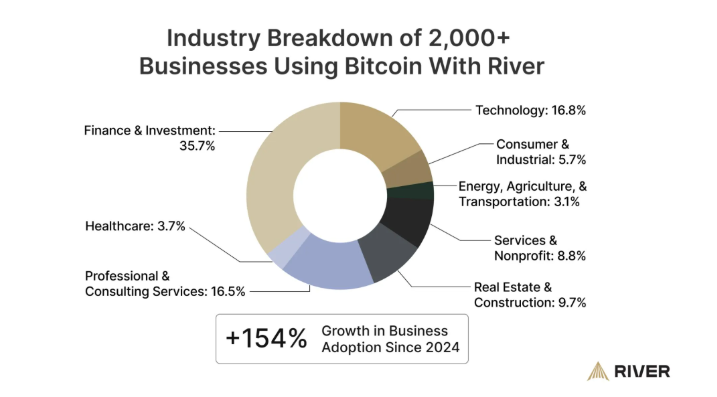

In the same tone, River’s statistics showed business Bitcoin holdings jumped 154% since 2024, with over 2,000 companies now using its River platform to accumulate BTC.

Industry Breakdown of Businesses Using Bitcoin. Source: River.

Industry Breakdown of Businesses Using Bitcoin. Source: River.

JPMorgan analysts also cited proposed and enacted legislation allowing states to invest in Bitcoin.

“We expect the year-to-date zero-sum game between gold and Bitcoin to extend to the remainder of the year, but are biased towards crypto-specific catalysts creating more upside for Bitcoin over gold into the second half of the year,” the analysts wrote in a note published Thursday.

Amid the optimism, BitMEX co-founder and former CEO Arthur Hayes says Bitcoin could reach $1 million by 2028. He cites US capital controls taxing foreign assets, prompting capital flight from US markets.

This, combined with treasury devaluation through money printing, will drive investors to Bitcoin as a digital, stateless asset, accelerating its price surge.

“Foreign capital repatriation and the devaluation of the gargantuan stock of US treasuries will be the two catalysts that will power Bitcoin to $1 million sometime between now and 2028,” Hayes wrote in his latest blog.

Chart of the Day

BTC market cap vs Gold. Source: TradingView

BTC market cap vs Gold. Source: TradingView

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.