VeChain and VeThor prices soar as shorts liquidations, open interest jump

0

0

VeChain (VET) and VeThor (VTHO) prices have gone parabolic in the past few days as investors have embraced a FOMO attitude. VET has risen in the past six straight days and moved to a high of $0.05, which was 100% above its lowest point this year, giving it a market cap of more than $3.6 billion.

VeThor Token price has also risen in the past six days, peaking at $0.0070, which was about 740% above its lowest point in 2023. The coin’s market cap has jumped to over $450 million.

VeChain and VeThor mainnet activity

VeChain and VeThor prices have become some of the best-performing cryptocurrencies this week as the crypto fear and greed index rose. The index has jumped to the greed zone of 75 as inflows in the industry rise. Bitcoin, itself has jumped from $20,000 in 2023 to over $52,000 and this remarkable run may continue.

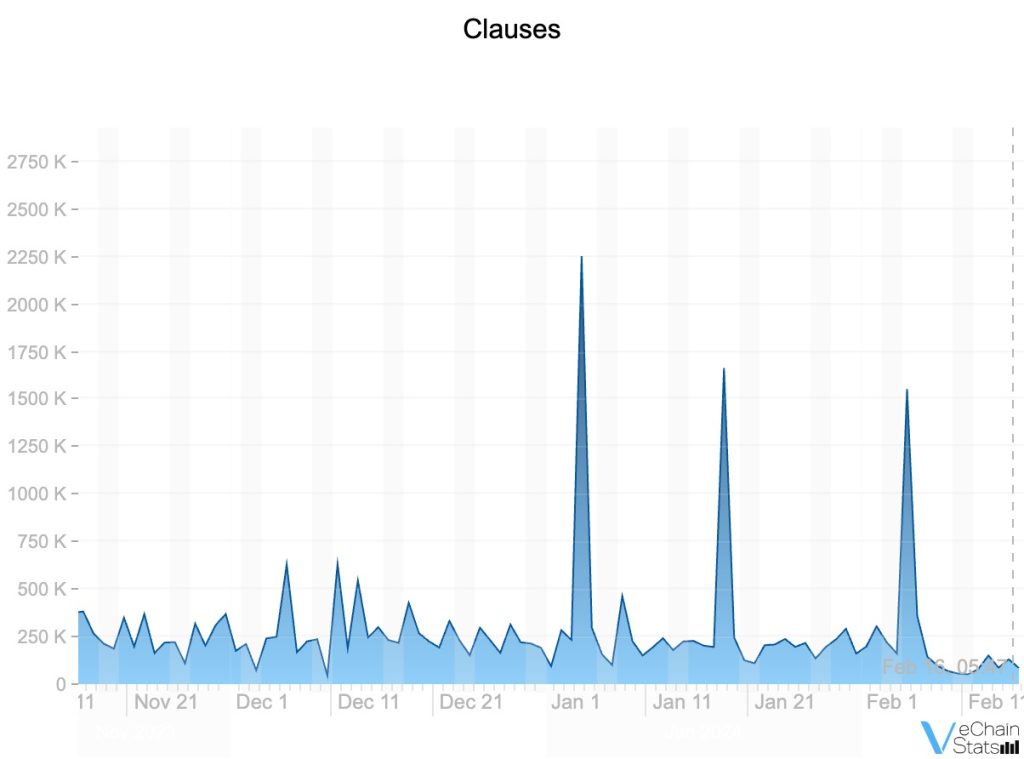

There was no immediate reason why these two tokens jumped. For one, as shown below, the mainnet activity in the network has not been strong lately.

Therefore, the most likely reason is that the rally started and then most traders pushed them high because of the Fear of Missing Out (FOMO). A piece of evidence for this is that the two tokens have been trending in social media platforms like X and StockTwits. Some analysts believe that the jump is likely because of potential upcoming news.

VeChain liquidations rise

What is clear, though, is that many short-sellers have been liquidated during this surge. Shorts liquidations jumped to a record high on February 11th. The VET shorts liquidations rose to over $1.1 million on that day and $1.21 million on Thursday.

Further data shows that VeChain’s open interest in the futures market has also jumped sharply lately. It spiked to a high of $65 million on Thursday, its highest point since March 22nd. This is a big increase since the interest was less than $10 million a few months ago.

Open interest is an important figure because it shows the amount of outstanding tokens in the futures market that are yet to be filed. A high open interest figure is a sign that there is more demand in the market. VeThor futures and options are not offered by most exchanges yet.

For starters, VeChain is a blockchain network that is an EVM-compatible network where developers can build all types of decentralised applications (dApps). It is also widely used by some companies to simplify their supply chain features. VeThor is part of the VeChain ecosystem in that it is used to pay gas in the network.

The post VeChain and VeThor prices soar as shorts liquidations, open interest jump appeared first on Invezz

0

0