Bitcoin Analysis: Willy Woo Predicts Surge to $75,000 with Massive Short Liquidation

0

0

- Bitcoin is on the brink of a notable surge, thanks to impending short position liquidations.

- Analyst Willy Woo has identified key triggers that could catapult Bitcoin prices.

- “Touching $72,000 will ignite a short squeeze event,” asserts Woo, highlighting a pivotal market moment.

Discover what could propel Bitcoin to unprecedented heights as expert insights unravel critical market dynamics.

Potential Liquidity Zones: Key to Bitcoin’s Next High

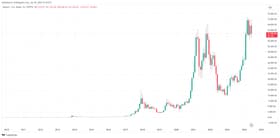

Renowned market analyst Willy Woo has recently drawn attention to the crucial liquidity zones that Bitcoin must navigate to reach new all-time highs. According to Woo, once Bitcoin touches the $72,000 mark, it will trigger a significant wave of short position liquidations. This action could set the stage for a rapid ascent to $75,000 and beyond.

The 72K Threshold: Catalyst for Market Movements

Woo’s analysis indicates that a breach of the $72,000 level will initiate a short squeeze, potentially liquidating around $1.5 billion in short positions. Such a scenario can spur unprecedented buying pressure, driving Bitcoin’s price upward. Data from CoinGlass supports this claim, emphasizing that surpassing $72,000 could result in the cumulative liquidation of $800 million worth of leveraged short positions across multiple exchanges.

Implications of a Sustained Bitcoin Rally

If Bitcoin maintains a trajectory past $72,500, it could trigger further liquidations worth approximately $1.2 billion in futures short positions. This could accelerate Bitcoin’s movement towards its previous all-time highs. Trading platforms and users need to be prepared for such volatility, which would likely increase market participation and trading volumes significantly.

Current Market Performance and Sentiment

Recent data from CoinGecko reveals that Bitcoin has experienced a 3% increase in the past 24 hours, trading at around $70,800. This upward trend reflects growing confidence in Bitcoin’s ability to breach critical resistance levels. Market sentiment appears positive, underpinned by the anticipation of significant upward price movements.

Conclusion

In summary, Bitcoin is poised on the edge of a significant price breakout, driven by the potential liquidation of substantial short positions. Investors and traders should stay vigilant as the $72,000 price point approaches, understanding that this could be the catalyst for a rapid climb to new highs. Monitoring these key liquidity zones and market dynamics will be crucial for capitalizing on upcoming opportunities in the crypto market.

0

0