Bitcoin and Ethereum Unlikely Targets of 51% Attacks, Here’s Why

1

0

On-chain crypto analytics firm CoinMetrics has released a new research report that debunks fears of blockchain takeovers. They say the need for more powerful mining rigs and the cost of 51% attacks make takeovers infeasible. Even as the Bitcoin network prepares for a decline in hashrate from the halving.

CoinMetrics researcher Lucas Nuzzi says a 51% attack on Bitcoin would need 7 million mining rigs. Ethereum’s churn rate limiting validators’ turnover would require takeover attempts to last six months.

Bitcoin’s Takeover Thwarted By Cost

The company also found that ideological 51% and 34% attacks on Ethereum and Bitcoin would be thwarted at different stages. If they were resourceful, governments would need to spend more than $20 billion to manufacture in volume their own version of the reverse-engineered Antminer S9 Bitcoin mining machine. Alternatively, they would have to pay almost $20 billion to buy those machines on the open market.

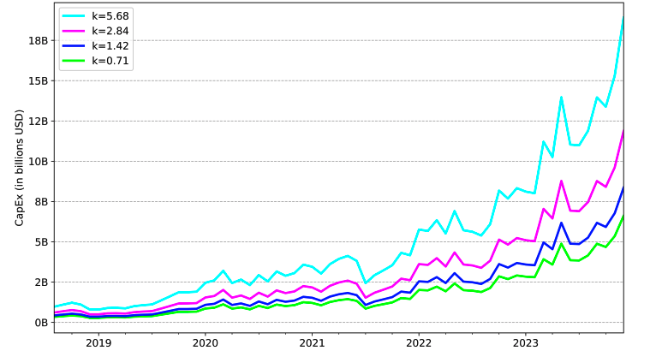

Capex Forecasts for Rig Purchases | Source: Lucas Nuzzi

Capex Forecasts for Rig Purchases | Source: Lucas Nuzzi

Read more: 51% Attacks on the Blockchain Explained: What Are the Dangers?

“This is the first empirical evidence…where adversarial actions become unattractive when compared to other strategies, such as honest participation in the network or abstention from attacking,” Nuzzi said.

The researchers also estimate that mounting a 34% attack on Ethereum liquid staking protocols like Lido Finance and Rocket Pool would cost over $34 billion in ETH. To do so, the attacker must manage over 200 nodes and spend $1 million on cloud services for six months. In addition, common crypto attack methods, including double spending attacks, selfish mining, and manipulating the transaction fee market, would cost too much to be financially feasible.

Bitcoin Halving Is Perfect Foil

According to crypto financial services firm Galaxy Digital, the upcoming Bitcoin halving will cause many miners to exit the market. The halving lowers crypto mining profits and can eject less energy-efficient mining machines.

The dropoff of miners can be measured by a decline in hashrate, which is the number of times miners try to guess the hash of a Bitcoin transaction block per second. A decline in hashrate implies a decline in online mining rigs and is used as a proxy for miners exiting the market.

“We estimate that roughly 15-20% of the network hashrate at the conclusion of 2023 (86-115 EH) could come offline at the time of the halving. Based on our analysis, we expected 2024 network hashrate to end in a range between 675 EH and 725 EH,” Galaxy said.

Bitcoin Network Difficulty | Source: Blockchain.com

Bitcoin Network Difficulty | Source: Blockchain.com

To counter the dropoff, the Bitcoin network will start to adjust the difficulty since the companies with more powerful machines could place power in the hands of a few entities. As these computers become more powerful, it will be harder for governments to attempt a 51% attack.

Nuzzi said new machines like the Antminer S21 are harder to reverse-engineer, making them difficult to replicate. Therefore, takeover attempts will always be playing catch-up.

Read more: How To Mine Cryptocurrency: A Step-by-Step Guide

BeInCrypto contacted the mining company Core Scientific on the likelihood of a 51% attack after the halving. The company had yet to reply at publication time.

1

0