Compound Price Prediction 2024, 2025: Can COMP Price Surge To $100?

0

0

The post Compound Price Prediction 2024, 2025: Can COMP Price Surge To $100? appeared first on Coinpedia Fintech News

With the bullish 2024 turning gaining momentum, the buyers are preparing for the positive events ahead. Following a successful Bitcoin halving event, along with the potential rate cuts and the Ethereum ETFs talks, might drive the crypto market and the COMP price higher.

With Compound having a sideways low volatile trend in motion, the breakout moment will be the trendsetter for 2024. The COMP price is above the psychological mark of $50, and the positive cycle keeps the breakout possibility alive.

Further, Compound has been one of the top-performing coins in 2023, reflecting the demand present for the altcoin. Hence, the chances are significant for Compound to reignite the bull run in 2024.

Are you considering this altcoin for your investment portfolio? Look no further, as we decode the possible COMP price prediction for 2024 and the years to come!

Table of contents

- Overview

- Importance of Price Prediction In Cryptocurrency Investing

- Factors Influencing COMP Price Movement

- What Is Compound (COMP)?

- COMP Price Prediction June 2024

- COMP Price Forecast 2024

- Compound Price Prediction 2025

- CoinPedia’s Comp Price Prediction

- What Does The Market Say?

- Fundamental Analysis

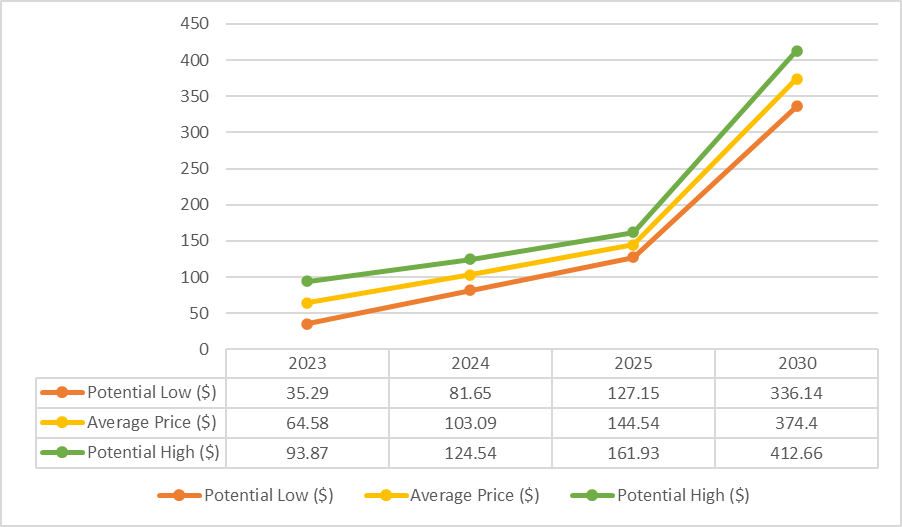

- Compound Price Prediction 2024 – 2030

- Compound Historical Market Sentiments 2020 – 2024

- FAQs

Market Top Gainer

Overview

| Cryptocurrency | Compound |

| Token | COMP |

| Price | $ 61.78582987 |

| Market cap | $ 509,629,721.4351 |

| Circulating Supply | 8,248,326.8818 |

| Trading Volume | $ 41,113,931.4211 |

| All-time high | - |

| All-time low | - |

| 24 High | $ 59.1200 |

| 24 Low | $ 55.2100 |

Importance of Price Prediction In Cryptocurrency Investing

When investing in cryptocurrencies like COMP, it’s natural for investors to ponder how a coin’s price may perform in the future. While predicting the price is impossible, analyzing historical trends and factors affecting supply/demand can provide valuable insights. Price predictions help investors gauge the return potential of holding an asset for the long run. They also give an idea about good entry/exit points over the next few years, aiding in portfolio allocation decisions.

Price forecasts factor in network growth metrics like TVL, user transactions and protocol adoption rates. They also consider macroeconomic conditions and industry-specific events. Analyst predictions provide a probable range for a coin’s value rather than fixed numbers. It helps manage risk by not relying entirely on targets. Investors can build diversified portfolios while keeping various prediction scenarios in mind

Factors Influencing COMP Price Movement

Many internal and external variables impact the price of COMP tokens over time. Monitoring these factors is essential to understand past performance and anticipate future trends. Some major aspects include the total value locked in the Compound protocol and adoption rates across different chains and markets. Protocol upgrades and new features also spur buyer interest.

Inflation rates, currency fluctuations, and macroeconomic policies set the backdrop for investor risk appetite, which impacts crypto demand. Regulatory clarity or confusion around certain activities influences participation. Further, comparable projects entering with new propositions change market dynamics. Popularity waves after celebrity promotions temporarily boost prices. Alternatively, negative news on major hacks or issues causes sell-offs.

Technical factors like support/resistance zones, trading volume and momentum signals guide traders. Social media engagement shows shifting community sentiments. Overall, balancing analysis of project-specific progress alongside the broader economic environment helps build a perspective on the price drivers for COMP in both bull and bear phases of the crypto market cycle.

To read our price prediction of Verge (XVG) Price Prediction (XVG) Click Here

What Is Compound (COMP)?

Learning from the makers, Compound is an algorithmic autonomous interest rate project that is built for developers. The protocol allows developers to access a plethora of open financial applications. The compound is open-source and maintained by the community.

To put things into perspective, Compound is a Defi lending protocol that allows users to earn interest on their cryptocurrencies. By depositing these into one of the many pools supported by the platform. The native asset of the platform is COMP, which is an ERC-20 token. That allows its holders to delegate voting rights to an address of their choice. Be it the owner’s own wallet, another user application, or a Defi expert.

COMP Price Prediction June 2024

Concluding the lower high trend, the COMP price shows a bullish reversal gaining momentum as it exceeds the resistance trendline. The buyers maintain dominance over the $50 mark and reflect strong demand at lower levels.

As per the Fibonacci levels, the post-retest reversal from the resistance trendline crosses above the 23.60% Fibonacci level. This increases the possibility of a bull run to the $73 mark or the 50% Fibonacci level. Conversely, a drop under $60 will test the $55 mark

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| June 2024 | 55 | 64 | 73 |

COMP Price Forecast 2024

If a number of projects seek the functionality of Compound, and if the industry sees Defis spreading the wings again. Increasing traffic in Compound’s Treasury and major announcements of collaborations and adoptions will turn imperative for the network.

Moreover, if the protocol gathers positive social sentiments, COMP’s price could reflect positive signs, wherefore the altcoin could surge as high as $125.54 by the end of 2024.

The year could turn fruitful for Compound if the crew behind the platform announces community-building initiatives. Moreover, the digital asset could also seek impetus from Bitcoin’s halving event.

On the contrary, ebbing volumes amidst a possible crash could knock the price down to $35.29. Successively, an equilibrium in buying and selling pressures might settle COMP at $79.91.

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2024 | 35.29 | 79.91 | 124.54 |

Compound Price Prediction 2025

Over the next three years, if Compound concentrates on several developments and manages to increase its user base. The digital coin could climb higher on the market charts. Moreover, if the factors in the industry play in favor of cryptocurrency. The road to $161.93 could be achievable.

However, regulatory norms and restrictions across the globe could shrink the price to $127.15. In conclusion, the lack of propelling events could hamper the price projection to an average level of $144.54.

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2025 | 127.15 | 144.54 | 161.93 |

Compound Price Prediction 2026 – 2030

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2026 | 161.38 | 184.42 | 207.46 |

| 2027 | 199.36 | 223.83 | 248.31 |

| 2028 | 224.19 | 259.42 | 294.65 |

| 2029 | 286.55 | 318.87 | 351.20 |

| 2030 | 336.14 | 374.40 | 412.66 |

Compound Price Forecast 2026: According to our analysts, COMP coin price prediction for the year 2026 could range between $161.38 to $207.46 and the average price of Compound could be around $184.42.

COMP price prediction 2027: According to our analysts, Compound price for the year 2027 could range between $199.36 to $248.31 and the average price of COMP could be around $223.83.

Compound Prediction 2028: According to our analysts, COMP crypto prediction for the year 2028 could range between $224.19 to $294.65 and the average Compound coin price could be around $259.42.

COMP coin price prediction 2029: According to our analysts, Compound’s forecast for the year 2029 could range between $286.55 to $351.20 and the average COMP coin price could be around $318.87.

Compound Price prediction 2030: According to our analysts, COMP predictions for the year 2030 could range between $336.14 to $412.66 and the average Compound price could be around $374.40.

To Read About Crypto Hack Report Q1 2024 Click Here

CoinPedia’s Comp Price Prediction

Hodlers, marketers, and savvies are quite optimistic about Compound. If the network poses major partnerships and adoptions in the near future. Then, the price of COMP could surge to a maximum of $124.54 by the end of 2023.

That said, if it loses out on steam amidst the diverging interest of marketers, the COMP price could stumble down to $35.29.

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2024 | 35.29 | 79.91 | 124.54 |

What Does The Market Say?

| Firm Name | 2024 | 2025 |

| Wallet Investor | $4.31 | $4.56 |

| priceprediction.net | $96.85 | $138.00 |

| DigitalCoinPrice | $116.96 | $154.84 |

| Trading Beasts | $52.97 | $83.28 |

*The aforementioned targets are the average targets set by the respective firms.

Fundamental Analysis

Compound was founded in the year 2017, by Robert Leshner and Geoffrey Hayes. Both Robert and Geoffrey had previously worked in higher positions at Postmates – an online food delivery service provider. Whilst Hayes is the CTO of Compound Labs Inc, Leshner is currently serving as the CEO of the firm.

The protocol enables anyone to rent and lend tokens through a decentralized market. While the lenders earn income in the crypto they lend, the borrowers pay interest for the borrowed sum. The network is handled automatically by “smart contracts”, which process to mint cTokens. After Ethereum and ERC-20 tokens are deposited. The process also enables Compound users to redeem their stake using their cTokens.

The network employs collateralization for all assets and also ensures that each pool is over-collateralized, at all times. If the factor falls any lower, the assets are sold to liquidators at a discounted price. Talking about Compound’s native asset COMP, the total supply of the crypto asset is slabbed at 10 Million COMP. Out of which, 6.7 million are currently in circulation.

Compound Price Prediction 2024 – 2030

Compound Historical Market Sentiments 2020 – 2024

Compound is a decentralized protocol that allows users to supply or borrow assets in exchange for earning interest or creating leverage, respectively. It saw decent growth in 2020, benefiting from the overall crypto bull market. However, 2021 saw its price decline along with most altcoins due to regulatory uncertainty and China’s crypto ban FUD.

Though highlighting its resilience, the protocol continued to see steady TVL and user growth. 2022 has been one of the worst crypto bear markets impacted by rising inflation, monetary tightening fears and geopolitical tensions. COMP saw its price plunge below its 2020 levels, which was stirred by weak macro factors.

Most analysts believe the current bear cycle could extend into early 2023 with crypto prices range-bound. If history is any indication, past bear markets have lasted 1.5-2 years on average. So, COMP may see continued volatility in the short term. However, once macro conditions stabilize and risk appetite returns, it is expected to climb back up.

With more institutional adoption and as the current crypto winter ends, COMP could start to resume its bullish trend by late 2023 or 2024. If the protocol continues expanding its features and TVL rises significantly, analysts think $100 per COMP is achievable before 2025, provided the macro scenario is favourable again.

Conclusion

This analysis presented the Compound’s historical market performance and key factors impacting its token price. Based on Compound’s vital growth metrics, like rising TVL and adoption trends, the predictions discussed see the potential for COMP to regain its upward momentum once macro factors stabilize. A price surge to $100 by 2025 is deemed plausible if Compound sustains leading its niche and institutional backing grows.

Both protocol-specific and broader economic variables will determine COMP’s price path. Further research on evolving DeFi use cases, regulatory dynamics, and correlations with benchmark assets like Bitcoin could provide additional context. Forecasts also depend on geopolitical stress and whether the current crypto winter extends.

While short-term volatility is expected, COMP showing resistance amid downturns bodes well for a multi-year rise if favourable conditions return to crypto markets. Continuous monitoring of demand drivers will be critical to validate $100 projections.

FAQs

Compound entitles lenders and borrowers to provide and take out loans by locking their assets into the protocol.

According to our COMP price prediction, the altcoin might surge as high as $125.54 by the end of 2024.

Compound is managed by a decentralized community of COMP token-holders and their delegates, who propose and vote on upgrades to the protocol.

According to our Compound price prediction, the COMP price could possibly reach as high as $161.93 by the end of 2025. COMP is predicted to reach a high of $412.66 by the end of 2030.

The community has created a Compound Forum to discuss governance proposals, and share ideas.

COMP is available for trade across leading cryptocurrency exchange platforms such as Coinbase Pro, Huobi Global, and Binance, amongst others.

COMP

BINANCE

0

0