Ether Investment Loses Steam: Largest Outflows in Two Years

0

0

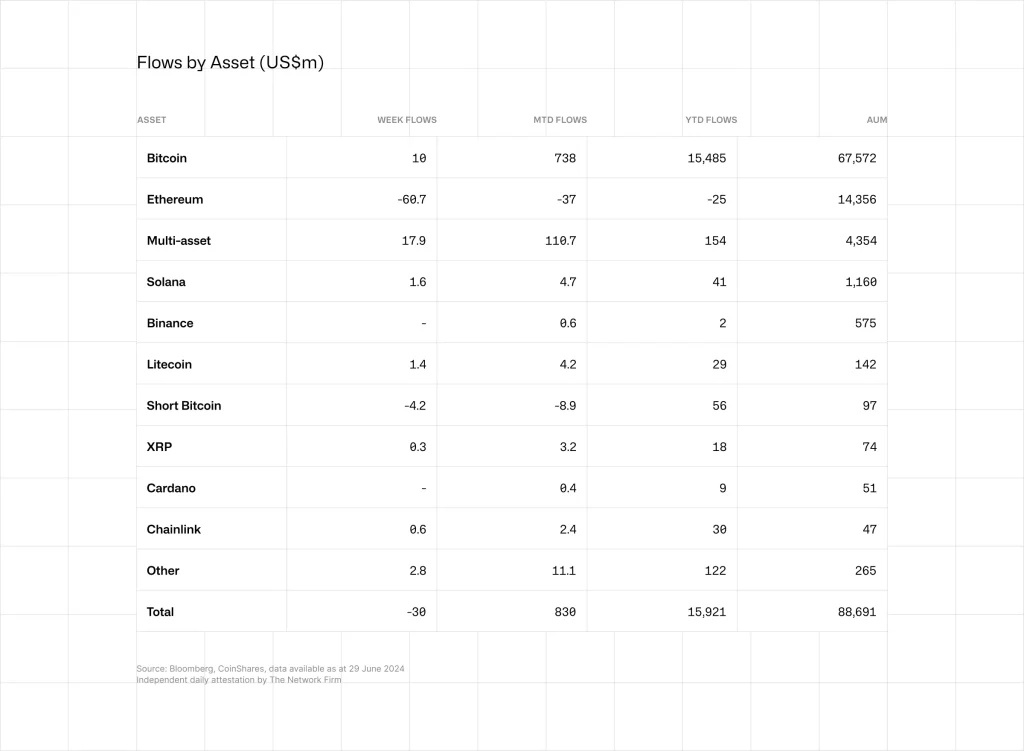

In the tumultuous final week of June, Ethereum exchange-traded products (ETPs) endured substantial financial turbulence, marking the largest net outflows since August 2022. Investors withdrew a notable $61 million from Ether investment products between June 24 and June 29.

This downturn accumulated to $119 million in outflows over the previous two weeks, culminating in a monthly total of $37 million extracted from Ethereum funds. Consequently, Ethereum funds have emerged as the worst-performing asset in terms of net flows year-to-date, with a total of $25 million pulled from these investments so far.

SEC Approval and Market Impact

Despite receiving a green light for Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) in May, Ethereum’s market price fell by more than 8.7% over June.

Market analysts had been optimistic following the SEC’s approval, anticipating a positive shift in investor sentiment. However, the SEC’s recent directive for prospective issuers to resubmit their S-1 forms by July 8 has delayed the expected launch of these ETFs until mid-July or potentially later.

Financial firm Bitwise projects that these funds could attract as much as $25 billion by the end of 2025, indicating a long-term confidence in the asset class.

Conversely, Bitcoin-related exchange-traded products witnessed an inflow of $10 million during the same period. This modest increase represents a significant turnaround from the prior staggering outflow of $630 million.

Following this recent performance, the total assets managed across all Bitcoin ETPs have climbed to a remarkable $67.57 billion.

Additionally, last week saw other digital assets registering inflows; multi-asset ETPs attracted $18 million, and there were notable inflows into altcoin-related ETPs, including Solana ($1.6 million), Litecoin ($1.4 million), Chainlink ($600,000), and XRP ($300,000).

The report from CoinShares also highlighted regional variations in investment flows. The United States, Brazil, and Australia experienced substantial inflows of $43 million, $7.6 million, and $2.9 million, respectively.

In stark contrast, negative sentiments plagued crypto investment products in Germany, Hong Kong, Canada, and Switzerland, which saw outflows of $29 million, $23 million, $14 million, and $13 million, respectively.

Bitcoin ETFs and Trading Volumes

Despite the overall $30 million in net outflows across digital asset investment products last week, Bitcoin ETFs showed signs of resilience. Most Bitcoin ETF providers reported minor net inflows, apart from Grayscale, whose Bitcoin fund experienced outflows totaling $153 million.

This contrasted sharply with the total $10 million inflow reported among other issuers, highlighting a partial recovery in investor confidence in Bitcoin-related products.

Trading volumes provided another perspective on the market’s dynamics, with a 43% increase week-on-week, totaling $6.2 billion globally as of June 29.

Although this figure represents a significant uptick, it still remains considerably below the $14.2 billion average weekly trading volume observed throughout the year.

Among altcoins, funds associated with Solana and Litecoin continued to attract investors, with inflows of $1.6 million and $1.4 million, respectively.

This year has seen a considerable $545 million withdrawn from blockchain equities, which represents 19% of their market capitalization. However, CoinShares’ latest report suggests that there may be early signs of improving sentiment towards Bitcoin.

James Butterfill, the Head of Research at CoinShares, noted a “significant stemming” of the recent outflows, which could indicate a turning point in market sentiment.

Overall, while Ethereum-based ETPs have faced significant challenges, marking them as this year’s worst-performing assets in terms of net flows, the broader cryptocurrency investment landscape shows signs of nuanced shifts.

With Bitcoin experiencing a stabilization in outflows and some altcoins seeing renewed interest, the digital asset market continues to display a complex interplay of investor sentiment and regulatory developments.

The post Ether Investment Loses Steam: Largest Outflows in Two Years appeared first on Coinfomania.

0

0