Connect Financial Community Update

0

0

Corporate update

As I’ve mentioned before, it is an absolute necessity for us to have all of the required licenses and accreditations in place prior to launch. While this isn’t a particularly sexy topic, it occupies a huge amount of time, resources and late nights with our compliance and legal teams. On top of these items, we are already deep in the process of providing evidence for our eventual SOC 2 and PCI-DSS level 2 accreditations.

In regards to Ascendex, we want reaffirm the delisting was requested by us. As part of our standard operating procedures we maintain ongoing due diligence of any vendor we utilize. This can include a range of factors from their social and governance policy to the more obvious financial and legal standings. It was brought to our attention that there was enough cause for us to remove all of our liquidity from Ascendex and then request for them to delist us. We cannot share more detail than that and hope that our track record on long term decisions like this prove that we take great care with our company and your trust.

As a continuation on our licensing and regulatory front we are well underway with our application in the EU after holding many fact finding and clarity conferences with the regulatory body there. We will be announcing more formal details as soon as possible here. In the meantime we continue with our US and Canada licensing. There is no timeline that we are comfortable releasing yet to you all as there are many factors that can add or subtract weeks to the timetable that are out of our control. But, all things are moving along as expediently as we can push.

Development update

Development of the core platform is proceeding steadily. We added some senior members to the team earlier in the quarter and they have brought the platform up to a whole new level of hardness and functionality.

We made the difficult decision to hold off opening up the platform for community testing until the system is compliant with all relevant regulations — Even interacting with low volumes of assets presents a risk. We all appreciate the community’s patience on this, it’s simply something that can’t be rushed.

Design Update

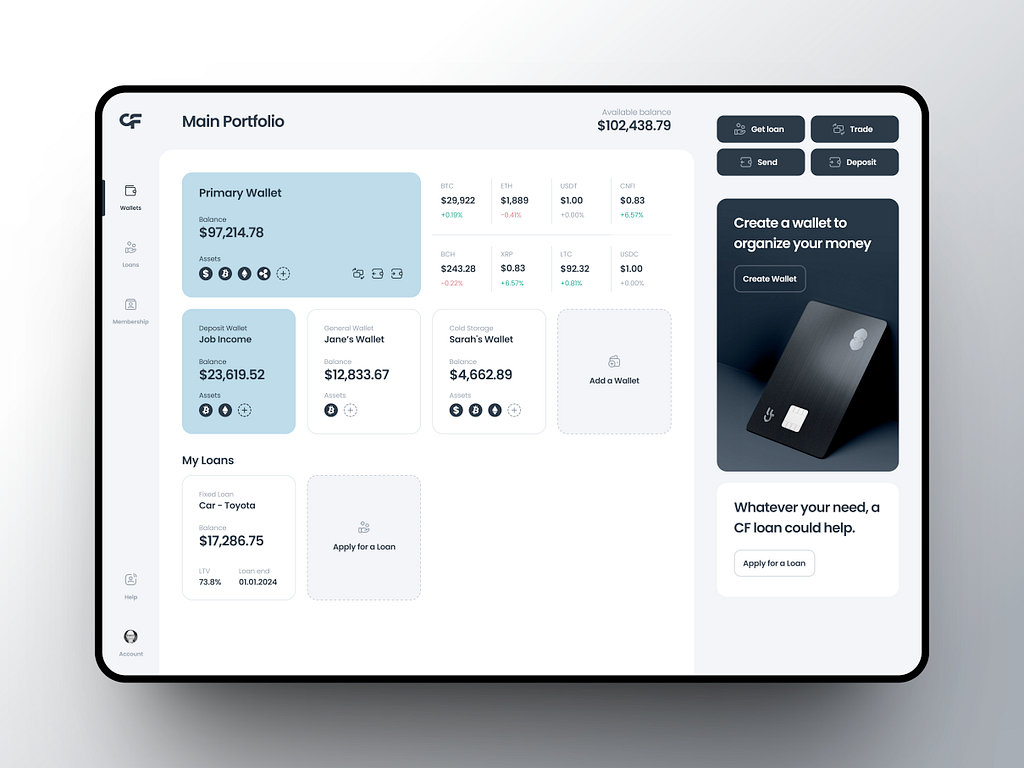

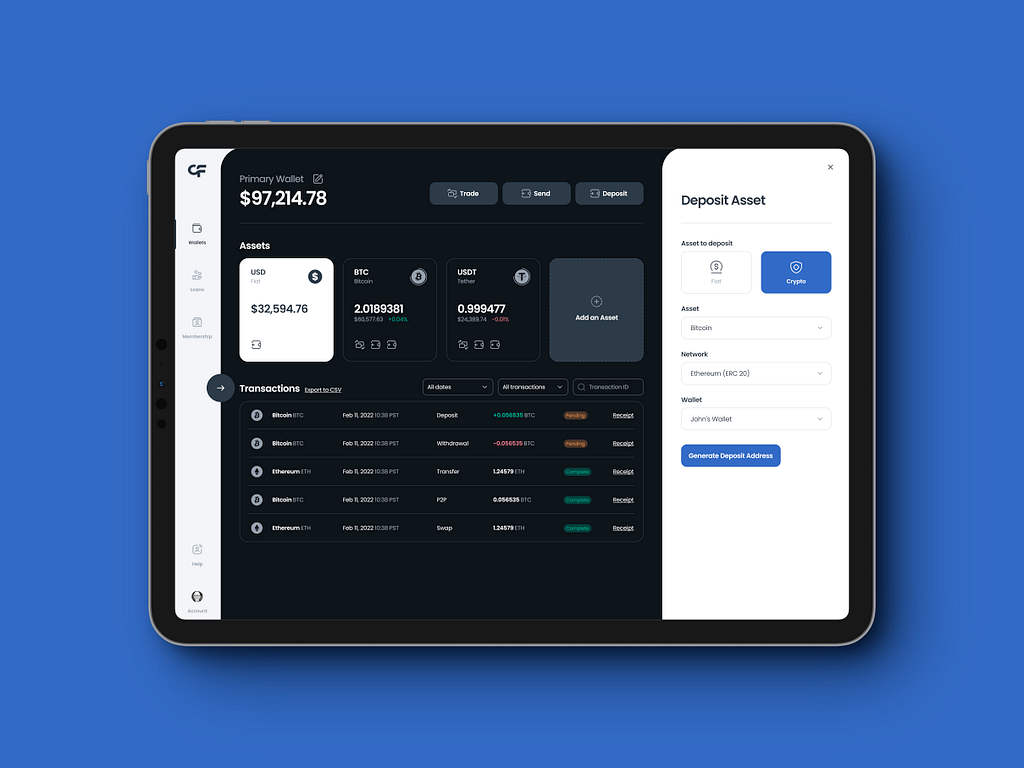

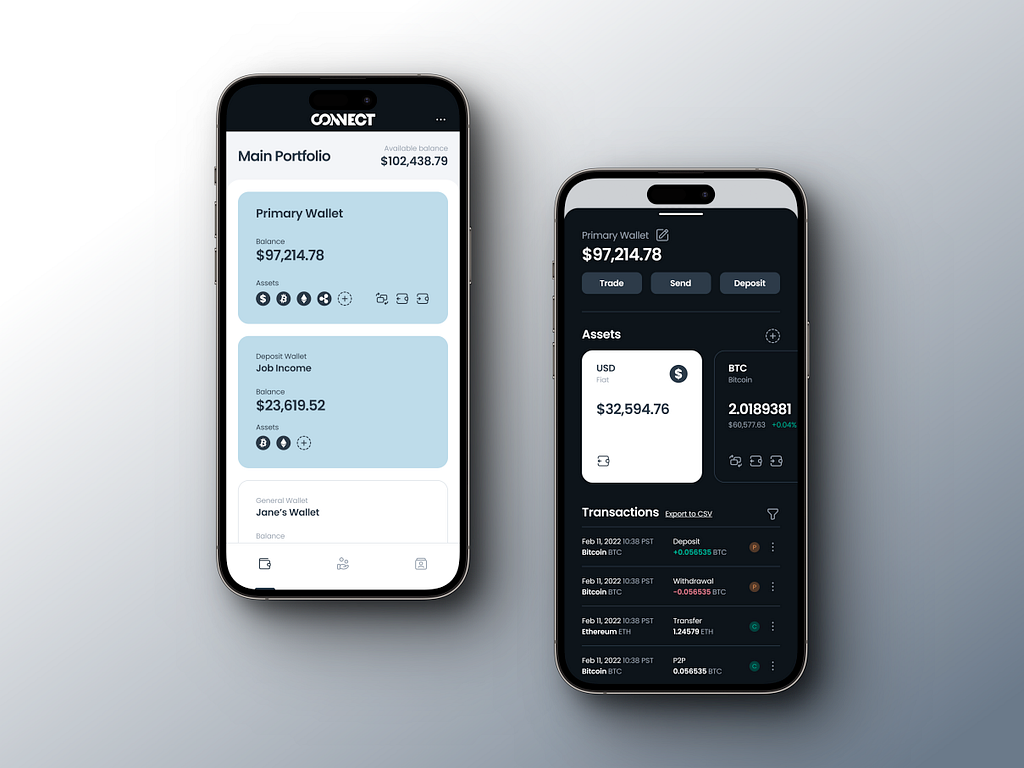

As mentioned in a previous update, while the engineering team fully rounds out all of the core engine pieces, we’ve taken the opportunity to revisit the design of the client portal.

While the focus has been on a toe-to-tip overhaul, we’ve also built out a range of responsive designs which was largely missing from the original site design.

To wit, we’ve welcomed Riki to the team. Riki is a very talented designer based in Auckland, New Zealand and has extensive background working with SaaS platforms, website design and product design. I’m sure that you’ll agree that his work looks great — here are a few sneak peeks of the updated client portal:

From the desk of Christo

Forgive me, team. I’ve just always wanted to write something under the heading “From the desk of Christo”.

Now that I’ve temporarily satisfied my ego, I’d like to take a short break from the being head down and building, and share some of the broader things that I’ve been thinking about as they relate to the market, and Connect Financial’s positioning.

If you were talking to me 18 months ago, we might be having a spirited conversation about DeFi, yield farming, looping staking strategies, protocol owned liquidity and other borderline degenerate topics.

Today, the market outlook is a bit different. With a Fear and Greed index glued in the neutral range, CT a ghost town and venture capitalists fleeing to artificially intelligent pastures, things are… well… a bit boring.

But even though things are quiet on the surface, you only need to look a little deeper to see a building groundswell.

There have been three charts in particular that have stood out to me this week. A perennial question asked by no-coiners is ******“******But what is the point of crypto? What’s the use case? What does it do?

And you know what? It’s not always an easy question to answer in practical, non-philosophical terms.

In my humble opinion, the most significant use case of crypto is already here today.

Crypto as collateral.

And boy. Things are heating up.

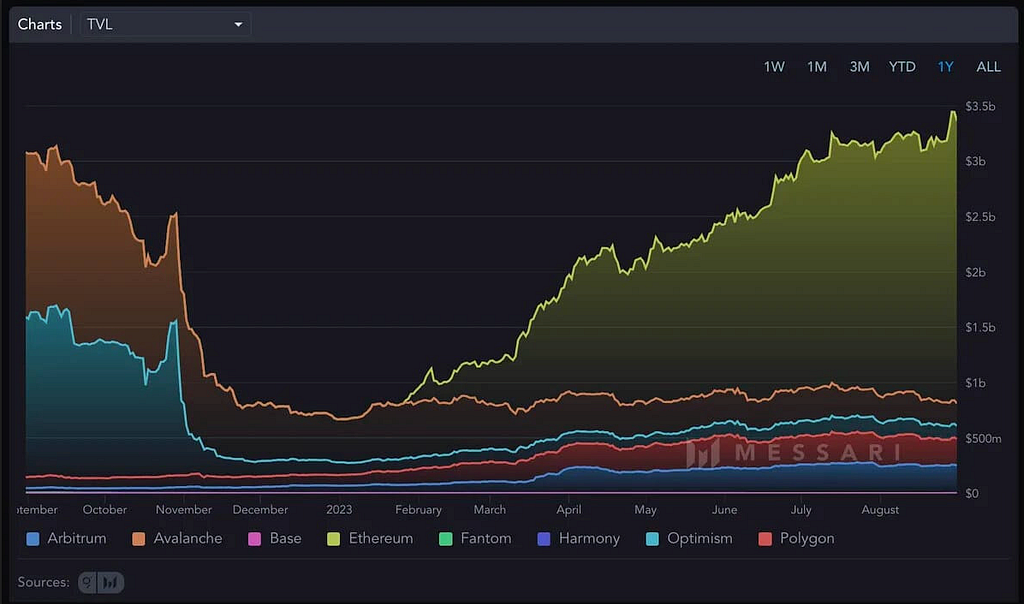

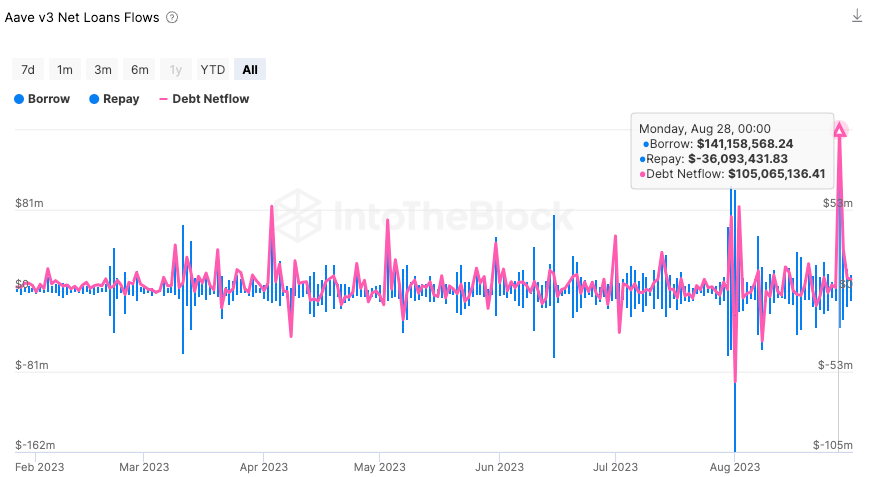

Take this chart 👆 for instance. This shows a record TVL held in AAVE v3 — a shade under $3.5 B-B-B-Billion — supporting $100M of new loan issuance last month:

Even in the depths of winter, addresses are committing and borrowing against collateral in record amounts.

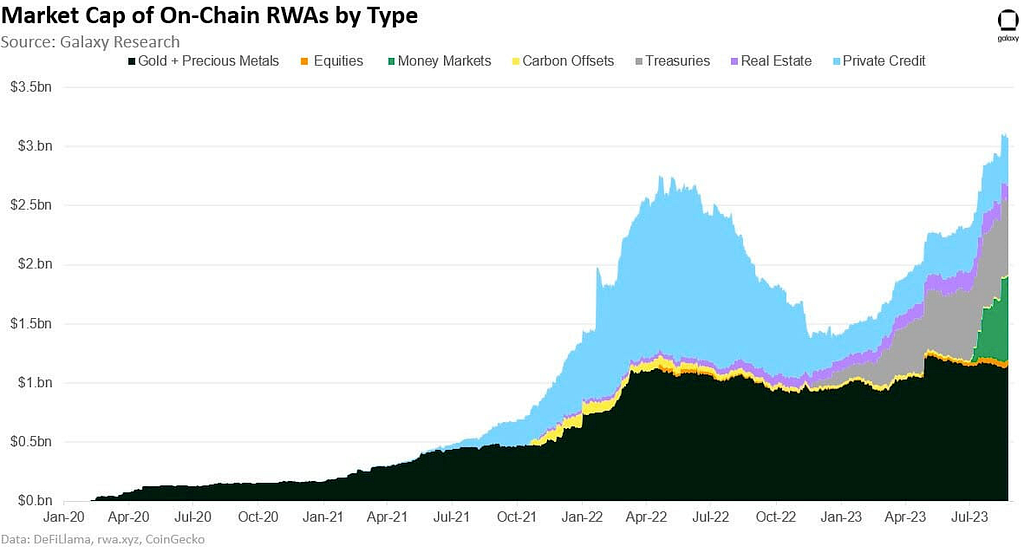

Where things get really interesting for me is tracking this normalisation of lending against another dominant narrative: Real World Assets (RWAs).

Over $3B of tokenised assets are now on chain. Some estimates are calling this a trillion dollar market. And over time, this tokenised value will be able to be used as — yup, you’ve got it — collateral for borrowing.

This is why I am so excited about what we’re developing and how we’re positioned at Connect Financial. With the normalisation of collateral based lending, we are building one of the most complete set of borrowing options to help crypto users access the significant value of their assets without needing to sell. And we’re doing this with complete 1:1 on chain transparency, segregation of corporate and client funds and zero rehypothecation.

In other words — we’re lending in the way that lending should be done.

Looking more broadly, we are also building out the infrastructure for accessing the stored value of collateralized RWAs through the Smart Metal product. We’re starting with precious metals, but are also gearing up to over other novel tokenized assets… I can’t say too much at the moment, but some recent developments here with discussions from certain members of the community have gotten us particularly frothy ;).

It is not simple nor quick to realise what we are building here, but when Connect Financial launches, I firmly believe that the market will see the substantial value that the product brings immediately.

Wrapping up

As you can see, there is a lot going on, and the next few months will be run at a fever pitch.

In October, the team will be getting together in real life for the first time in more than two years at Money 2020 in Las Vegas. We’ve opted this year to not be presenting at or sponsoring any part of the conference, but we are looking forward to feeling the broader pulse of Fintech in 2023, raising the awareness of Connect Financial with key industry players, meeting with our current partners, meeting future potential partners and, of course, taking in a show and a meal or two.

We will target the next update after we return from the conference, giving our community insight into the event and the happenings.

As always we appreciate you, our community and hope you remain safe and well.

0

0