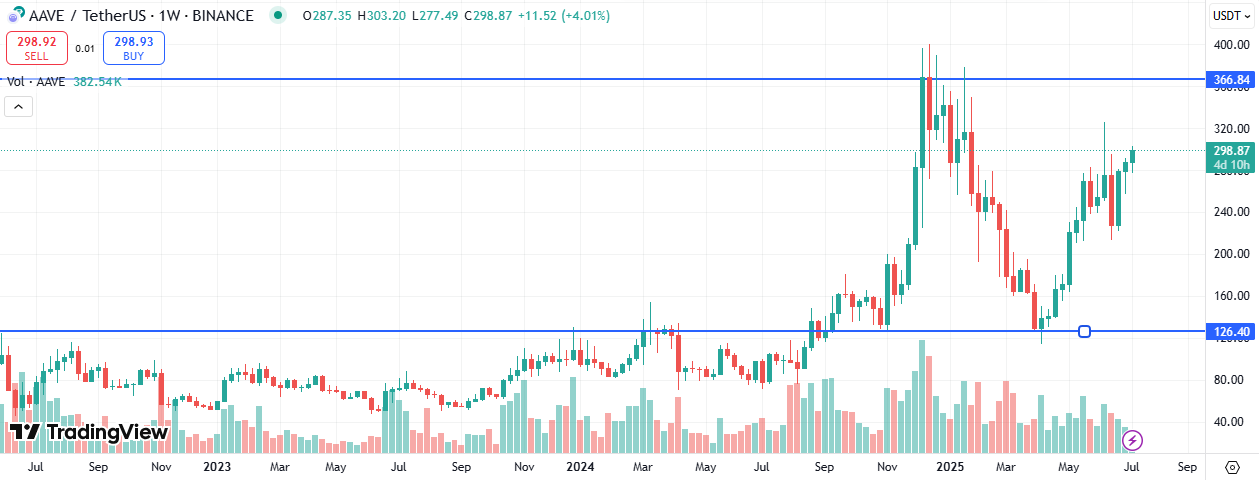

Aave Price Forecast – AAVE Eyes $366 Resistance as Bulls Take Control

0

0

Highlights:

- Aave continues to gain momentum despite most altcoins’ slow movement

- Momentum driven by DeFi growth and improved tokenomics

- Rally through multi-week resistance could see Aave hit $500 soon

Aave (AAVE) is in the green today, continuing the momentum it has built up in the past month. In the last 7 days, Aave is up by 14%. Aave is up by 4% to trade at $301.54 in the day. This makes it one of the best-performing altcoins on a day when most altcoins are sending mixed signals. Aave trading volumes are also on the rise, up 22% to $499 million. The rising volumes indicate that buyers are coming in strongly and expect Aave to continue doing well during the day. A couple of factors support the bullish outlook for Aave.

Aave Gaining Market Share In DeFi

One of them is Aave’s growing importance in the fast-growing stablecoins market. Data indicates that Aave controls about 5% of the total stablecoins flow. This is a considerable increase from Aave’s share of 3% at the start of the year. It indicates that with an improved regulatory environment in the US, investors are increasingly confident in transactions through decentralised networks like Aave.

Another indicator that Aave is gaining in adoption is its growing presence in the DeFi market. Data indicates that Aave dominated DeFi lending revenue in June 2025. Such dominance points to the overall health of the Aave network, a factor that could attract more investment flows as DeFi increasingly goes mainstream.

DeFi lending sector doubled to $55B TVL in June

And somehow no one is talking about it$Aave still leads with $16.5 billion

I stay steady looking for lowcap defi gems cos thats the narrative that will blow up next pic.twitter.com/lu6JgBBufM

— Dami-Defi (@DamiDefi) July 8, 2025

Regulatory Clarity A Major Boost for Aave Price

The Aave force in the DeFi market is also evident in its increased connectivity to Ethereum’s vast ecosystem. Recently, Aave founder Stan Kulechov announced that Aave now had a complete DeFi Cycle.

This is a big deal as it points to the growing importance of Aave in DeFi, and could play a significant role in pushing its value higher going into the future. Kulechov also pointed to Washington’s policies as a growth driver for Aave. He noted that US policymakers are now more interested in helping DeFi grow. This could help push the integration of DeFi with traditional finance. Given Aave’s increasing dominance in the DeFi space, this could trigger a surge in demand, which could see Aave rally to new highs in the short to medium term.

WATCH: @StaniKulechov says the US is making a “big push” to lead in #crypto and #DeFi policy.

From Capitol Hill to the White House, the @aave founder shares insider takeaways and why he’s bullish on #stablecoin clarity and self-custody.

Interview by @alpGasimov pic.twitter.com/SkZJlrkPVg

— Roundtable Network (@RTB_io) July 8, 2025

Aave Upgrades Make It More Attractive to Investors

Aave also has a couple of upgrades that are set to make it more usable in DeFi. One of them is the Aave V4 upgrade. The upgrade brings a couple of advantages to the network. One of them is the anti-GHO mechanism. Through this mechanism, Aave stablecoin debt is now more aligned with Aave staking. This makes for a more sustainable ecosystem long term.

Aave V4 isn’t a product upgrade.

It’s a containment strategy.—

They don’t say this out loud, but you can see it if you’ve ever liquidated a $100M book or advised on protocol insolvency.

Aave V4 is not about innovation. It’s a soft fork of trust.Every “module” screams the…

— FatRatKiller (@FatRatKiller) July 8, 2025

Then there is the introduction of the Umbrella safety module. Through this module, Aave now has better security, protecting it from the many hacks common in DeFi. However, the most significant improvement to Aave is the token buyback feature. Through this feature, the supply of Aave tokens will go down over time, a factor that, based on the laws of demand and demand, could push Aave to new highs long term.

Technical Analysis – Aave Price Gaining Upside Momentum

Aave has been gaining upside momentum since it made a V-shaped recovery in April. Based on the current momentum, the first target for Aave is at $366.84, which is a key multi-week resistance.

If bulls are strong enough to push Aave price through the $366.84 resistance, then a short-term rally to $500 or higher could follow.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.