Bitwise Dogecoin ETF Launches Today: Can BWOW Succeed Where Grayscale Stumbled?

0

0

This article was first published on The Bit Journal.

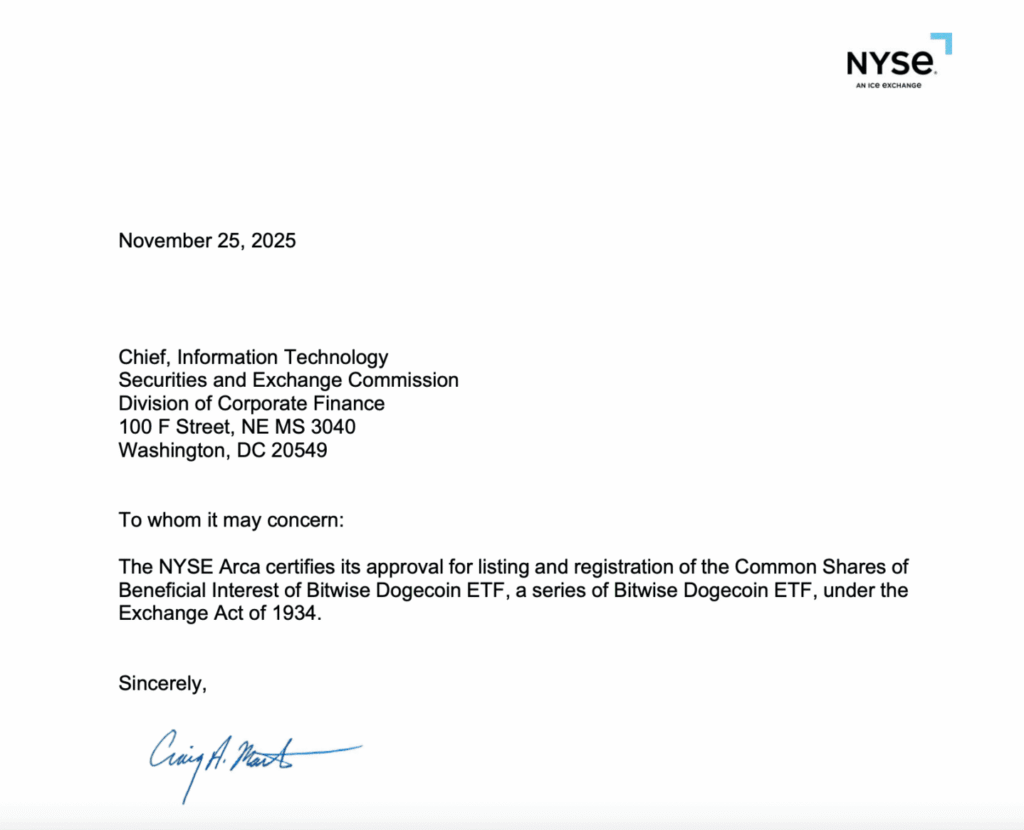

NYSE Arca has approved Bitwise’s Dogecoin ETF for trading. The fund will trade today under the ticker BWOW.

The decision comes days after the Grayscale Dogecoin ETF entered the market with weak early volume. The new listing marks another step in the growing push to bring meme coin assets into regulated financial products.

Bitwise Signals Rising Demand for Regulated DOGE Access

Bitwise confirmed the approval in a public statement on X. The firm said the market now needs a clearer path for regulated exposure to Dogecoin. The DOGE ETF gives investors a simple structure that tracks the token’s price. Coinbase Custody Trust will handle asset storage and oversight.

Dogecoin remains the tenth-largest cryptocurrency by market value. The token holds a $22 billion market cap and sees more than $1 billion in daily trading volume.

By gaining NYSE Arca certification, the DOGE ETF now enters a broader pool of investors. Bitwise expects interest from both institutions and everyday traders looking for regulated access to DOGE.

Growing Interest From Major Institutions

The approval reflects a shift in how traditional finance views meme-driven digital assets. For years, Dogecoin was treated as a joke coin. But listing a DOGE DOGE ETF on a major exchange signals a change.

Also Read: Dogecoin Price Forecast: Whales Scoop Up 4.7B DOGE as Double Bottom Signals Big Reversal

Investors can now access the token through a regulated structure instead of buying it directly. This gives Dogecoin a level of recognition previously reserved for larger cryptocurrencies.

SEC Delay Adds Complexity

The SEC recently delayed its official decision on the Bitwise Dogecoin ETF. Regulators extended the review period until November 12, 2025. The long delay shows how cautious the agency remains when reviewing meme coin products.

Despite that, NYSE Arca’s certification allows the Dogecoin ETF to trade while the federal review continues. Bitwise first submitted the proposal in March, making today’s launch a milestone after months of regulatory steps.

Competitors Prepare To Enter the Market

Bitwise will likely not stand alone for long. 21Shares is preparing its own Dogecoin ETF and has updated its filing to speed up approval. The fund also appeared on the DTCC listing site, which often signals an upcoming launch.

More issuers may join the Dogecoin ETF market if demand continues to rise. Analysts expect a multi-issuer environment similar to what developed around Bitcoin and Ethereum ETFs.

Limited Reaction From the Market

Dogecoin’s price has not reacted strongly to the news. The token dropped about 1% over the last day. It also remains down more than 27 percent over the past month.

Traders may be waiting to see whether the Bitwise DOGE ETF brings stronger inflows. The muted reaction shows that the market wants proof of demand, not just new product launches.

Grayscale’s Slow Start Sets Expectations

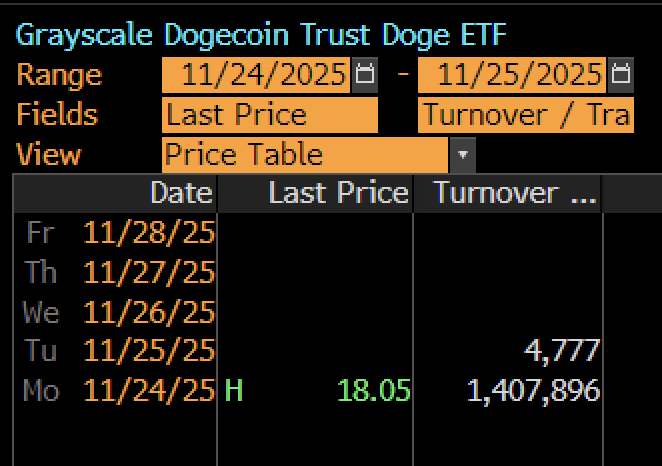

The Grayscale Dogecoin ETF entered the market earlier this week. Analysts expected at least 12 million dollars in first-day trading volume. The fund reached only 1.4 million.

Bloomberg analyst Eric Balchunas said that demand fades the further a fund moves from Bitcoin. The slow start has lowered expectations across the sector. Still, some experts believe the Bitwise Dogecoin ETF may perform better due to its branding and early attention.

Meme Coins Gain New Legitimacy

The new listing pushes Dogecoin deeper into the regulated investment landscape. Bitwise has long focused on making crypto easier to access. A Dogecoin ETF lowers the barrier for investors who want exposure without dealing with wallets or private keys.

The product may increase Dogecoin’s credibility and improve liquidity. It may also lead to more meme-coin ETFs in the future as investor demand grows.

Competition With Early Funds

The REX-Osprey DOGE fund launched in September. It uses an active management strategy. The fund manages about 25 million dollars in assets.

It entered the market early, but new competition from Bitwise may shift investor attention. More choices will allow traders to compare different approaches within the DOGE ETF market.

Conclusion

The approval of the Bitwise Dogecoin ETF marks a turning point for meme coin investing. It signals rising interest from institutional players and growing demand for regulated crypto exposure.

With more issuers preparing their own products, the DOGE ETF category may become one of the most watched areas in the crypto market. Today’s launch shows that meme coin assets are moving closer to the center of mainstream finance.

Also Read: Dogecoin Whales Accumulate 15 Million DOGE as Retail Traders Exit the Market

Appendix: Glossary of Key Terms

Dogecoin ETF: A regulated fund that tracks the price of Dogecoin and trades on a public exchange.

NYSE Arca: A U.S. exchange known for listing ETFs and digital asset products.

Bitwise: A crypto asset manager that creates regulated investment products for digital markets.

Custodian: A regulated entity that safeguards and stores a fund’s underlying assets.

Market Cap: The total value of a cryptocurrency based on its price and circulating supply.

Trading Volume: The amount of an asset traded within a set time, often measured daily.

Securities Act of 1933: A U.S. law that sets disclosure rules for investment products.

DTCC Listing: A registration step that prepares an ETF for settlement and public trading.

Active Management: A strategy where fund managers make frequent decisions to outperform the market.

Frequently Asked Questions Dogecoin ETF

1- What is a Dogecoin ETF?

It is a fund that tracks the price of Dogecoin and trades on a stock exchange.

2- Why is the Bitwise Dogecoin ETF important?

It gives investors regulated exposure to Dogecoin without direct ownership.

3- When will the fund begin trading?

It begins trading today on NYSE Arca.

4- Who secures the assets?

Coinbase Custody Trust stores and manages the fund’s holdings.

References

Read More: Bitwise Dogecoin ETF Launches Today: Can BWOW Succeed Where Grayscale Stumbled?">Bitwise Dogecoin ETF Launches Today: Can BWOW Succeed Where Grayscale Stumbled?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.