Solana ETF inflows hit $476 million while SOL price struggles

0

0

This article was first posted on The Bit Journal.

Solana ETFs are pulling in serious money while the broader crypto market feels heavy. Spot funds tied to Solana have logged seventeen straight trading days of net inflows, lifting cumulative demand to about 476 million dollars since late October, with no net outflow day yet on the record.

One of the strongest sessions came this week, when Solana ETFs absorbed more than 55 million dollars in fresh capital, marking the second biggest daily intake since launch. Most of that volume moved into a leading staking-focused product, followed by rival funds, as new listings in major markets added more Solana tickers to the shelf for institutions.

Solana ETFs Flows stay strong while price drops

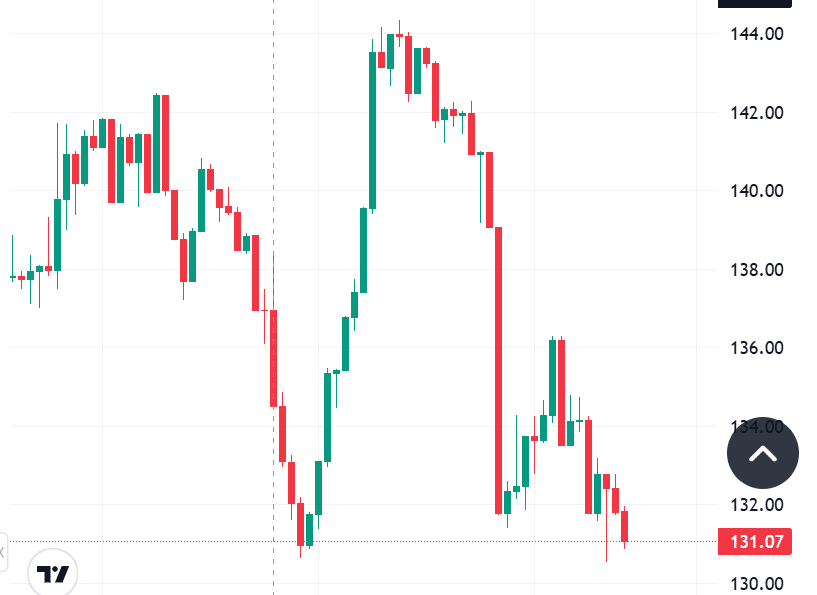

The inflow streak in Solana ETFs is unfolding while the token itself is under pressure. Solana has fallen from recent highs near 186 dollars to roughly the low 130s, close to a 30 percent slide from peak to recent trading levels, even as regulated products keep attracting capital.

At the same time, several funds linked to Bitcoin and Ether have seen mixed or negative flows, with data showing net outflows from some large products. That backdrop makes the resilience of Solana ETFs stand out, since assets under management in these vehicles have climbed into the hundreds of millions of dollars only weeks after their debut.

For institutional allocators, Solana ETFs offer a clean way to tap the network’s fast transactions, active decentralized finance activity, and staking yield while staying inside existing brokerage, compliance, and custody frameworks. That is important for pensions, advisory platforms, and wealth managers that cannot simply open an account on a crypto exchange and move size.

The technical picture focuses on the 140 and 120 dollar zones

Price charts tell a more cautious story than the ETF flow tape. Analysts flag a band around 135 to 140 dollars where repeated rallies have stalled, turning that area into both support and resistance. If this zone gives way decisively, several trading desks warn that Solana could revisit the 120 dollar region that acted as a springboard earlier in the year.

Derivatives data also reflects an uneasy balance. Open interest in Solana futures has retreated from the peak of the autumn rally, which suggests that aggressive momentum traders have already reduced leverage. Yet positioning around 140 dollars still shows short sellers leaning into each attempt to bounce, even as Solana ETFs continue to grind higher in the background.

This gap between steady demand through Solana ETFs and hesitation in the futures market highlights a split in time horizons. ETF buyers typically think in quarters and years, while many derivatives traders react to intraday swings, economic data, and fast changing sentiment.

Behind the inflows into Solana ETFs sits a wider structural thesis. Research on altcoin-focused exchange-traded products suggests that such vehicles could pull in tens of billions of dollars in their first months, with several billion potentially flowing into Solana strategies if the current launch pipeline fills out.

Global numbers from earlier Solana products in Europe and Asia already showed that investors were willing to place significant sums into regulated funds instead of holding the token directly. The new wave of United States Solana ETFs adds deeper liquidity, clearer rules, and well known brands, which tend to matter when institutions move from watchlists to actual allocation decisions.

Outlook for Solana ETFs and the wider market

For the broader crypto landscape, the resilience of Solana ETFs is an early test of whether investors will use regulated funds to rotate beyond Bitcoin and Ether in a more measured way. Strong, sustained inflows in the middle of a drawdown suggest that at least part of the market now sees Solana as a core position instead of a speculative side bet.

The near term risk is straightforward. A clean break below the mid 130s could invite a deeper move toward 120 dollars and leave recent ETF buyers sitting on paper losses, which might slow the next wave of subscriptions. If support holds and inflows into Solana ETFs keep building, this phase may later look like the moment when patient capital stepped in while faster money stepped away.

Frequently Asked Questions

Q: What do sustained inflows into Solana ETFs really indicate?

A: They indicate that long-horizon investors are adding regulated exposure to Solana even while short-term traders respond cautiously to volatility and price pullbacks.

Q: Can Solana ETFs on their own push the price higher?

A: No. Solana’s price also depends on macro conditions, overall crypto liquidity, and on chain usage. ETF flows are one important input, not a guarantee of gains.

Glossary of Key Terms

Exchange traded fund (ETF)

A regulated investment vehicle that trades on stock exchanges and holds underlying assets such as cryptocurrencies, stocks, or bonds.

Net inflow

The amount of money entering a fund after redemptions are subtracted. Positive net inflow usually signals that investors are adding exposure.

Open interest

The total value of outstanding futures contracts that have not been closed. Rising open interest often suggests growing speculative positioning.

Support and resistance

Price zones where buying or selling has repeatedly slowed or reversed past moves. Traders use these levels to frame risk and potential breakouts.

References

Read More: Solana ETF inflows hit $476 million while SOL price struggles">Solana ETF inflows hit $476 million while SOL price struggles

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.