Axie Infinity Price Outlook – AXS Bulls Target $1.42 Amid Rising Retail Demand

0

0

Highlights:

- The Axie Infinity price has increased by 7% to $1.38 today.

- Axie Infinity’s first-ever bAXS airdrop was completed on Thursday, marking a shift in the AXS game’s tokenomics.

- The technical picture indicates building bullish momentum, as AXS bulls target $1.42, amid surging retail demand.

Axie Infinity (AXS) price is on a positive start to the week with 7% gains to $1.38 at the time of writing on Monday. This is an indicator that the gaming token is in demand once again. This is upon the recovery of the bonded AXS (bAXS) token airdrop that was taken on Thursday. An increase in the trading volume and AXS futures Open Interest on Monday also suggests a high level of retail demand. This might make the short-term outlook move towards the $1.42 zone.

On Thursday, the initial airdrop of the 100,000 bAXS tokens was done upon the basis of the Axie score and over 10 staked AXS tokens. The reason to use bAXS is the restriction of the direct sale of ecosystem or gameplay rewards. The bond is not transferable between players and has a variable fee, which the sellers pay the treasury. This assists in maintaining the circulating values in the ecosystem. The ecosystem will grant gameplay rewards as bAXS tokens to overcome these in-game economic problems in the future.

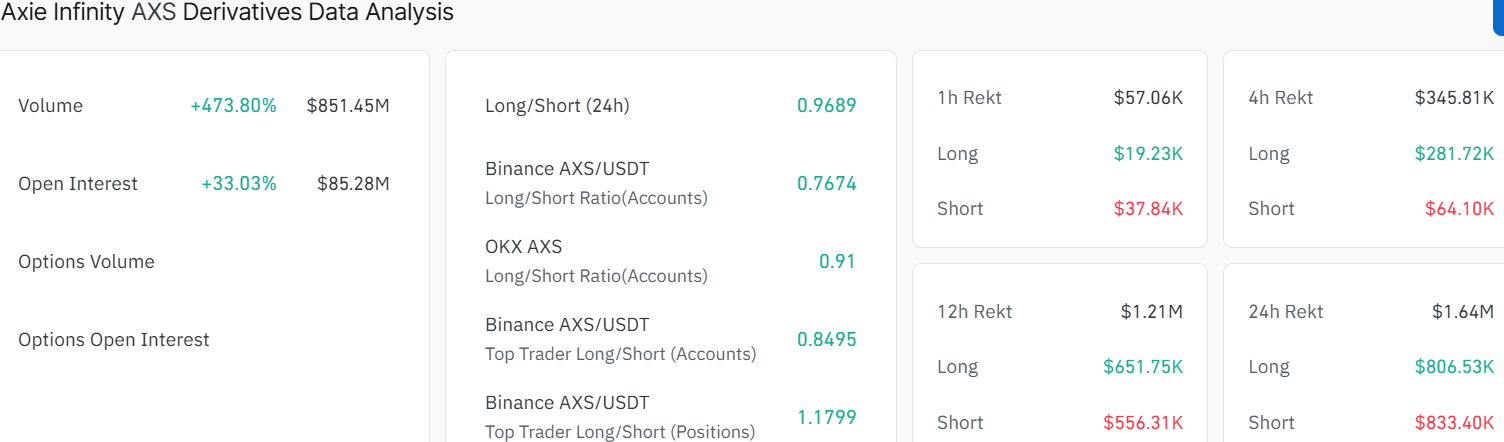

According to CoinGlass data, the Open Interest (OI) of the AXS futures has risen by approximately 33% in the past 24 hours and is at $85.28 million. This indicates a rise in the inflow of capital as traders expect to gain even more. On the other hand, the trading volume is up by 473% to $851.45 million, indicating intense trading activity.

During inflows, both short liquidations of $833,040 and long liquidations of $806,053 are higher, implying that bearish positions outnumbered the bullish positions.

AXS Price Targets $1.42

The 1-day Axie Infinity chart shows a clear sign of building bullish momentum. Price recently bounced off a strong support level around $1.25, which has held multiple times. This support has acted as a solid foundation, allowing AXS to recover from previous declines.

The Axie Infinity price is moving within a bearish channel, making lower lows and lower highs. The recent support at $1.25 has cushioned against further downside, signaling that buyers are regaining control. Currently, the price is accumulating within the channel, where sellers are gradually losing influence and buyers have begun gaining momentum. The bulls are showing strength, showing that the market has stabilized and is preparing for potential further gains.

On the upside, there is a clear resistance zone between $1.42 and $1.73. AXS has tested this area multiple times but has struggled to break above it decisively. Currently, the price is consolidating just below this zone, eyeing a potential rebound for the next upward move.

A confirmed breakout above $1.42 could open the door to a reward zone near $1.73, representing the next likely target for bullish traders. The RSI analysis further supports this positive outlook. The Relative Strength Index sits around 43.60, suggesting there is still room for the Axie Infinity price to move higher before encountering selling pressure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.