Chainlink (LINK) Price Likely to Retrace Back to $15

0

0

Chainlink’s (LINK) price is expected to draw down in the coming days after the altcoin surprised the market with a commendable rise.

The investors that have been aiding the growth could be the ones to attempt to book profits.

Chainlink Investors Are Skeptical

Chainlink’s price is above a key support level, which was possible with the help of the broader market cues. LINK rallied with Bitcoin and other crypto assets. But the whales, too, had a hand in making this happen.

The addresses holding between 100,000 and 1 million LINK had been consistently adding LINK to their wallets. However, two days ago, they suddenly ramped up their accumulation, resulting in a rise of 2.5 million LINK. This $41.5 million supply is evidence that whales are looking to sell.

Chainlink Whale Holding. Source: Santiment

Chainlink Whale Holding. Source: Santiment

Buying during a bull run is either due to conviction or profit-taking, and with this cohort, it is the latter.

This selling could halt the ongoing rally in Chainlink’s price.

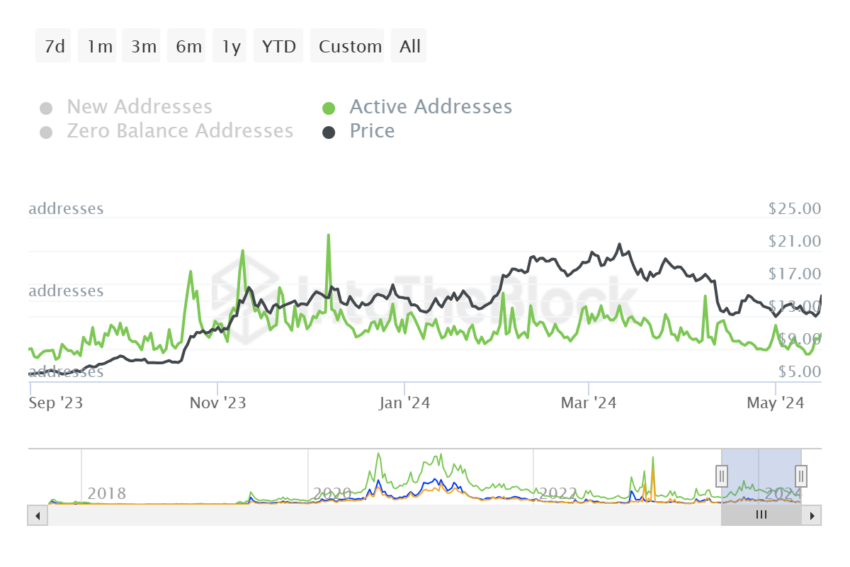

Furthermore, retail investors are already discouraged from participating on the network. The active addresses indicator measures the number of addresses conducting a transaction on the network.

The average active addresses on the network have dropped from 4an average of 4,400 in April to 2,000 at the moment. LINK holders stepping away from the network suggests that they were not anticipating the rally, making the rise likely less impactful for these investors.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Chainlink Active Addresses. Source: IntoTheBlock

Chainlink Active Addresses. Source: IntoTheBlock

However, if they become active on the network again, Chainlink’s price could benefit from it.

LINK Price Prediction: Chainlink Above Key Resistance

Chainlink’s price has risen 27% in the last three days, reclaiming the support of 61.8% Fibonacci Retracement. This level is also known as the bull market support floor, and a bounce above it secures the rise.

Should the conditions mentioned above impact LINK, the altcoin could fall through this support. This would result in the price falling to $15.5 or lower, potentially sending the cryptocurrency to $15.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

Chainlink Price Analysis. Source: TradingView

Chainlink Price Analysis. Source: TradingView

On the other hand, if LINK bounces off the 61.8% Fib level, it could continue the uptrend. This would enable Chainlink’s price to breach the 78.6% Fib level at $16.6, invalidating the bearish thesis.

0

0