Coinbase Surpasses Expectations in Q1 2024

0

0

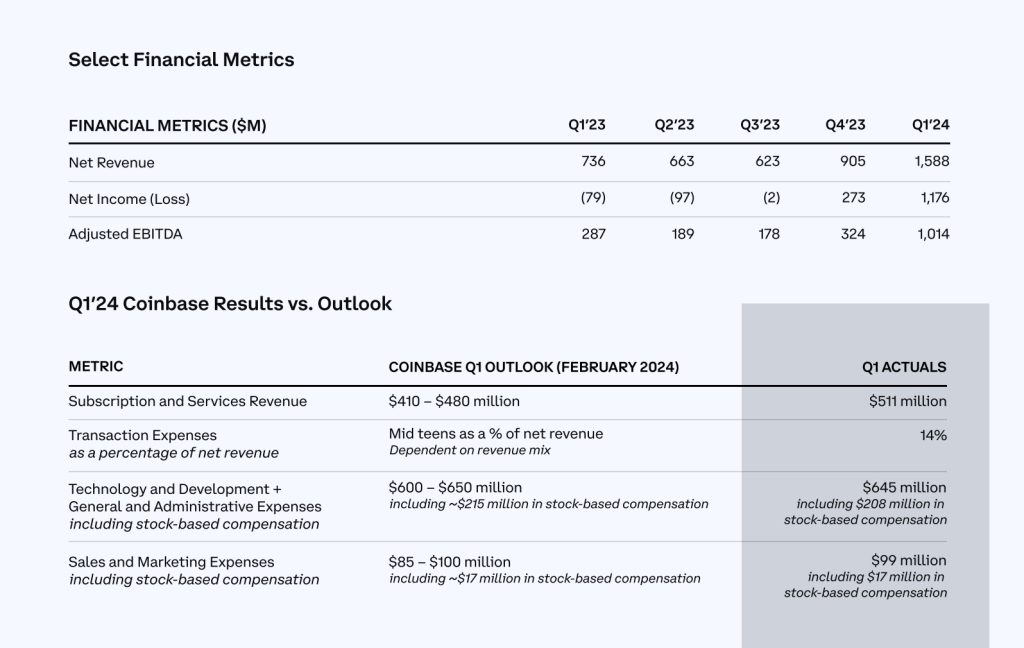

Coinbase, the leading American cryptocurrency exchange, reported a strong first quarter of 2024, exceeding Wall Street expectations by a significant margin. The company’s net income reached $1.18 billion, translating to $4.40 per share, a sharp contrast to the $78.9 million loss reported in the same period last year.

This Marks Coinbase’s First Profitable Quarter In Two Years

The impressive net income included a $650 million gain on crypto assets, attributed to the adoption of updated accounting standards. Coinbase’s total revenue also saw a significant increase of 72% compared to the previous quarter, reaching $1.6 billion. Consumer transaction revenue doubled year-over-year to $935 million, while subscription and services revenue played a growing role, contributing $511 million.

In a statement, Coinbase highlighted its progress on key 2024 priorities, including driving revenue growth, increasing platform utility, and advocating for regulatory clarity. The company pointed to its expanding market share in US spot and derivatives trading, record highs on its Coinbase Prime platform, and the growth of USDC, a stablecoin pegged to the US dollar.

Additionally, strong adoption of Coinbase One, a subscription service offering benefits like fee discounts and rewards, was noted. The company also acknowledged the increasing contribution of its international business to overall growth.

Coinbase’s Stock Is Heavily Influenced By Fluctuations In The Market

Those fluctuations come particularly from Bitcoin. The first quarter witnessed a surge in Bitcoin’s price, reaching a new all-time high of over $73,000 in March. This, along with the Dencun upgrade on the Ethereum network (the second-largest cryptocurrency), led to a significant increase in trading volumes on Coinbase’s platform.

Furthermore, the cryptocurrency sector saw a notable influx of institutional investors, fueled by the SEC’s approval of several US spot Bitcoin ETFs, many of which partnered with Coinbase for custody services. By the end of the quarter, these funds had amassed over $50 billion in investments. Despite the strong earnings report, Coinbase’s stock price remains volatile. Following a nearly 9% pre-market rise on the day the report was released, the stock is still down over 14.5% year-to-date.

This decline is attributed to a correction in the crypto market that occurred in April, with Bitcoin falling by 16% and some altcoins experiencing even steeper drops. Analysts, including John Todaro of Needham & Co., expressed concerns about the potential impact on Coinbase’s Q2 performance. Todaro noted that the second quarter appears weaker than the first, and the recent crypto price pullback could erase the gains in retail user activity witnessed in Q1.

Coinbase Also Faces Ongoing Challenges Beyond Market Fluctuations

The company is currently embroiled in a legal battle with the SEC over allegations of unregistered securities sales. A judge has recently ruled that the lawsuit can proceed to a jury trial. Additionally, insider activity at Coinbase has drawn scrutiny. According to CNBC, company insiders, including four C-suite members, sold a combined $383 million worth of shares in the first quarter.

This represents more than double the amount sold in the previous quarter and the highest level since Coinbase’s IPO in 2021. Fred Ehrsam, co-founder and board member, was the biggest seller, netting $129 million. This significant level of insider selling raises questions about potential strategic shifts within the company as it navigates a potentially challenging second quarter.

The post Coinbase Surpasses Expectations in Q1 2024 appeared first on Coinfomania.

0

0