Bittensor (TAO) Derivatives Market Activity Spikes, But Not for Good Reasons

0

0

TAO, the altcoin that powers Bittensor’s decentralized machine learning network, has witnessed a 36% price rally in the past 24 hours as the general cryptocurrency market rebounds following Monday’s decline.

This has led to an uptick in the token’s derivatives market activity. However, this is not without a catch.

Bittensor Futures Traders Bet Against a Price Rally

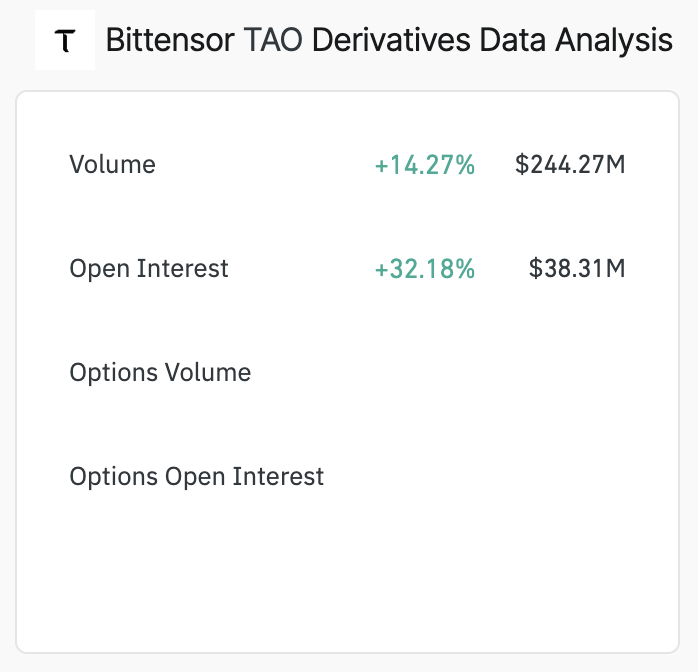

According to Coinglass, TAO’s derivatives market has recorded a 14% upswing in daily trading volume in the past 24 hours.

When an asset sees an increase in derivatives trading volume, it suggests a growing interest in the underlying asset. Since derivatives allow traders to speculate on price movements without owning the underlying asset, a spike in trading volume may suggest that more traders are engaging in speculative activities, which may drive up price volatility.

TAO’s rising open interest confirms this influx of new traders over the past 24 hours. According to Coinglass, the coin’s open interest has increased by 32% during that period, totaling $38.31 million.

TAO Derivatives Market Activity. Source Coinglass

TAO Derivatives Market Activity. Source Coinglass

Read More: Top 9 Safest Crypto Exchanges in 2024

An asset’s open interest refers to the total number of outstanding derivative contracts, such as options or futures, that have not been settled. When it spikes like this, more traders are opening new positions in the market.

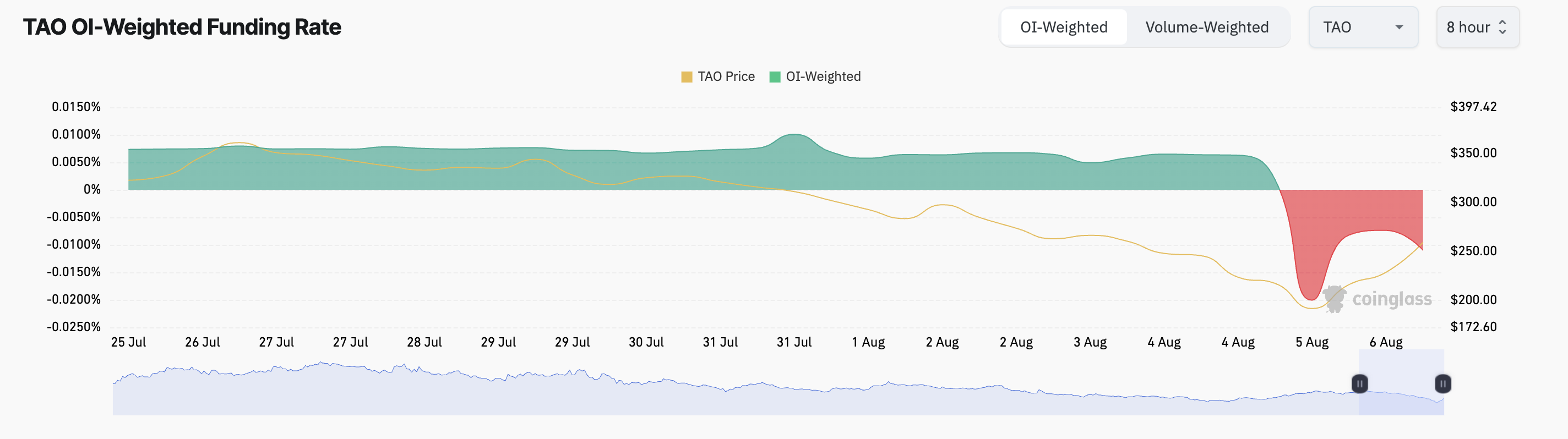

However, TAO’s negative funding rate signals that these new traders have mostly opened short positions. As of this writing, the token’s funding rate across cryptocurrency exchanges is -0.01%.

TAO Funding Rate. Source Coinglass

TAO Funding Rate. Source Coinglass

Funding rates are used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are negative, it means more traders are buying the asset, expecting a decline, than those buying in anticipation of a rally.

TAO Price Prediction: A Bullish Divergence Offers Hope

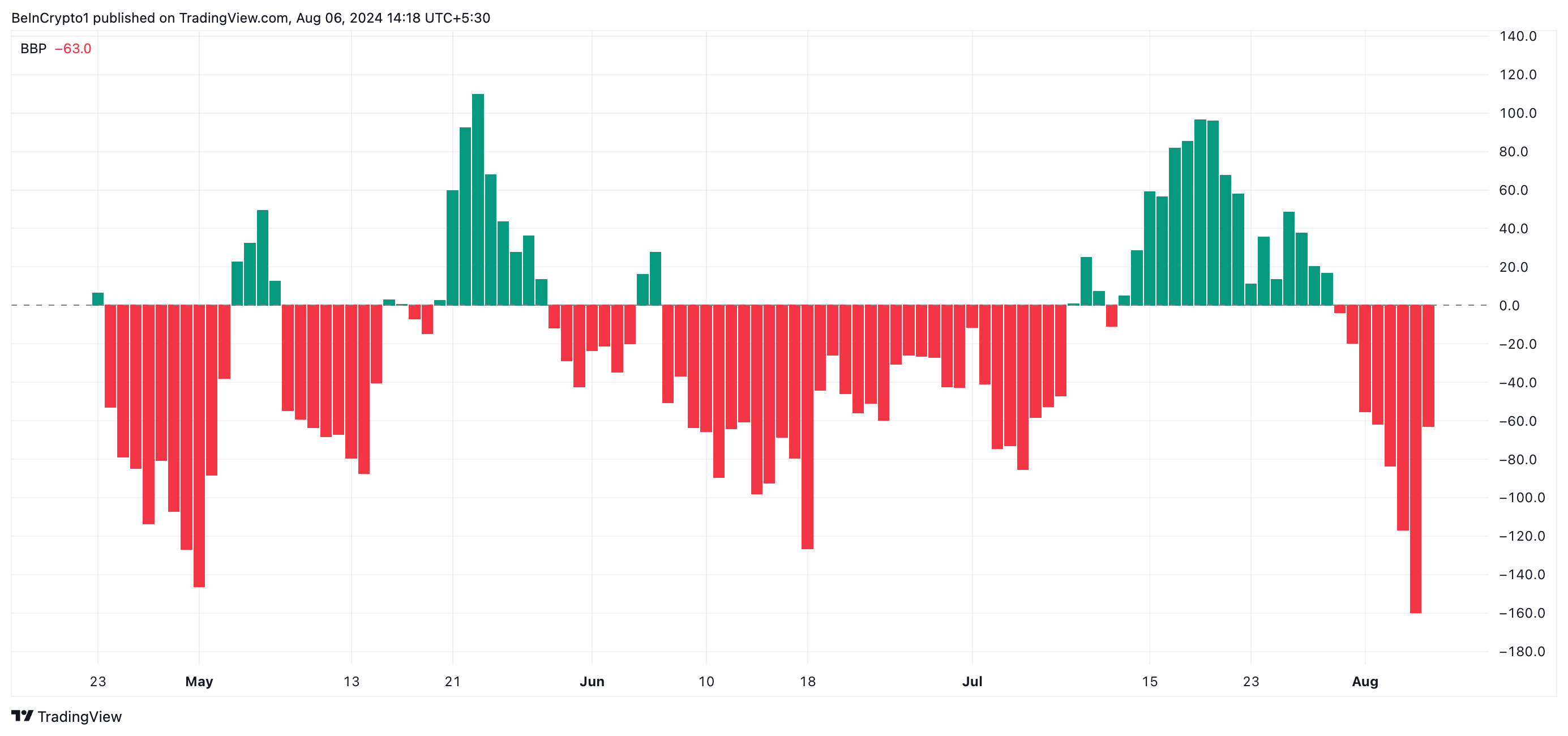

Readings from TAO’s one-day chart reveal that its double-digit price rally over the past 24 hours might not be sustainable. This is because the bearish bias toward the altcoin is still significant.

At press time, its Elder-Ray Index returns a negative value of -64.2. For context, this indicator has returned values below zero since July 30, and the recent price rally has not changed that.

An asset’s Elder-Ray Index measures the relationship between the strength of buyers and sellers in the market. When its value is negative, it means that bear power outweighs bullish presence.

Bittensor Price Analysis. Source: TradingView

Bittensor Price Analysis. Source: TradingView

If the bears remain in control and continue to put downward pressure on TAO, its price may fall below $200 to trade at $163.70.

However, the bullish divergence between TAO’s price and its Chaikin Money Flow (CMF) hints at the possibility of a rally. While TAO’s price has maintained a downtrend since July 28, its CMF has risen, creating a bullish divergence.

This divergence often signals a potential bullish reversal. While the price is declining, buying pressure is increasing, which could lead to a price uptrend.

Read More: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Bittensor Price Analysis. Source: TradingView

Bittensor Price Analysis. Source: TradingView

If this buying pressure gains momentum, it could push the token’s value to a two-month high of $419.80.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.