Bitcoin faces critical $70,000 barrier ahead of Ethereum ETF verdict

1

0

Quick Take

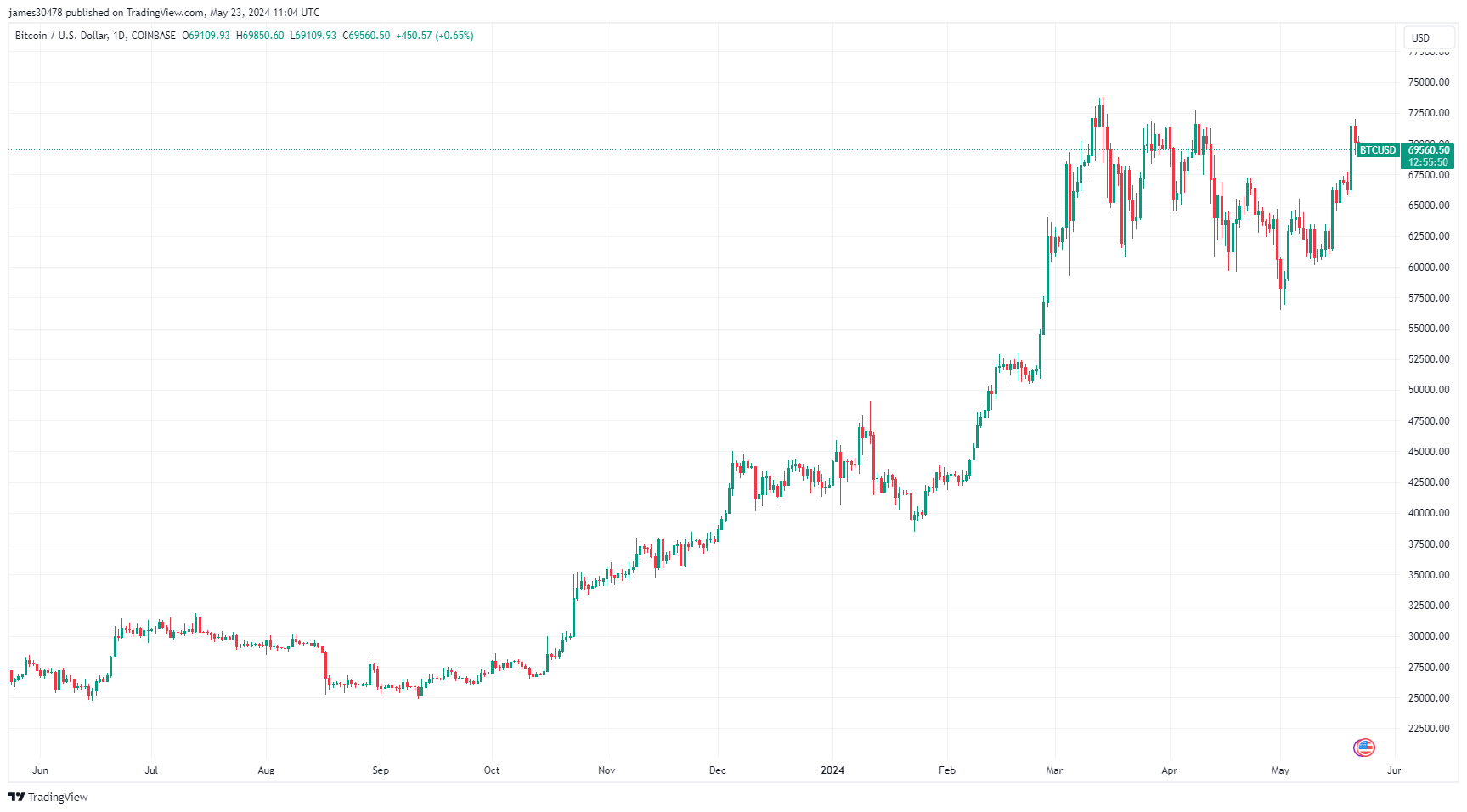

Bitcoin is currently trading just below $70,000, a critical resistance level, while its all-time high (ATH) stands around $73,600. The digital asset community is eagerly awaiting the decision on the Ethereum ETF, which could potentially propel Bitcoin to new heights.

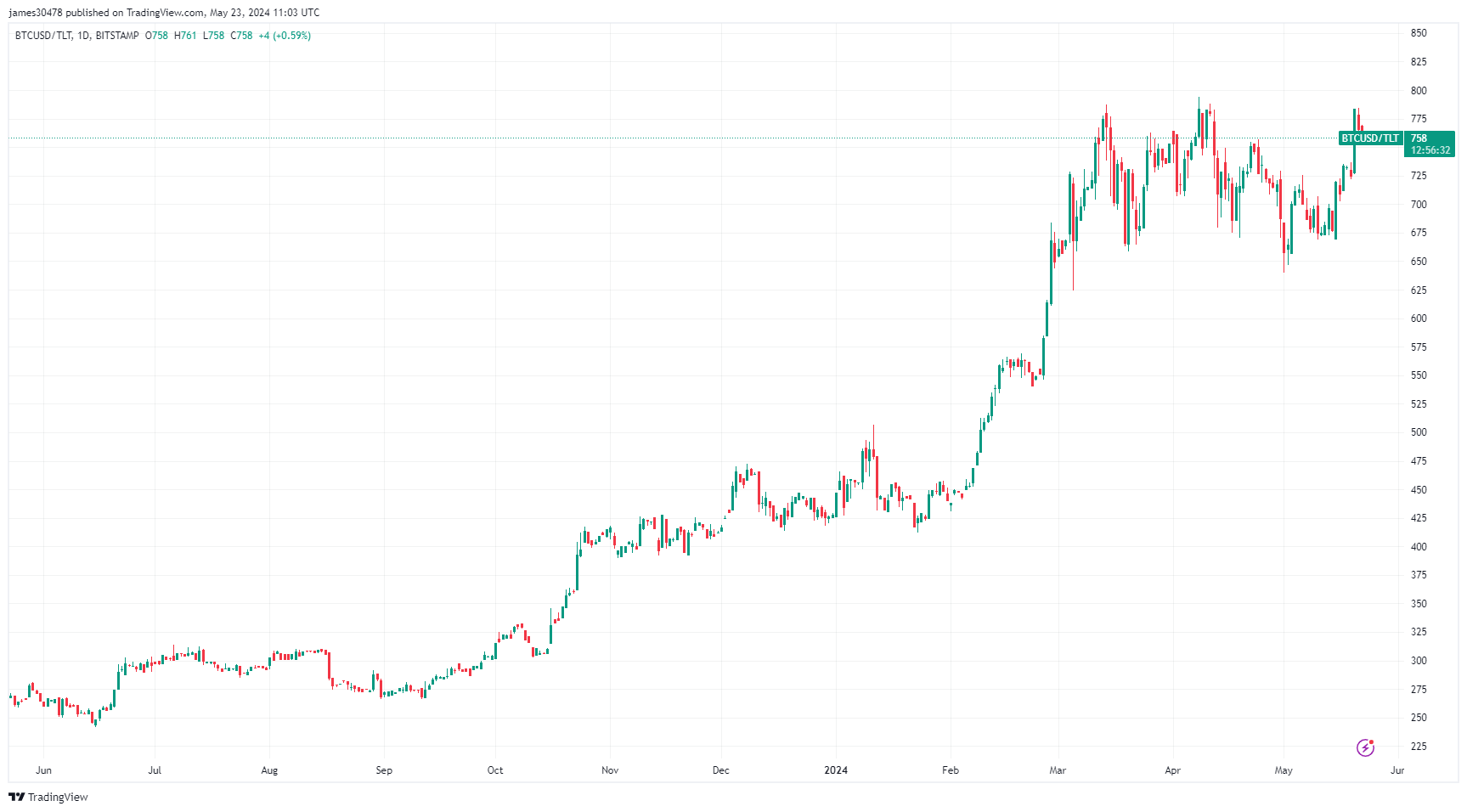

When comparing Bitcoin against TLT, the 20+ year Treasury Bond ETF, we see it is also at a critical resistance level, maintained since March. Currently, it takes 758 TLT to equal one Bitcoin. This highlights that Bitcoin has yet to reach new highs against the US dollar, the world’s reserve currency, and TLT, one of the largest bond ETFs globally.

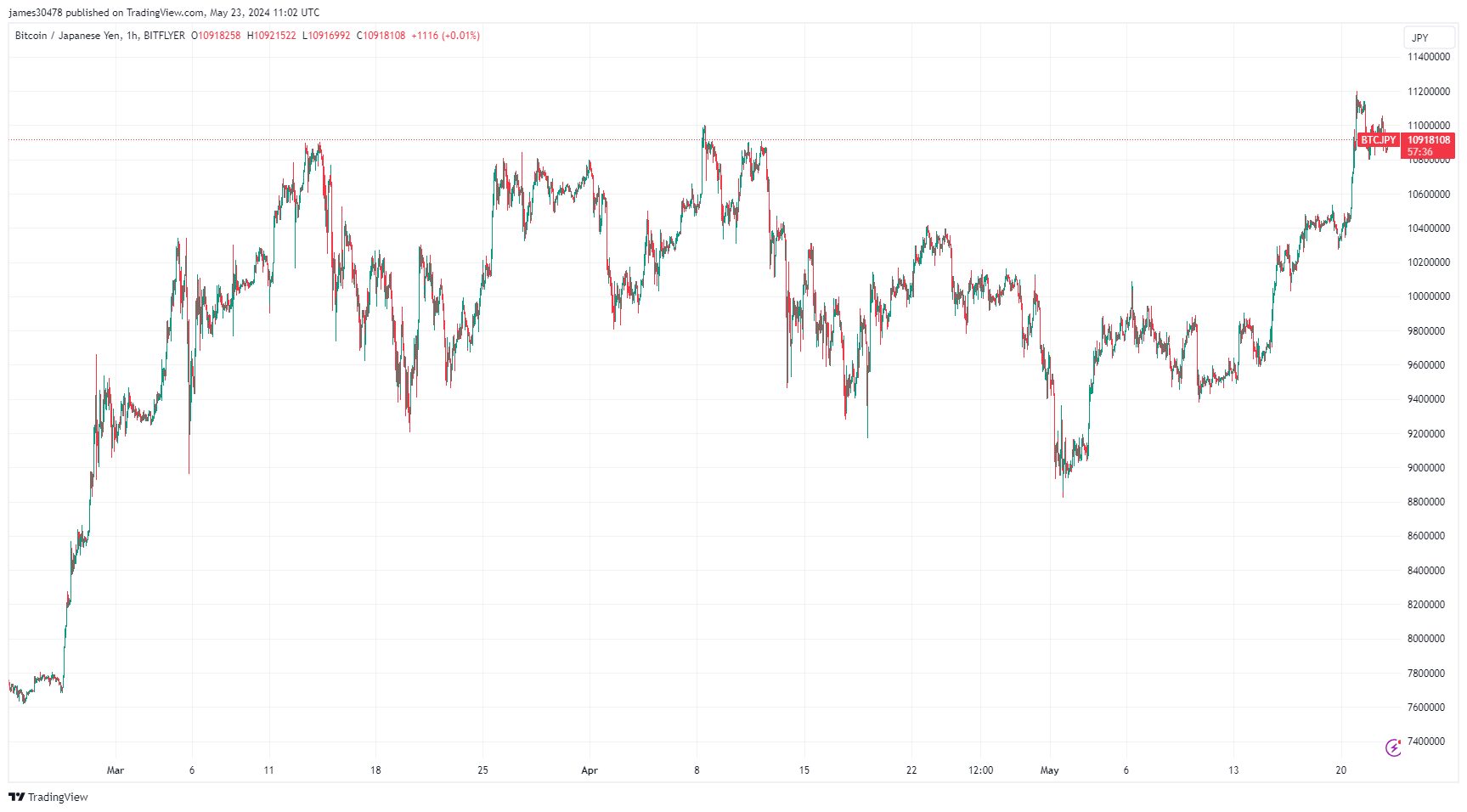

In other major currencies, Bitcoin is still near its ATH in British Pounds, trading around £54,500, just shy of its peak at £57,500. Interestingly, Bitcoin reached a new ATH in Japanese Yen on May 21, hitting roughly ¥11,200,000. This is significant because Japan often leads Western economies in financial trends. Bitcoin breaking new highs in the Japanese Yen may signal that it may soon achieve new ATHs in other major currencies and financial instruments.

These figures are all nominal and do not account for inflation-adjusted values. For Bitcoin to achieve new highs in real terms, adjusted for inflation, it would need to reach approximately $77,000.

The post Bitcoin faces critical $70,000 barrier ahead of Ethereum ETF verdict appeared first on CryptoSlate.

1

0