WLFI Price Dips 15% as Liquidity Outflows Hit $82M

0

0

The WLFI price has taken an unexpected dip, despite a series of major developments from World Liberty Finance. The Trump-backed crypto entity had aimed to strengthen its position through the launch of its USD1 stablecoin on the Aptos blockchain.

Yet, the WLFI price dropped by more than 15% over the past week. Analysts now see mixed signals in the market. Short-term traders are exiting positions, while large investors seem to be accumulating, setting the stage for a possible rebound.

Liquidity Outflows Pressure WLFI Price

World Liberty Finance had been expected to boost the WLFI price through innovation and ecosystem expansion. The launch of USD1 was intended to stabilize WLFI’s value and attract new investors.

However, instead of rising, the WLFI price saw a steep decline. Trading volume surged to $550 million, more than double the previous day’s low. Analysts believe the sharp movement reflects growing volatility rather than confidence.

Also Read: Is WLFI’s $0.20 Support Strong Enough to Stop the Bleeding?

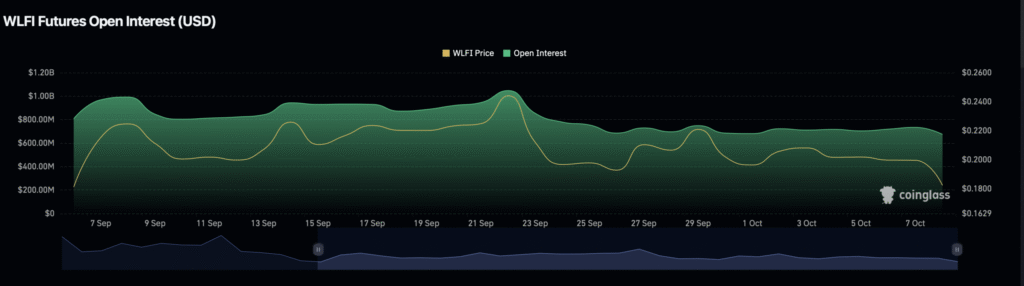

CoinGlass data shows that WLFI experienced a liquidity outflow of $82 million, cutting the total value locked to around $630 million. This drop signaled that many traders were pulling funds amid bearish pressure.

Market Sentiment Weakens

Investor sentiment around the WLFI price has turned cautious. Data from CoinMarketCap indicates that 4% of investors shifted from bullish to bearish positions. The community sentiment index dropped from 79% to 75%.

Despite the pullback, analysts note that large holders and institutions are still active in the market. Their presence could provide support for the WLFI price and limit further downside.

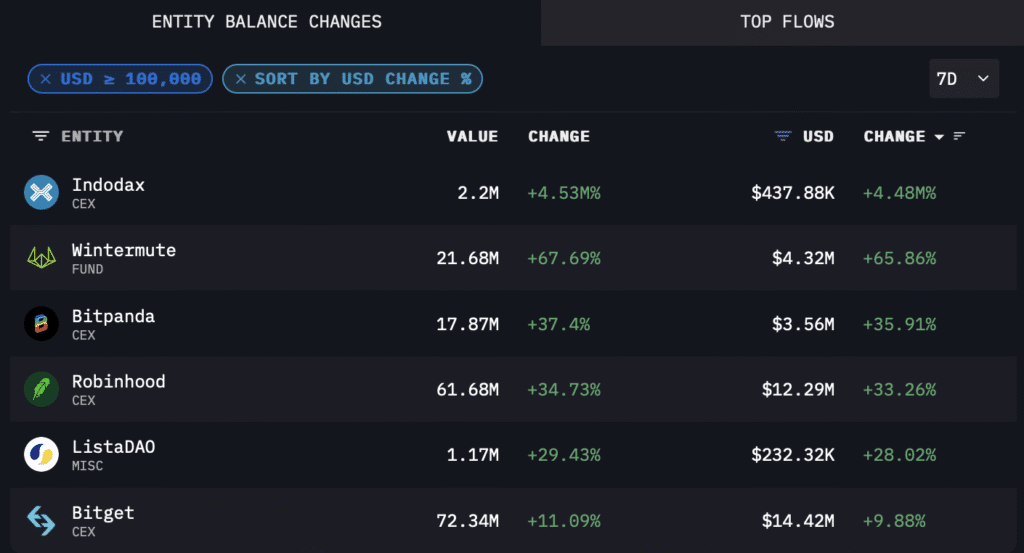

Institutional Accumulation Rises

Reports from Arkham Intelligence suggest that major crypto platforms have started buying WLFI in large amounts. Robinhood, Bitget, Bitpanda, and Indodax together invested more than $30 in the token over the last week.

Analysts believe the renewed interest from large investors could push the WLFI price higher once market sentiment improves. Institutional confidence often signals long-term faith in an asset’s potential, even when short-term traders are selling.

Exchange Movements Show Mixed Activity

While some exchanges increased their WLFI holdings, others trimmed positions slightly. Binance, MEXC, and Coinbase each sold small portions of their WLFI reserves, under one percent of their total holdings.

This suggests that while smaller traders are reducing exposure, strong liquidity remains across the market. The WLFI price could benefit from this balance between short-term selling and long-term accumulation.

Funding Rate Remains Positive

The WLFI price is supported by a positive Funding Rate, which stands at 0.0033%. A positive rate means traders are paying to hold long positions. This usually indicates confidence that prices will rise.

Analysts see this as a bullish signal. Even after the recent drop, some investors continue to inject capital into WLFI markets. This helps sustain trading activity and keeps demand alive.

Technical Indicators Hint at Recovery

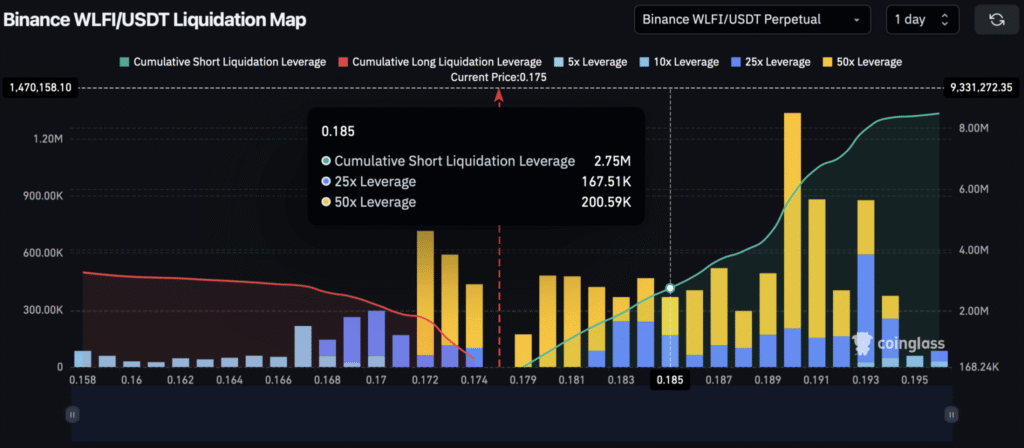

According to the one-day liquidation map, several long liquidity clusters are positioned above WLFI’s current trading range. Such clusters often attract price movements toward them. Analysts say that if the pattern holds, the WLFI price could rally toward the $0.193 mark in the near term.

The setup suggests a possible recovery as the market stabilizes. However, traders are advised to remain cautious and watch key resistance levels before re-entering positions.

Broader Market Overview

The current WLFI price trend reflects the complex dynamics of the crypto market. On one hand, World Liberty Finance continues to innovate through product launches and partnerships. On the other, investor reactions remain tied to short-term volatility and broader market sentiment.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Oct 2025 | $ 0.129143 | $ 0.146467 | $ 0.183947 |

4.68%

|

| Nov 2025 | $ 0.140061 | $ 0.144877 | $ 0.149675 |

14.82%

|

| Dec 2025 | $ 0.138134 | $ 0.143594 | $ 0.148553 |

15.46%

|

This dual behavior has become common in the digital asset space. Strong fundamentals can often be overshadowed by sudden shifts in liquidity and market fear. The WLFI price may therefore continue to fluctuate until investor confidence returns.

Conclusion

Despite the sharp decline, the WLFI price shows early signs of stability. Institutional accumulation, a positive Funding Rate, and growing liquidity clusters suggest potential for recovery. Large investors appear to be preparing for future gains, even as smaller traders exit.

Analysts highlighted that if buying momentum continues, WLFI could see a gradual rebound in the coming weeks. The key factor would be whether the token can maintain support and regain trust among retail investors.

Summary

The WLFI price fell over 15% over the past week despite World Liberty Finance launching its stablecoin, USD1, on the Aptos blockchain. Heavy liquidity outflows and rising trading volumes reflected short-term bearish sentiment.

Yet, institutional investors such as Robinhood and Bitget accumulated WLFI, hinting at a possible rebound. A positive Funding Rate and liquidity clusters suggest growing optimism. Analysts believe WLFI’s decline may be temporary as whales and large investors position for long-term gains.

Also Read: Will WLFI’s USD1 Stablecoin on Aptos Gain Traction With Trump Jr.?

Appendix: Glossary of Key Terms

USD1: WLFI’s stablecoin launched on the Aptos blockchain.

Aptos (APT): Layer-1 blockchain hosting WLFI’s stablecoin.

Liquidity Outflow: Withdrawal of funds reduces the total market value.

Funding Rate: Indicator showing trader sentiment in perpetual markets.

Whales: Large investors or institutions holding significant crypto assets.

TVL (Total Value Locked): The total amount of assets staked or locked in DeFi protocols.

CoinGlass: Analytics platform tracking derivatives and market liquidity.

Frequently Asked Questions About WLFI price

1. Why did the WLFI price drop after the stablecoin launch?

Because of short-term profit-taking, liquidity outflows, and cautious market sentiment.

2. What is driving optimism around WLFI’s recovery?

Institutional accumulation, a positive Funding Rate, and technical liquidity patterns.

3. How does USD1 affect WLFI’s ecosystem?

It adds stability and utility by allowing staking and cross-chain liquidity growth.

4. Could WLFI price rebound soon?

Analysts say a rebound is possible if institutional buying continues and volatility eases.

Read More: WLFI Price Dips 15% as Liquidity Outflows Hit $82M">WLFI Price Dips 15% as Liquidity Outflows Hit $82M

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.