Crypto Investors Lose Millions Through Known Fault on DeFi Protocol Radiant Capital

1

1

Cross-chain lending protocol Radiant Capital (RDNT) lost 1,900 ETH to a decentralized finance (DeFi) exploit that attacked a new lending market for the USDC stablecoin. The attacker targeted the Ethereum layer-two solution Arbitrum protocol on January 2, 2024.

The Radiant team received reports of an issue regarding a new USDC market on Arbitrum late on January 2, 2023. Its DAO Council temporarily suspended the protocol’s lending and borrowing markets while they investigated the situation.

DeFi Exploit Beats Known Radiant Capital Issue

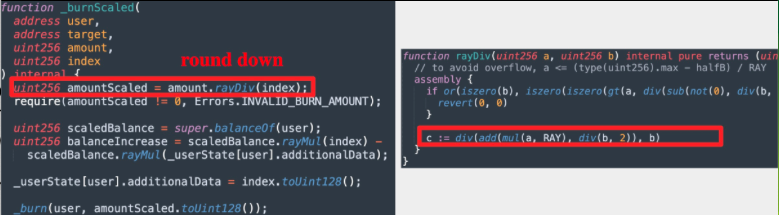

Blockchain security firm Peckshield said the attacker exploited a new USDC market six seconds after activation. The entity seems to have exploited an issue that affects lending markets forked from decentralized finance protocols Compound and Aave. They targeted a known rounding issue in the smart contracts used in the Aave and Compound code.

Read more: DeFi Lending Explained: What Are DeFi Loans?

Radiant Smart Contract Rounding Issue | Source: PeckShield Inc.

Radiant Smart Contract Rounding Issue | Source: PeckShield Inc.

Radiant, specifically Radiant v2, was launched almost a year ago with the goal of being the decentralized protocol with the lowest price-to-fee ratio. It launched on Ethereum in October 2023 and has $445.1 million invested. On Ethereum, it offers yields on providers of USDC, Tether (USDT), SavingsDAI (sDAI), Ethereum (ETH), wrapped stETH (wstETH), and Rocket Pool ETH (rETH) liquidity.

DeFi liquidity relies on smart contracts, whereas traditional finance liquidity usually relies on an institutional intermediary. DeFi users can create a new market and deposit their liquidity into a smart contract. Liquidity providers earn fees for trades on the markets for which they provide liquidity.

Read more: How is Ethereum Leading the Decentralized Finance Revolution?

How DeFi is Rising From The Ashes

The Radiant exploit is one of the largest so far this year, even as DeFi protocols soldier on despite Bitcoin getting attention from institutional investors. Last year, a new wave of security companies emerged to use AI in a broader framework to assess DeFi security.

Anchain.AI and Cyvers offer tools to understand criminal behavior on-chain and means to assess smart contract code for vulnerabilities. The DeFi space also became the target of regulators who think that certain stakeholders must be held responsible if sanctioned entities use a protocol.

“There’s still a core group of folks that are not only writing the software, like the open source software, but they often have governance and fees,” said the chairman of the US Securities and Exchange Commission, Gary Gensler.

The crypto industry hopes that Bitcoin, which does not have a decentralized marketplace of comparable size to Ethereum, will receive additional liquidity through exchange-traded products starting in January. The market expects an SEC decision on a Bitcoin exchange-traded fund from ARK Invest on January 10, 2023.

Do you have something to say about the Radiant Capital USDC exploit or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

1

1