Top News That Will Impact the Crypto Market in May 2024

0

0

May 2024 is poised to be a pivotal month for the crypto market, influenced by several critical events that could shape its trajectory.

From key economic indicators to significant regulatory decisions, here’s an overview of what market watchers anticipate this month.

Macroeconomic Factors: Federal Reserve Meeting and April CPI Report

The Federal Reserve’s Federal Open Market Committee (FOMC) meeting, concluding on May 1, is among the most anticipated events. Despite ongoing concerns about persistent inflation, the Fed will likely maintain the borrowing rate steady between 5.25%-5.5%.

This decision could signal a continued conservative approach amidst economic uncertainties, impacting investor sentiment in the crypto sector.

On May 2, the US Treasury Department is slated to announce its refunding plans for the upcoming quarter, potentially offering some relief to markets. After three consecutive quarters of increasing auction sizes, the Treasury plans to steady most of its auction sizes.

Investors are particularly keen on the details of an anticipated debt repurchase program and its implications for long-term US financing strategies amid escalating debt concerns. Although there may be increases in specific issues like the 10-year Treasury Inflation-Protected Securities (TIPS), most auctions are expected to remain unchanged, which could influence market liquidity and interest rates.

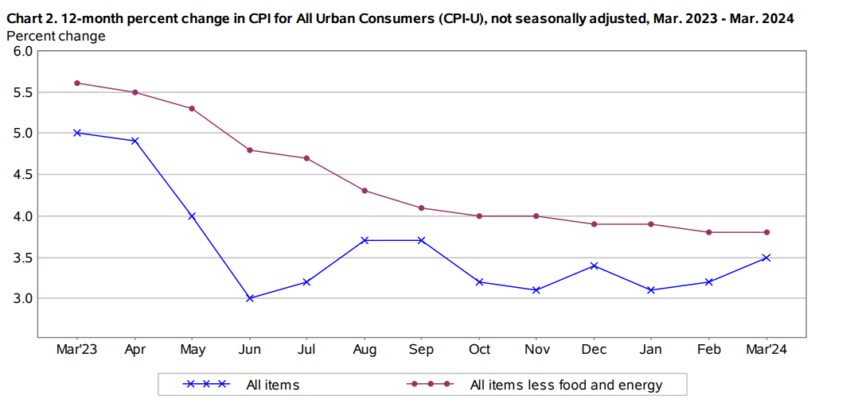

Another noteworthy development is the April Consumer Price Index (CPI) report on May 15. As shelter costs contributed to over half of the 3.5% CPI inflation rate as of March 2024, the financial market will keep a close eye on this report. Any significant change might influence the Fed’s monetary policy, impacting crypto market stability.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

CPI for All Urban Consumers (CPI-U) from March 2023 to March 2024. Source: US Bureau of Labor Statistics

CPI for All Urban Consumers (CPI-U) from March 2023 to March 2024. Source: US Bureau of Labor Statistics

Spotlight on Hong Kong: The Bitcoin Asia Conference

On the global stage, the Bitcoin Asia Conference in Hong Kong on May 9-10 stands out as a key event. This conference will bring together top figures from the crypto and traditional finance (TradFi) industry, including Han Tongli of Harvest Global Investment Limited and Elizabeth Stark of Lightning Labs.

The insights and developments shared here could influence market trends, particularly as Hong Kong embraces spot Bitcoin and Ethereum ETFs.

Legal Challenges: The Tornado Cash Trial and Its Implications

The market is also watching the legal proceedings against Tornado Cash developer Alexey Pertsev in the Netherlands, with a verdict expected on May 14. Pertsev faces charges of money laundering, with prosecutors recommending a 64-month jail sentence.

BeInCrypto reported in August 2022 that the Netherlands Crime Agency (FIOD) arrested Pertsev in Amsterdam following the sanctions from the US treasury upon Tornado Cash. FIOD alleged Persev for sponsoring illicit financial flows, money laundering, and mixing cryptocurrencies through a decentralized Ethereum mixing service, Tornado Cash.

Meanwhile, other Tornado Cash developers in the US, Roman Storm, and Roman Semenov, faced several charges from the Department of Justice (DOJ). The charges include conspiring to commit money laundering, operating an unlicensed money transmitter, and violating sanctions imposed by OFAC.

The crypto community keenly awaits the outcome of Tornado Cash’s case, which fears it may establish a precedent that threatens developers of privacy-focused software within the ecosystem.

SEC Decisions: The Fate of Ethereum and Bitcoin ETFs

At the end of the month, the crypto community is also anticipating the US Securities and Exchange Commission (SEC) responses to the spot Ethereum ETF filings. The spotlight is on VanEck’s and ARK’s applications, with deadlines for the SEC’s decision set for May 23 and May 24, respectively.

Despite the anticipation, skepticism runs high among industry experts regarding the SEC’s approval. Jan van Eck, CEO of VanEck, doubts the spot Ethereum ETF approval.

“The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the Bitcoin ETFs — and right now, pins are dropping as far as Ethereum is concerned,” van Eck explained earlier in April.

VanEck isn’t alone in its pessimism. Industry analysts like James Seyffart and Eric Balchunas of Bloomberg Intelligence echo the sentiment. Balchunas himself reduced his approval odds from 70% to less than 35%.

Read more: Ethereum ETF Explained: What It Is and How It Works

In addition to the Ethereum ETF filings, the SEC has also postponed decisions on options trading for spot Bitcoin ETFs. A recent notice indicated that the Commission has set May 29, 2024, as the deadline to approve, disapprove, or begin proceedings to decide on the disapproval, thereby allowing the New York Stock Exchange to list options on spot Bitcoin ETFs potentially.

These events collectively bear the potential to either stabilize or volatile the crypto market throughout May 2024. The crypto community remains on high alert, prepared to navigate the outcomes of these developments.

0

0