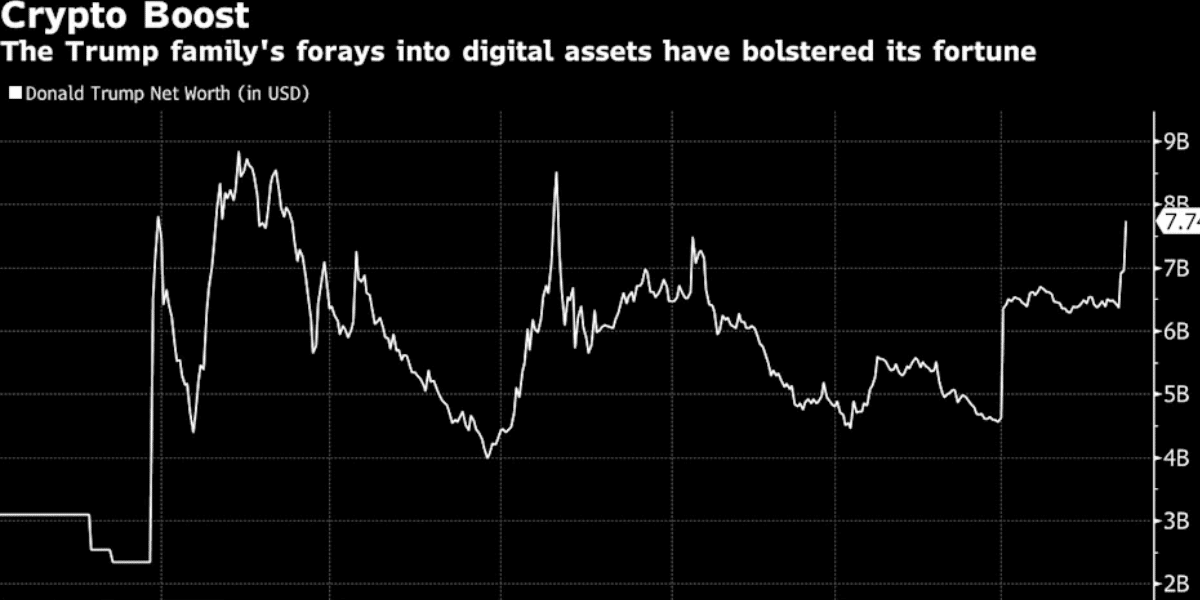

Trump Family’s $1.3B Crypto Fortune Highlights Shift From Real Estate to Digital Assets

0

0

US President Donald Trump’s family has racked up a USD 1.3B windfall in weeks from two crypto ventures ABTC and WLFI, less than a year after their launch.

According to a Bloomberg report, the two crypto ventures ABTC and WLFI marked one of their fastest growths to date. The projects, World Liberty Financial (WLFI) and American Bitcoin Corp (ABTC), feature Donald Trump Jr. and Eric Trump, the sons of Trump, as key figures. Barron Trump is also named as a co-founder of World Liberty.

ABTC and WLFI are all under One Year Old

Describing the details of the USD 1.3B windfall, the Bloomberg report stated that World Liberty Financial had its value boosted by at least USD 670 million after striking a deal with Alt5 Sigma (ALTS) to allow token trading. While data shows that Alt5’s share price has since declined, Bloomberg reported that Trump held stakes worth hundreds of millions. Moreover, the Trumps still hold a vast trove of WLFI tokens valued at several billion.

Also read: Trump-Backed WLFI Token Hits Market: Bullish and Bearish Predictions Ahead

Meanwhile, American Bitcoin Corp (ABTC), which was subsequently folded into Gryphon Digital Mining and renamed, saw its Trump holdings grow close to $1 billion. Eric Trump’s stake in ABTC, the crypto mining firm launched last March, is currently valued at USD 500 million following a surge in the firm’s price during its September trading debut.

Push for Bitcoin Treasuries

The USD 1.3B windfall shows how quickly the family’s wealth has shifted from their original traditional ventures, such as Mar-a-Lago. While recently attending an industry event in Hong Kong, Eric Trump told attendees he had backed the crypto asset class for years. He urged them to join the digital asset train immediately. Eric told the attendees he was eager to become a strong advocate for the sector.

Also read: Eric Trump Launches Bitcoin Mining Giant to Rival MicroStrategy

ABTC and WLFI now operate at an intersection of cryptocurrencies and public markets. In the past, cryptocurrency investments were highly sought after as an alternative to traditional financial ventures. However, the current trend is for publicly listed companies to seek crypto assets to bolster their value and relevance. The concept has been significantly boosted by Michael Saylor’s for Bitcoin Treasuries, which has created a steadier demand for the volatile asset class.

Conclusion

The USD 1.3B windfall to the Trump family via ABTC and WLFI comes hot on the heels of greater scrutiny surrounding the crypto industry. While the US Securities and Exchange Commission (SEC) under Biden cracked down on the crypto industry, the Trump administration appointed crypto-friendly regulators. The President has personally pledged to turn the US into the “crypto capital of the world.”

Read more crypto news on the platform.

Summary

- The Trump family’s USD 1.3B windfall over a few weeks sharply rivals the decades they spent building wealth using traditional assets.

- The wealth from crypto ventures ABTC and WLFI rivals long-held real estate properties, such as Mar-a-Lago, which have been synonymous with the family.

- The USD 1.3B windfall highlights the broader crypto wealth phenomenon, where users can generate substantial fortunes quickly compared to traditional assets that require years.

Glossary to Key Terms

ABTC: American Bitcoin Corp, a bitcoin mining and treasury company backed by President Trump, Eric, and Donald Jr.

WLFI:(WLFI) is a decentralized finance (DeFi) platform launched in September 2024, designed to offer cryptocurrency-based financial services such as borrowing, lending, and earning interest using blockchain technology and smart contracts.

Alt5: A fintech company offering blockchain solutions for digital assets, including a crypto payment gateway (Alt 5 Pay) and an OTC trading platform (Alt 5 Prime).

Mar-a-Lago: Luxury resort club and national historic landmark in Palm Beach, Florida. US President Donald Trump owns it.

Frequently Asked Questions for WLFI and ABTC

Who is the owner of World Liberty Financial?

A Trump business entity owns 60 percent of World Liberty and is entitled to 75 percent of all revenue from coin sales. Eric Trump and Donald Trump Jr hold leadership roles.

What is the purpose of WLFI?

WLFI aims to strengthen the US dollar’s reserve status through decentralized alternatives to CBDCs.

Are WLFI and USD1 the same?

USD1 is a stablecoin launched by World Liberty Financial in March. It is designed to maintain a 1:1 value with the US dollar and is intended to facilitate cross-border transactions for institutional investors, individuals, and other DeFi enthusiasts.

What is ABTC in crypto?

American Bitcoin Corp is a newly public entity backed by Donald Trump Jr., Eric Trump, and Hut 8 trading on the NASDAQ under the ticker “ABTC” following a merger with Gryphon Digital Mining.

Read More: Trump Family’s $1.3B Crypto Fortune Highlights Shift From Real Estate to Digital Assets">Trump Family’s $1.3B Crypto Fortune Highlights Shift From Real Estate to Digital Assets

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.