SEC Acceleration of Bitwise Crypto ETF Highlights Strength in XRP and Solana

0

0

This Article was first published on The Bit Journal.

The Bitwise crypto ETF gained a significant boost after the U.S. Securities and Exchange Commission approved its listing, opening a new door for regulated crypto exposure. According to the SEC order, the ETF will hold a blend of leading digital assets, subject to strict pricing and surveillance rules to protect investors.

What the Approval Means for Crypto Markets

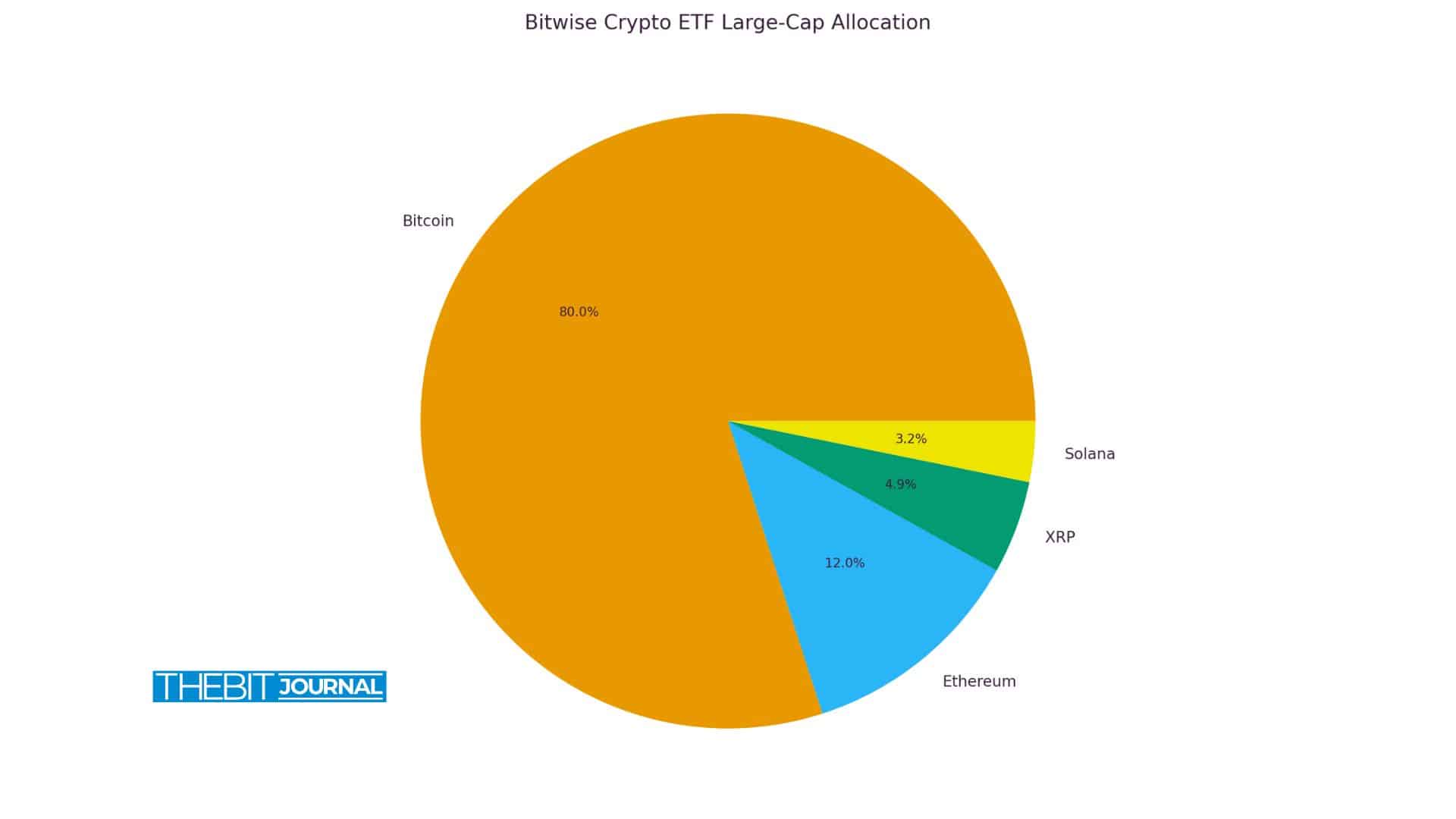

The Bitwise 10 crypto Index Fund, known officially as the Bitwise crypto ETF, follows a set of ten major cryptocurrencies. At mid-2025, meanwhile, its leading ones are Bitcoin (roughly 77.94 percent), Ethereum (about 11.65 percent), Autumn (around 4.76 percent), and Solana, respectively, close to 3.11 percent.

This focus on large companies offers investors a simple and direct route to the markets for both the main crypto and the upcoming ones through a single regulated fund.

Why XRP and Solana Are Core to the Fund

XRP and Solana’s inclusion raised questions among some analysts. The SEC highlighted the potency of its derivatives markets in response. Both assets trade actively on the CME, where futures contracts show real institutional demand. The SEC cited this liquidity when explaining its role in the ETF.

Derivatives Demand Hits Records

Institutional appetite for XRP and SOL futures on CME continues to grow. Their combined open interest recently hit a record $ 3 billion, according to CME data.

Key figures include:

- Futures on Solana began in March 2025. Open interest per day was about 12,500 contracts in August, and the total was approximately $895 million in notional value.

- XRP futures, which started in May, had an average of 9,300 contracts in August, generating a notional value of $ 942 million.

- The CME will launch options on SOL and XRP futures starting October 13, 2025, giving traders more tools to manage exposure.

These trends show that the Bitwise crypto ETF is built on rising institutional infrastructure rather than speculation.

Risks and Safeguards in the Fund

The ETF’s structure carries trade-offs. While it offers regulated exposure, it concentrates heavily on a few assets. About 90 percent of its value comes from Bitcoin and Ethereum.

The expense ratio stands at 2.5 percent, which is higher than many mainstream ETFs.

The ETF uses strong safeguards to reduce manipulation. It relies on CF Benchmarks for pricing accuracy, performs intraday valuation, shares surveillance data, and triggers automatic trading halts when needed. These protocols mirror those used in other regulated products.

Potential Impact on the Crypto Ecosystem

This approval may change how institutions view altcoins. The Bitwise crypto ETF could:

- Bring more capital from traditional investors into a diversified crypto vehicle.

- Encourage more ETFs that include assets beyond Bitcoin and Ethereum.

- Improve pricing transparency and trust in the crypto market through regulated structures.

For long-term crypto investors, the fund offers a practical way to hold leading assets while watching smaller players grow.

Conclusion

The Bitwise crypto ETF approval marks a shift in how digital assets are framed for regulated investors. Supported by strong futures markets for XRP and Solana and held within a transparent rules-based structure, the ETF offers a balanced and credible path into crypto.

For investors seeking broad, large-cap exposure without trading each token individually, this fund is a solid option.

Glossary of Key Terms

- ETF (Exchange-Traded Fund): A fund under strict regulations that behaves like a stock during its trading and possesses a variety of assets in its portfolio.

-

Futures: It is an agreement between traders that will allow them to purchase or sell an asset collectively at a set price and at a future date (open contracts shall mature).

-

Open Interest (OI): The total amount of unexecuted futures contracts in existence at any one time.

- CF Benchmarks: A regulated price index provider used by funds for fair crypto valuation.

- Rebalance: The process of adjusting the weight of assets in a fund to match a target allocation.

FAQs About Bitwise crypto ETF

Q: Can regular investors buy the Bitwise crypto ETF?

Yes. After it lists on NYSE Arca, any investor with a brokerage account can trade it like a stock.

Q: How often does the ETF rebalance its portfolio?

It rebalances monthly to stay aligned with its underlying index.

Q: Why does XRP have a smaller weight compared to Bitcoin or Ethereum?

The fund weighs assets by market cap. Bitcoin and Ethereum are much larger.

Q: Are there other altcoins in the ETF?

Yes. Besides XRP and Solana, the fund includes Cardano, Chainlink, Avalanche, SUI, Litecoin, and Polkadot.

References

Read More: SEC Acceleration of Bitwise Crypto ETF Highlights Strength in XRP and Solana">SEC Acceleration of Bitwise Crypto ETF Highlights Strength in XRP and Solana

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.