Willy Woo Predicts Bitcoin (BTC) Liquidation Cascade at $72,000 Leading to New All-Time High

0

1

- The cryptocurrency market is buzzing with speculation as Bitcoin (BTC) approaches a significant price milestone.

- Expert analysts are predicting a chain reaction of liquidations set to trigger once Bitcoin hits this critical price point.

- On-chain analyst Willy Woo’s latest insights offer valuable perspectives on the potential market movements ahead.

Bitcoin on the Brink: A Cascade of Liquidations Looms at $72,000

Bitcoin’s Potential Liquidation Trigger

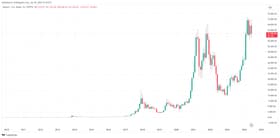

According to renowned on-chain analyst Willy Woo, Bitcoin (BTC) is on the verge of reaching a pivotal price point that could trigger a cascade of liquidations. Woo, who has amassed a substantial following on social media platform X, highlights that $1.5 billion worth of short positions could face liquidation if Bitcoin climbs past $72,000, potentially propelling the digital currency to a new all-time high of $75,000.

The Bitcoin Macro Oscillator (BMO)

Delving deeper into the metrics, Woo examines the Bitcoin Macro Oscillator (BMO). This composite indicator is built from four key signals: the Market Value to Realized Value (MVRV) ratio, the volume-weighted average price (VWAP) ratio, cumulative value-days destroyed (CVDD), and the Sharpe Ratio. Each of these indicators provides unique insights into market dynamics and investor behavior.

Understanding the Key Indicators

The MVRV ratio is a critical measure for assessing whether Bitcoin is overvalued or undervalued. It compares Bitcoin’s market capitalization to its realized capitalization, giving a comprehensive view of market sentiment.

Similarly, the VWAP ratio serves as an essential tool for traders, calculating the average price of Bitcoin throughout the trading day by factoring in both volume and price movements. This indicator helps determine whether Bitcoin is being bought or sold below its average price, providing a clear intraday price action picture.

Analyzing Coin Days Destroyed and Sharpe Ratio

The coin days destroyed metric offers another vital perspective by evaluating the value of each Bitcoin transaction with added weight based on the duration each coin has been held. Meanwhile, the CVDD indicator tracks the cumulative sum of these destroyed coin days, offering insights into long-term holding patterns.

Furthermore, the Sharpe Ratio provides a comparative analysis of an investment’s return versus its risk. By dividing the excess returns of a portfolio by its volatility, it helps gauge the risk-adjusted return of Bitcoin investments.

Woo’s Analysis and Market Implications

Woo’s analysis underscores the positive impacts of Bitcoin’s recent consolidation under bullish demand. He notes that this consolidation phase has been beneficial, allowing the price to potentially rise further before encountering significant resistance. According to Woo, the Bitcoin Macro Oscillator now indicates room for additional upward movement, signaling a positive outlook for Bitcoin in the near term.

Conclusion

In summary, Bitcoin is approaching a critical threshold that could ignite a cascade of liquidation events, significantly impacting its price trajectory. By utilizing composite indicators like the BMO, MVRV, VWAP, CVDD, and Sharpe Ratio, investors can gain nuanced insights into market behavior and make more informed decisions. As Bitcoin nears this pivotal moment, the market will be watching closely to see if it can break through and achieve new heights.

0

1