White Hat Hacker Saves the Day Amid $1.3 Million DeFi Exploit

0

0

A white hat hacker, known only as “c0ffeebabe.eth,” emerged as a savior in the decentralized finance (DeFi) ecosystem amidst a significant exploit targeting the Blueberry Protocol. This intervention safeguarded a substantial sum of 457.6 Ethereum (ETH), valued at around $1.3 million.

The Blueberry Protocol, a decentralized platform enabling lending and leveraged borrowing up to 20x of collateral value, faced an immediate threat on February 23.

How a White Hat Hacker Tackled the DeFi Exploit

Firstly, the foundation behind the protocol took swift action. They issued an urgent advisory on X, urging users to withdraw their funds to prevent further losses. Despite their efforts, the protocol’s front end became inaccessible, heightening the crisis.

However, within 30 minutes, the foundation managed to pause the protocol. This quick response ensured the safety of deposited funds and prevented additional exploitation. Notably, “c0ffeebabe.eth” was crucial during this turmoil.

“All drained funds were front run by @ coffeebabe_eth and are now safe in the Blueberry multisig, less the validator payment. The protocol has been paused until further notice. Further details and a full post-mortem will be posted as soon as available,” Blueberry Protocol Foundation said.

Read more: Crypto Project Security: A Guide to Early Threat Detection

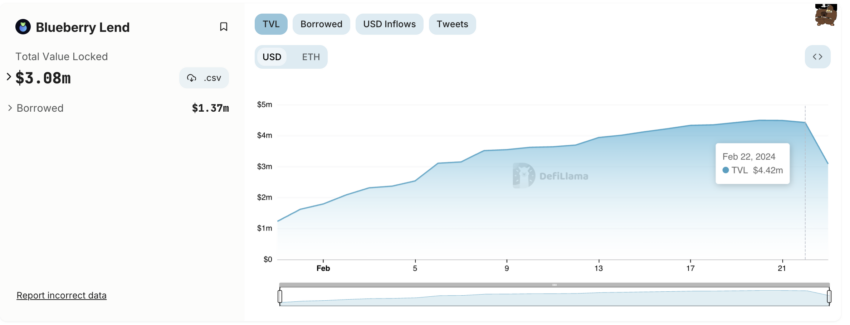

The exploit led to the drainage of funds from key lending markets, including Bitcoin (BTC), Olympus (OHM), and USDC. The total value locked (TVL) in the Blueberry Protocol faced a potential threat due to this exploit. The swift actions helped avert a larger crisis, preserving the integrity of the protocol’s TVL.

Blueberry Protocol TVL. Source: DefiLlama

Blueberry Protocol TVL. Source: DefiLlama

This proactive approach is reminiscent of an incident in July 2023. Then, a reentrancy attack on Curve Finance led to over $50 million in losses. The attackers targeted stable pools that used outdated versions of Vyper smart contract programming language. Despite this, Vyper’s official documentation had recommended these versions.

Crypto Hacks Targeting DeFi

After the Curve Finance attack, the crypto community saw a glimmer of hope. c0ffeebabe.eth used an Ethereum-arbitrage trading bot. This bot outsmarted the attackers, recovering $5.4 million meant to be stolen. The recovered funds were returned to the Curve team.

Read more: 13 Best AI Crypto Trading Bots To Maximize Your Profits

However, various security incidents continue to plague the crypto ecosystem. In fact, January 2024 alone witnessed hackers siphoning off over $180 million from crypto users, showcasing the escalating threats in the DeFi space.

2023 was no less daunting, with the DeFi ecosystem losing a staggering $1.8 billion to nefarious actors.

These figures highlight the critical need for robust security measures and the invaluable role of ethical hackers in safeguarding digital assets.

0

0