Tether Announces New Framework, Eyes Tech and Education

1

0

Tether, a prominent stablecoin issuer, announced an expansion on April 18, 2024, introducing four new business divisions — Data, Finance, Power, and Education.

This move indicates Tether’s intent to broaden its influence and diversify beyond its core stablecoin operations.

Tether’s New Focus on Tech and Education

With its new framework, Tether is positioning itself at the forefront of technological innovation.

The Tether Data division will concentrate on strategic investments in emerging fields such as artificial intelligence (AI) and peer-to-peer (P2P) platforms. Its partnerships with companies like Holepunch and investments in Northern Data Group highlight this focus on innovation.

Simultaneously, Tether Finance will remain the hub for Tether’s existing stablecoin products and financial services. The division aims to utilize blockchain technology to make global financial systems more inclusive. Moreover, its upcoming digital asset tokenization platform could play a role in wider digital asset adoption.

Read more: A Guide to the Best Stablecoins in 2024

Meanwhile, Tether Power marks the company’s entry into Bitcoin mining, emphasizing environmentally sustainable practices. This division aligns with Tether’s stated priority to support the Bitcoin network responsibly.

Lastly, Tether is diving deep into educational initiatives through its Tether Edu division. Tether Edu supports global access to digital skills, focusing on blockchain and P2P technologies. Its key initiatives include public-private partnerships and investments like Lugano’s Plan B and the Academy of Digital Industries.

Paolo Ardoino, the CEO of Tether, emphasized the company’s innovative ethos in a recent statement.

“With this evolution beyond our traditional stablecoin offerings, we are ready to build and support the invention and implementation of cutting-edge technology that removes the limitations of what’s possible in this world,” Ardoino said.

This announcement comes when the regulatory environment for stablecoins is becoming more intricate.

US senators Cynthia Lummis and Kirsten Gillibrand have recently proposed new legislation regulating stablecoins. The proposed bill, set for discussion in Congress next month, seeks to enhance consumer protection and preserve the integrity of the US dollar in digital finance.

“It protects consumers by mandating one-to-one reserves, prohibiting algorithmic stablecoins, and requiring stablecoin issuers to comply with US anti-money laundering and sanctions rules,” Senator Gillibrand remarked.

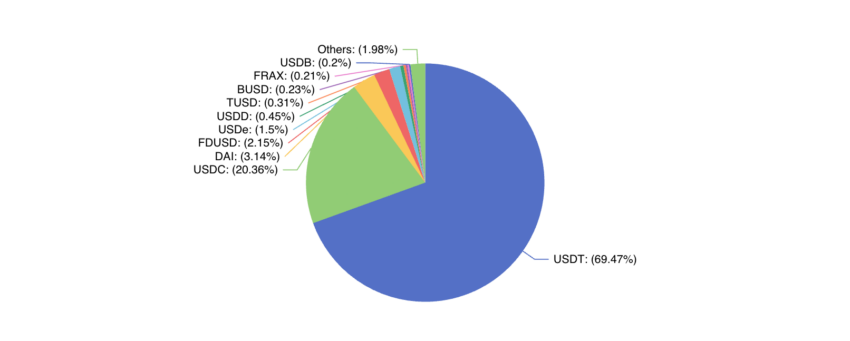

Although Tether’s stablecoin is not algorithmic, there are some allegations and concerns that USDT is being used for illicit activities, such as terrorism financing. USDT, being the biggest fish in the pond, frequently invites regulatory scrutiny.

Read more: What Are Algorithmic Stablecoins?

Stablecoin Market Dominance. Source: DefiLlama

Stablecoin Market Dominance. Source: DefiLlama

In the latest development, the US Treasury has raised concerns about Russia’s alleged use of Tether’s USDT to circumvent international sanctions and support its military operations.

Undersecretary Wally Adeyemo expressed this concern in a statement to the Senate Committee on Banking, Housing, and Urban Affairs. He further highlights the need for additional tools to protect national security.

Nonetheless, Tether’s expansions beyond stablecoins could pave the way for fostering a more inclusive future of digital assets.

1

0