Why Is the Crypto Market Up Today?

0

0

The cryptocurrency market has seen a spike in activity over the past 24 hours, marked by an increase in total market capitalization. Bitcoin (BTC) has broken above the psychologically significant $95,000 level, reinforcing positive sentiment among investors and helping to drive overall market strength. Immutable’s IMX leads the altcoin rally with a 13% hike in its value over the past day.

In the news today:-

- Freight Technologies Inc. has announced a $20 million stock offering to buy TRUMP meme coins as part of a treasury strategy similar to MicroStrategy’s Bitcoin play. However, the move appears less about crypto enthusiasm and more about hedging against potential economic fallout from looming US-Mexico tariffs that could impact its logistics business.

- Strategy reported over $4.2 billion in net losses for Q1 2025 despite profits from its Bitcoin holdings. The firm then announced plans to raise $84 billion through new offerings, sparking mixed reactions from shareholders.

TOTAL Nears Key $3 Trillion Mark

The total crypto market capitalization has increased by $60 billion over the past 24 hours. TOTAL currently stands at $2.97 trillion, just below the resistance formed at $3.02 trillion.

Its climbing on-balance volume (OBV) on a daily chart confirms the spike in market-wide accumulation today. The key momentum indicator is at 23.17 trillion, and is currently in an upward trend.

The OBV indicator measures cumulative buying and selling pressure by adding volume on up days and subtracting it on down days. A rising OBV like this suggests that volume is flowing into the market, confirming bullish price movements and indicating strong demand across the board.

If buying pressure strengthens among spot market participants, TOTAL could attempt to break above the resistance at $3.02 trillion and flip it into a support floor. If successful, it could extend its rally toward $3.07 trillion.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

However, if market demand wanes, TOTAL could shed recent gains and plunge to $2.89 trillion.

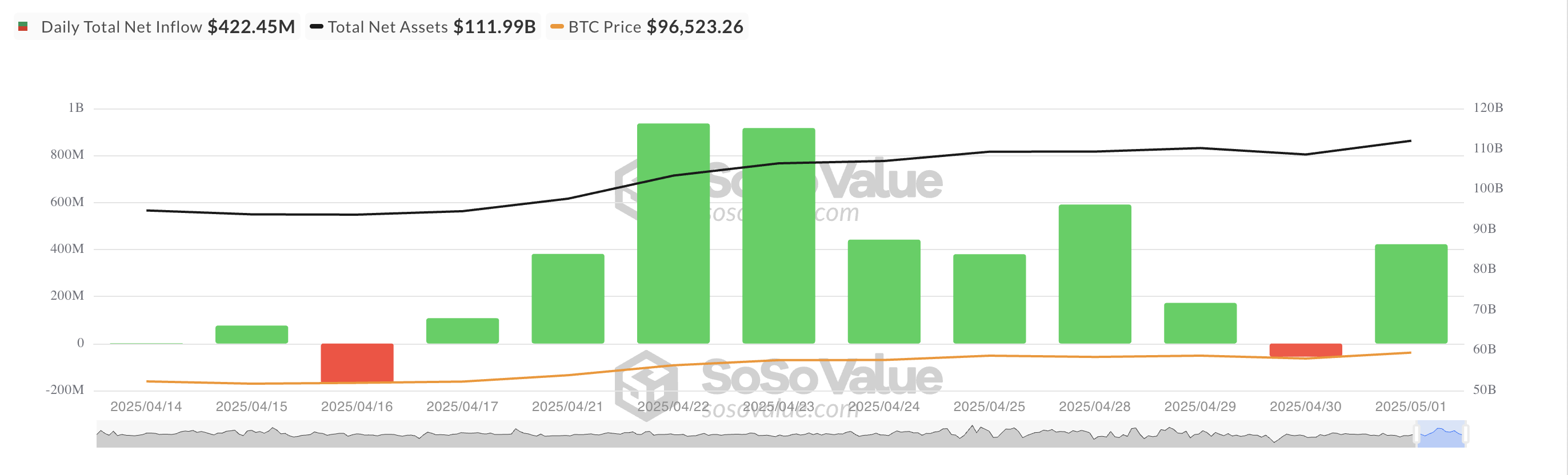

From Red to Green: Bitcoin ETFs Rebound

On Thursday, BTC’s break above the psychological $95,000 price barrier prompted institutional investors to pour capital into spot Bitcoin ETFs, totaling $422.45 million.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Yesterday’s inflows came after these funds registered a mid-week net outflow of $56.23 million on Wednesday. This sudden swing from outflows to inflows highlights how responsive institutional capital has become to key price levels and how spot ETFs are emerging as a reliable indicator of broader market sentiment.

The influx also confirms the renewed confidence in BTC’s long-term trajectory despite lingering macroeconomic uncertainty.

On Thursday, BlackRock’s iShares Bitcoin Trust (IBIT) once again posted the highest daily inflow among all Bitcoin ETF issuers. The fund attracted $351.38 million in net inflows for the day, pushing its total historical net inflow to $42.39 billion.

Meanwhile, Ark Invest and 21Shares’ ETF ARKB recorded the highest net outflow among all issuers on Tuesday, with $87.23 million exiting the fund. As of this writing, ARKB’s total historical net inflows stand at $2.65 billion.

IMX Soars as Trading Volume Explodes

IMX ranks as today’s top gainer with a 14% price surge over the past 24 hours. At press time, the altcoin trades at $0.64.

IMX’s 24-hour trading volume has spiked by more than 280%, reaching $146 million. This increase in volume suggests heightened investor interest and strong market participation in the rally. When an asset’s price and trading volume rise simultaneously, the price movement is backed by conviction.

High volume during an upward price move reflects high demand and investor confidence, making IMX’s rally more sustainable. If this trend persists, the altcoin could rally to $0.73.

IMX Price Analysis. Source: TradingView

IMX Price Analysis. Source: TradingView

Conversely, if IMX demand leans, its price could fall to $0.55.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.