Analyst sees Fed powering Bitcoin to $180,000 before year’s end

0

0

Bitcoin will hit as high as $180,000 by the end of the year thanks to the Federal Reserve.

That’s the bullish prediction made by Mark Connors, head of research at crypto investment firm 3iQ, amid stubborn inflation figures, the Japanese yen’s chaotic drop on Monday, and growing geopolitical tensions.

Connors told DL News that the US central bank will likely step in as precarious macroeconomic conditions have soured investors’ appetite for riskier assets.

That sentiment has been exemplified by the lull in spot Bitcoin exchange-traded fund inflows since the start of April and by investors fleeing to haven assets like gold.

The Fed’s response to any currency, credit, or funding failure will be “swift and meaningful,” Connors said.

That hope is why 3iQ is keeping its expectations elevated.

The derivatives market is showing signs of optimism.

Option traders have ploughed millions of dollars into bets that Bitcoin could soar 57% to $100,000 as early as September, according to market maker Wintermute.

Research firm Bernstein estimates that Bitcoin will hit $150,000 and that the total value of the crypto market will reach $7.5 trillion by 2025.

In the meantime, however, Connors is urging traders to be cautious.

The yen wobbles

On Monday, the Japanese yen dropped to its lowest level against the US dollar in over three decades before sharply reversing to levels held last week.

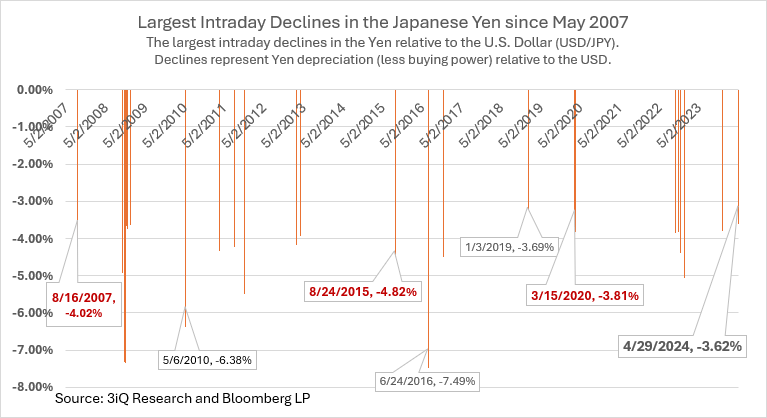

The yen is down 11% to the dollar since the new year began. Monday saw the currency move as much as 3.6% in a single day’s trade, one of the worst on record since 2007.

Market action suggests an unusually large reversal in risk-taking by participants is fast approaching, Connors said.

That could signal a brief risk-off mood among investors like that seen during the Brexit crisis in 2016, Connors said.

He compared events seen during the Global Financial Crisis in August 2007, the Greek government debt crisis in 2010, and the Covid-19 pandemic, beginning in 2020.

“Unfortunately for risk assets, we see Monday’s move as the start of a longer risk-off move.”

Crypto market movers

- Bitcoin is down 1.4% over the past 24 hours to trade at $61,700.

- Ethereum dropped 4.4% to just over $3,000.

What we’re reading

- Here are the top 10 corporate Bitcoin holders as haul reaches $19bn — DL News.

- Crypto Hacking Group Lazarus Impersonates Fenbushi Capital Exec: Report — Milk Road.

- Binance Founder Changpeng Zhao’s Sentencing on Tuesday: What to Expect — Unchained.

- Australia Prepares For A Wave Of Spot-Bitcoin ETF Launches: Bloomberg — Milk Road.

- EigenLayer airdrop is happening after all — but it won’t include US, VPN users — DL News.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.

0

0