Chainlink (LINK) Set for Correction as Rally Overextends Bullishness

0

0

Chainlink’s (LINK) price broke out of the consolidation and marked a monthly high of less than a week.

However, this may lead to LINK holders moving to sell their holdings before they lose the chance to secure their gains.

Chainlink Investors May Book Profits

Chainlink’s price is $16.8 after rising nearly 30% this past week. However, this resulted in the altcoin hitting saturation, historically synonymous with corrections.

This is evident in the Relative Strength Index (RSI). RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

Currently, the RSI is above 70, suggesting LINK is overbought on the 12-hour chart. This happened last in February, after which the rally took a break. The same could be the fate of Chainlink’s price as well.

Chainlink RSI. Source: TradingView

Chainlink RSI. Source: TradingView

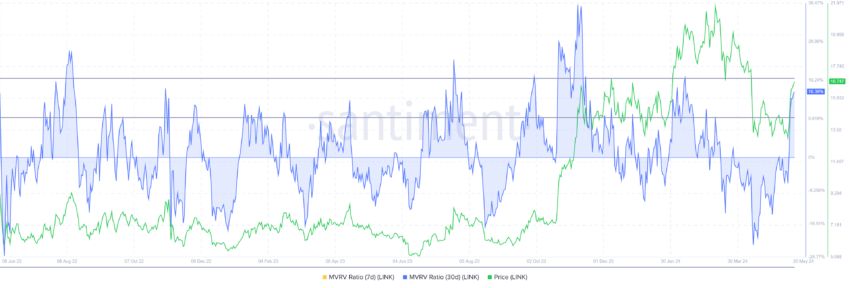

Plus, it could face additional discomfort from its investors should it move to sell, which is a probable outcome. This is because the Market Value to Realized Value (MVRV) signals profit-taking.

The MVRV ratio tracks investor gains/losses. Chainlink’s 30-day MVRV of 16% suggests profit, possibly prompting selling. Historically, LINK tends to correct at MVRV levels of 10%- 20%, labeling this a risky zone.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Chainlink MVRV Ratio. Source: Santiment

Chainlink MVRV Ratio. Source: Santiment

Such is the situation with Chainlink; investors could move to secure their gains, signaling a drawdown.

LINK Price Prediction: Return to $15 Likely

Chainlink’s price, trading at $16.8, breached multiple resistances to push past the resistance at $16.5. Closer to $17.0, the altcoin is noting a major rally. However, this push that brought LINK to a monthly high could also cause a decline.

Should the aforementioned conditions turn out to be true, Chainlink’s price could fall back to $15.0. Once the support at $15.6 is broken, this would happen, possibly extending the decline to $14.4.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

Chainlink Price Analysis. Source: TradingView

Chainlink Price Analysis. Source: TradingView

However, if the investors do not move to sell and the rally continues to rise, Chainlink’s price could continue to rise. Crossing $17.5 would invalidate the bearish thesis, pushing LINK towards $18.

0

0