Top Crypto News This Week: Ethereum Pectra Upgrade, Sonic Summit, Polkadot App, FOMC Meeting, and More

0

0

Several events across various ecosystems made it to the list of top crypto news this week. Key highlights include Ethereum’s much-anticipated Pectra Upgrade and the FOMC (Federal Open Market Committee) meeting.

This week, traders and investors looking to capitalize on event-specific volatility should watch the following headlines.

Ethereum’s Pectra Upgrade

On May 7, the Ethereum network will activate its much-anticipated Pectra Upgrade, with 11 Ethereum Improvement Proposals (EIPs) slated for implementation.

Ethereum Pectra Upgrade. Source: Catakor on X

Ethereum Pectra Upgrade. Source: Catakor on X

Key features include EIP-7251, which is expected to raise the staking cap from 32 ETH to 2048 ETH. The Pectra upgrade also brings enhancements for user-friendly wallets, including improved UX, easier recovery, and no ETH for transactions.

“Ethereum is having its biggest upgrade this month,” DeFi researcher hodl shared on X (Twitter).

These changes aim to boost staking participation and dApp adoption, potentially increasing ETH demand and, effectively, the Ethereum price.

Ethereum (ETH) Price Performance. Source: BeInCrypto

Ethereum (ETH) Price Performance. Source: BeInCrypto

However, exchanges may temporarily halt ETH transactions during deployment, which could spark short-term volatility.

While a smooth rollout could drive bullish sentiment and reinforce Ethereum’s dominance, technical hiccups might erode confidence and pressure ETH prices.

Meanwhile, it is worth mentioning that Ethereum’s Pectra Upgrade has faced multiple delays already. Reasons range from due diligence checks, such as the Hoodi and Sepolia testnets, to ensure smooth running before mainnet release.

Sonic Summit

The Sonic Summit, pivotal for the Fantom ecosystem, will commence on May 6 before the Pectra Upgrade. It will be held in Vienna for three days.

The event will see the network display advancements in its high-throughput, EVM-compatible blockchain. Reportedly, discussions will center on Fantom’s sub-second transaction finality, dApp scalability, and potential partnerships.

“Got your ticket for Summit yet? You’ll meet these pioneering teams leading the DeFi scene on Sonic,” Sonic Labs wrote.

Sonic Summit. Source: Sonic Labs blog

Sonic Summit. Source: Sonic Labs blog

Announcements of new projects or integrations could ignite interest in Sonic’s (formerly Fantom) S token, driving speculative trading and price spikes.

The summit’s focus on developer tools and enterprise use cases may attract institutional attention, boosting long-term adoption. However, markets could see muted reactions or profit-taking if the event lacks major reveals.

Polkadot App Release

Adding to the list of top crypto news this week, Polkadot is planning an app release that will enable staking, shopping, and saving on a single platform.

The prospective Polkadot app aims to simplify user interaction with its interoperable blockchain ecosystem. The all-in-one approach could attract retail users, boosting adoption and increasing demand for DOT tokens.

Staking incentives may lock up supply, potentially supporting price appreciation. Meanwhile, shopping and saving features could draw real-world use cases, enhancing Polkadot’s utility.

The app’s success hinges on user experience and security, as any vulnerabilities could erode trust. If Polkadot gains traction, competitors like Cosmos may face pressure.

Hyperliquid’s New Fee System And Staking Tiers

More closely, the Hyperliquid ecosystem unveiled a new fee system and staking tiers on Monday, May 5. With these product launches, stakers of the decentralized derivatives platform’s powering token, HYPE, receive trading fee discounts.

“…the new Hyperliquid fee system is now live. This means perps and spot fees are now different (spot fees count as double volume) and trading fee discounts for staked HYPE are officially active,” Steven.hl highlighted.

The move is intended to incentivize staking while at the same time reducing the circulating supply. These measures could support price HYPE stability, potentially inspiring a surge.

Meanwhile, it will be interesting to see revenue trends over the next few weeks. The tiered structure may attract high-volume traders, boosting platform activity and revenue.

Hyperliquid (HYPE) Price Performance. Source: BeInCrypto

Hyperliquid (HYPE) Price Performance. Source: BeInCrypto

Despite the launch, the impact on the HYPE token was underwhelming, dropping by 1.42% in the last 24 hours. As of this writing, HYPE was trading for $20.58.

FOMC Meeting and Powell Conference

Featuring among the US economic indicators with crypto implications this week, the FOMC meeting and subsequent Federal Reserve chair Jerome Powell conference also rank among the top crypto news this week.

On May 8, the Fed will announce its next interest rate decision, a critical event for crypto markets. Higher rates typically reduce risk appetite, potentially triggering sell-offs in Bitcoin, as investors shift to safer assets. Conversely, a pause or rate cut could spark a rally, as seen in past dovish signals.

“Fed Press Conference FOMC this Wednesday, May 7th Rate cuts are NOT expected … but will they end quantitative tightening?” trader Ozzy posed.

BitMEX co-founder and former CEO Arthur Hayes recently predicted that the Fed’s shift to quantitative easing (or ending quantitative tightening) could propel Bitcoin’s price to $250,000. Other analysts also favor this pivot, citing the MOVE Index and global market instability as triggers.

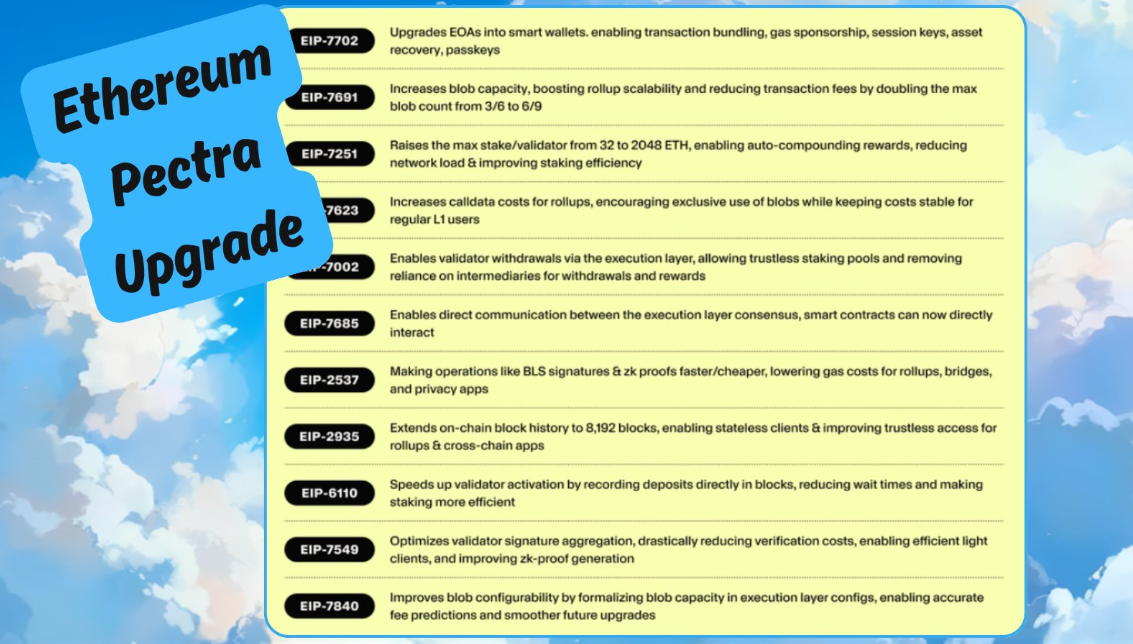

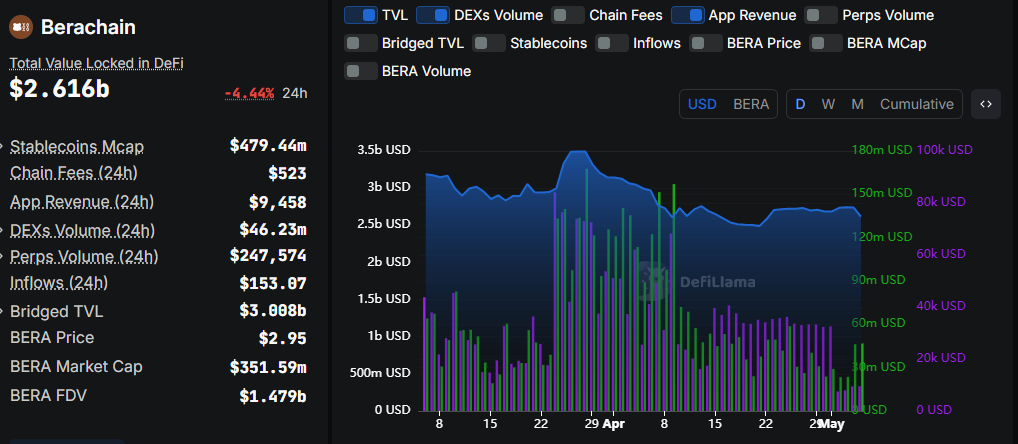

Berachain’s Boyco Unlock

Berachain’s Boyco funds are set to unlock on May 6, releasing a significant token supply. Specifically, roughly $2.7 billion in TVL (total value locked) will unlock from Boyco Vaults on Berachain on Tuesday.

As one of the largest unlocks, this event could trigger sharp liquidity shifts and heightened volatility.

Berachain TVL. Source: DefiLlama

Berachain TVL. Source: DefiLlama

Langerius, founder of HuntersofWeb3, explained that over $2 billion in total is awaiting release, ascribing the ongoing BERA sell-off to the expectation of this event.

“There’s over $2 billion in total waiting. And because of that, BERA is dumping fast. Looks like whales are about to farm this one and move on to the next,” Langerius stated.

Unlocking events often trigger sell-offs, as early investors or insiders cash out. Markets should brace for volatility, with traders likely front-running the unlock.

However, Berachain was the worst-performing blockchain of the past month, and some analysts say the BERA token price may have already bottomed out.

“I strongly believe BERA has hit the bottom right now…and with that ton of liquidity unlocking, I do hope we see the price of at least $5 in the upcoming days,” one user expressed.

Coinbase Earnings

Also on the watchlist among top crypto news this week is the Coinbase exchange’s earnings call. The call will provide insights into the US-based exchange’s Q1 2025 performance, a bellwether for the crypto industry.

Strong revenue from trading fees or growth in institutional services could signal strong market health, boosting sentiment for crypto. Conversely, weak results or regulatory concerns might spark bearish reactions, as Coinbase’s stock often correlates with crypto prices.

Markets will scrutinize guidance on trading volumes, user growth, and Web3 initiatives like Base blockchain. Positive surprises could drive speculative buying, while disappointing metrics might trigger sell-offs.

Coinbase’s performance often sets the tone for exchange tokens like BNB. Traders may position ahead of the call, with volatility expected post-announcement. Historical earnings beats suggest an upside, but macro headwinds could temper optimism.

“FOMC and Coinbase earnings. Volatile week in the crypto market,” analyst CrypNuevo remarked.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.