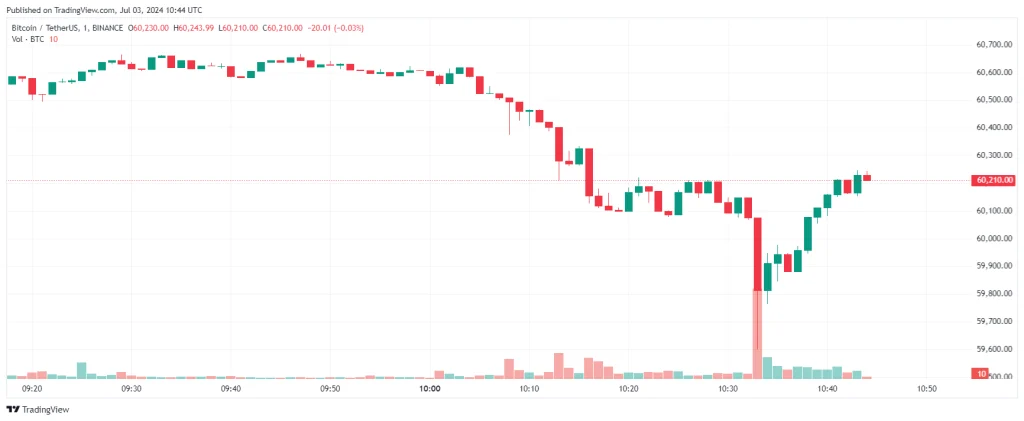

Why Did Bitcoin Suddenly Plunge Below $60,000?

0

0

The Bitcoin market has recently experienced a sharp decline, pushing its price back toward $60,000. This downturn followed revelations from a previously bullish billionaire investor who has seemingly reversed their stance on the cryptocurrency.

Over the last month, Bitcoin has lost nearly 15% of its value, fueled by concerns of a potential “true correction” in the market.

Federal Reserve’s Economic Outlook

Federal Reserve Chair Jerome Powell highlighted a “critical period” for the U.S. economy during a speech at the European Central Bank’s conference in Portugal. Powell described the current level of U.S. debt as sustainable, but he criticized the fiscal trajectory as unsustainable.

He specifically pointed out the risks posed by the Biden administration’s policy of running substantial deficits at a time of full employment, a strategy he deemed unsustainable in economically favorable times.

These statements contributed to growing market anxiety, impacting both traditional and cryptocurrency markets.

In the same vein, Treasury Secretary Janet Yellen issued a stark warning regarding the burgeoning $34 trillion U.S. debt. Analysts speculate that this escalating debt could potentially drive the Bitcoin price to an unprecedented $1 million over the next 18 months.

However, her warning also intensified fears of economic instability, further pressuring the crypto market.

Market watchers have been closely monitoring the Federal Reserve for any signs of interest rate adjustments. Although expectations initially included up to seven rate cuts in 2024, recent assessments have scaled these expectations back to just one or two cuts.

Powell, expressing his concerns, noted the importance of getting the balance on monetary policy right during this critical period, a topic that preoccupies him in the early hours. This cautious stance on rate cuts added to market uncertainty, contributing to the Bitcoin sell-off.

Recent Fed Updates and Disinflation Path

The Federal Reserve, in its last update, opted to keep interest rates steady but signaled a possible cut in 2024 with further reductions anticipated in 2025. This follows a period of aggressive rate hikes in response to the spiraling inflation triggered by significant Covid-era stimulus spending and money printing.

Powell also remarked on the U.S. returning to a ‘disinflationary path’, but emphasized the need for more data before the Fed would consider cutting rates.

Russ Mould, investment director at AJ Bell, interpreted Powell’s emphasis on disinflation as an indicator that the Fed might be closer to reducing rates, potentially starting as soon as September. This cautious approach has kept investors on edge, affecting both the stock and crypto markets.

The financial community is now focused on the upcoming release of the Fed’s June meeting minutes and the forthcoming jobs report. A weaker-than-expected jobs report could solidify expectations for a September rate cut, a scenario to which markets currently assign a roughly 70% probability.

Meanwhile, the crypto market is under additional pressure due to warnings from BlackRock, the world’s largest asset manager.

Analysts at BlackRock described an “unprecedented” scenario in which central banks may need to maintain higher interest rates than before the pandemic to manage persistent inflationary pressures.

This development could negatively impact Bitcoin prices and the broader crypto market, adding to the sell-off triggered by Powell and Yellen’s statements.

Impact of Mt. Gox Creditor Repayments

Adding to Bitcoin’s challenges is the potential commencement of creditor repayments by the defunct crypto exchange Mt. Gox, expected to begin in early July. Charles Edwards, founder of Capriole Investments, highlighted a significant uptick in Bitcoin transactions, attributing it to Mt. Gox’s upcoming distributions.

More than $9.4 billion worth of Bitcoin is owed to approximately 127,000 creditors, a situation that could lead many investors to cash out after a decade of untouched profits.

However, this potential market impact could be mitigated by the continued institutional interest in Bitcoin. U.S.-based spot Bitcoin exchange-traded funds (ETFs) have accumulated over $52.5 billion in Bitcoin since their inception in January, suggesting that the $9 billion from Mt. Gox might be absorbed by these substantial inflows.

As the cryptocurrency and financial markets brace for these developments, all eyes will be on the Federal Reserve’s next moves and the broader economic indicators that will shape the near-term financial landscape.

The cautious and critical statements from U.S. economic leaders have significantly contributed to the current market volatility, underscoring the interconnectedness of traditional financial policies and the crypto market.

The post Why Did Bitcoin Suddenly Plunge Below $60,000? appeared first on Coinfomania.

0

0