Xend Finance — First Cross-Chain DeFi Credit Union

2

0

Xend Finance — First Cross-Chain DeFi Credit Union

The DeFi ecosystem has introduced solutions to problems faced by the traditional financial system. Taking a look at products like Compound, that enable users to lend or provide liquidity and earn interest when borrowers pay back, this is done without any form of verification or KYC. All operations are carried out on a trustless network.

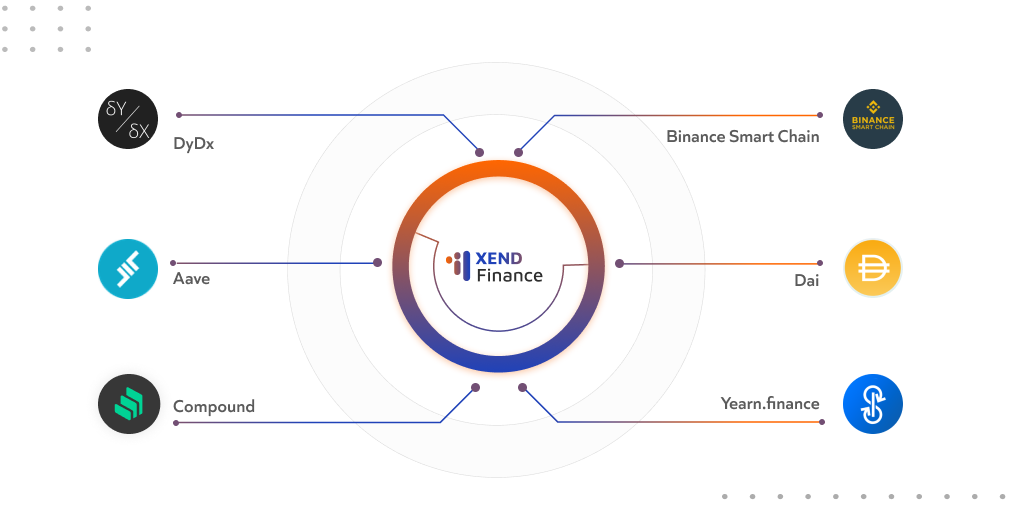

Protocols like Yearn finance have also been able to provide better yields for users by aggregating multiple DeFi protocols to provide the best yields for the users. However, a problem faced by the users is that some of these platforms are completely built on very slow and non-scalable layer-1 blockchains. This affects the overall performance of the entire system and leads to very high on-chain transaction fees. The experience in using these existing platforms is very poor. Users who do not have blockchain experience always find it difficult to understand and navigate these platforms.

DeFi was created essentially to decentralize traditional finance systems and processes by making them more secure, more transparent, more accessible and to increase the value-added by these traditional financial services.

Credit Unions and Cooperatives are a very traditional industry with over 1.4 Trillion dollars in market size. This industry performs all operations as a regular bank such as savings, borrowing, and lending.

The main problems faced by this industry include low Annual Percentage Yields (APY), geographical limitations (i.e. people must be in a particular geographical area), or they must belong to the same institution or society to become members of these unions and cooperatives. Deposits made by members of these Credit Unions and Cooperatives are almost never insured and they are faced with difficult access to liquidity.

The Credit Union, the cooperatives, and its members are a very huge and untapped market and the current level of complexity in the DeFi space will never allow them to get the value the DeFi tools have to offer.

Solution — Xend.Finance — DeFi Credit Union and Cooperatives

Key Features

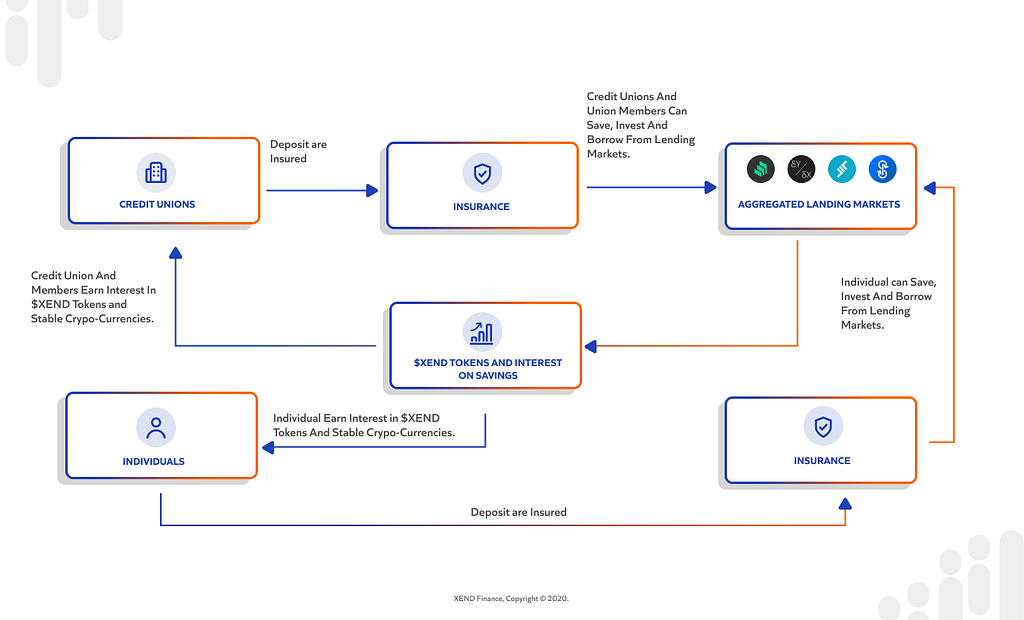

Xend Finance is a DeFi Credit Union. It is a protocol that decentralizes and optimizes operations of traditional credit unions and cooperatives and provides better yields for the unions and its members through lending protocol optimizations as well as asset security through decentralized insurance.

Xend Finance is powered by Binance Smart Chain. This provides support for the complexity of logic, security, scalability, low fees, and cross-chain asset transfers and messaging.

Xend Finance is backed by Binance and Google Launchpad.

Fiat To Crypto On-Ramp And Off-Ramp

Xend Finance leverages easy-to-use interfaces to onboard existing non-crypto users who have fiat and do not have easy access to crypto. This increases the adoption of DeFi by abstracting the existing complexity pushed to the users in current DeFi products.

Lending Protocol Optimization

Xend Finance maximizes users' profits by optimizing and aggregating lending protocols. This helps to abstract the complicated DeFi subroutines away from the users.

Insurance Of Deposits

Xend Finance leverages decentralized insurance to protect the deposit of its users.

Cross-Chain Asset Transfer And Interoperability

Xend Finance is being developed on Binance Smart Chain and this enables cross-chain asset transfers and messaging.

$Xend

$Xend is the native token used to carry out operations such as rewarding users, protocol fees, and governance on the platform.

Reward

As users perform lending, saving, and other operations on the platform they receive $Xend rewards based on a reward distribution algorithm. The rewards reduce over time and this leads to scarcity, hence giving holders more value.

Protocol Fees

$Xend is used to pay for protocol fees such as Credit Union group subscription fees per saving cycle. $Xend is also deducted as a charge for defaulting in group savings.

Governance

Xend Finance is a Decentralized Autonomous Organization (DAO) governed by $XEND holders using three different smart contracts:

Xend Token Smart Contract, Governor Smart Contract, and Time Lock Smart Contract.

These smart contracts will allow the Xend Finance community to propose features, vote, and execute approved proposals.

Summary

Xend Finance is a user-friendly platform that provides a simple and easy user interface for users to on-board as well as maximizing yield for its users.

Powered by Binance Smart Chain, Xend Finance offers support for multiple blockchains.

Xend Finance is providing a simple and easy to use SDK for crypto and non-crypto projects to easily integrate and get the full power of DeFi.

Our team is made up of experienced mathematicians, finance, cryptography, and blockchain engineers. We are very proud to have Tier one investors like Binance and Google Launchpad. We are very excited to be one of the first to build on Binance Smart Chain. The support for Both DeFi and CeFi makes the development experience a great one.

If you’d like to support us, join our communities on Telegram and Twitter.

Xend Finance — First Cross-Chain DeFi Credit Union was originally published in Xend Finance on Medium, where people are continuing the conversation by highlighting and responding to this story.

2

0