Top Layer 2 Cryptos Primed for Explosive Growth On Ethereum Whales Frenzy

0

0

Over the past three weeks, the altcoin market has witnessed a sluggish consolidation following the lead of the top two crypto assets Bitcoin and Ethereum. However, the ETH price resilience above the $3600 support is bolstering buyers to prevent a major correction in Layer 2 Crypto

According to recent data from the crypto analytics firm IntoTheBlock, large Ethereum (ETH) holders, often referred to as “whales,” have significantly increased their holdings. On Thursday, these major investors recorded a net inflow of 267,000 ETH, marking the most substantial daily accumulation observed since March. This surge in ETH holdings among large investors could signal a growing confidence in the asset’s future value.

On Thursday, large ETH holders recorded a net inflow of 267k $ETH, marking the highest daily accumulation since March. pic.twitter.com/uBBhRpCxRz

— IntoTheBlock (@intotheblock) June 10, 2024

The Impact of Layer-2 Cryptos on Ethereum’s Transaction Economy

As per a recent analysis from Altcoindaddy, the Ethereum network is seeing significant developments, highlighted by the data derived from Intotheblock. As Ethereum evolves, layer-2 solutions like Arbitrum, Optimism, and Base are transforming its economic landscape by offering lower transaction fees and fostering a diverse application ecosystem.

This shift has led to a notable decrease in Ethereum’s transaction fees to a six-month low, demonstrating the impact of these scalable solutions.

Institutions are increasingly favoring Arbitrum for its transaction volume, while Base attracts a broad user base. Meanwhile, Optimism’s “SocialFi” applications are gaining traction, reflecting the varied applications driving Ethereum’s network growth.

Also Read: Bitcoin Notes $2B Inflows But Ethereum Steals The Spotlight, Here’s Why

1) Arbitrum (ARB)

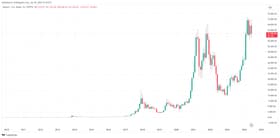

Arbitrum is a Layer-2 scaling solution for Ethereum designed to improve its speed and reduce transaction costs without sacrificing security. Over the past two months, the ARB price has traded sideways trying to hold its ground above $0.93 support.

The $0.93 level accompanied by an ascending trendline of the daily chart creates a strong accumulation for buyers. The Arbitrum coin currently trades at $0.96, while the market wavers at $2.8 Billion.

A potential rebound from the bottom support will uplift the asset by 30% to challenge the key resistance of $1.27. A successful breakout from this resistance will signal a major trend reversal and assist ARB’s price to chase higher targets of $1.6 and $2.27.

Also Read: What Will Happen If VanEck’s Ethereum Price Prediction of $22,000 Comes True?

2) Optimism (OP)

Optimism is a Layer-2 scaling solution for Ethereum that leverages Optimistic Rollup technology to enhance transaction throughput and reduce costs. An analysis of the daily chart shows the OP price is resonating within two covering trendlines signaling the development of a triangle pattern.

Under the influence of this setup, the OP price is getting squeezed into a narrow range preparing for an imminent breakout. Currently, this altcoin trades at $2.2 seeking support at the pattern’s lower trendline.

In the last 24 hours, the Optimism coin shows a market cap of $2.4 Billion, while the trading volume is recorded at $259.6 Million.

If the pattern holds true, the crypto buyers will break the overhead trendline signaling the continuation of the prevailing rally. The post-breakout could propel the OP coin value to $3, followed by $4.86.

3) StarkNet (STRK)

StarkNet is a decentralized Layer 2 scalability network built on Ethereum, utilizing zero-knowledge (ZK) rollup technology, specifically through STARK proofs, to enhance scalability without compromising security.

Amid the current market uncertainty, the STRK coin price is struggling to sustain above the $1.4 resistance. The coin price reverted thrice from this resistance within two months, indicating the sellers are actively defending this level.

A recent reversal from this resistance has tumbled the StarkNet coin 20% to trade at $1.118, while the market cap plunged to $1.45. With sustained selling, the coin price revisited the psychological support of $1 to replenish bullish momentum

For buyers to regain control of this asset, a breakout $1.4 resistance is needed. The potential breakout will intensify recovery momentum and bolster buyers to chase $1.68, followed by $2.4.

Key Takeaway

Since the completion of the Dencun upgrade on March 13th, Ethereum’s transaction fees have notably reduced bolstering the appeal of the layer 2 solution. Amid the current market consolidation, this asset class can provide suitable dip opportunities and potential notable gains as market renters recover sentiment.

The post Top Layer 2 Cryptos Primed for Explosive Growth On Ethereum Whales Frenzy appeared first on CoinGape.

0

0