Bitcoin Whales Accumulate BTC Ahead of the Bitcoin Halving

0

0

Ignoring the high market volatility in recent days, Bitcoin whales have continued to amass a huge number of BTC tokens in anticipation of the coming halving event. This move underscores investors’ confidence in the asset, creating positive sentiment across the market and hoping for an imminent price surge. Meanwhile, the move coincides with the reduced inflows into Bitcoin spot ETF in the last few weeks.

Bitcoin’s price has fluctuated greatly since last weekend, rising and dropping sharply. At the beginning of the week, the tokens’ price increased to $67,000 before crashing back to the $62k zone. Despite this, whales continue to buy the dip, expecting an upward trajectory soon.

Bitcoin Whales Bet Large

In an exciting development, Bitcoin, the largest cryptocurrency by trade volume, has enjoyed massive investments from whales (large investors) over the last month. Recent data shows that these entities have accumulated significant tokens ahead of the halving event scheduled to take place between April 19 and April 20.

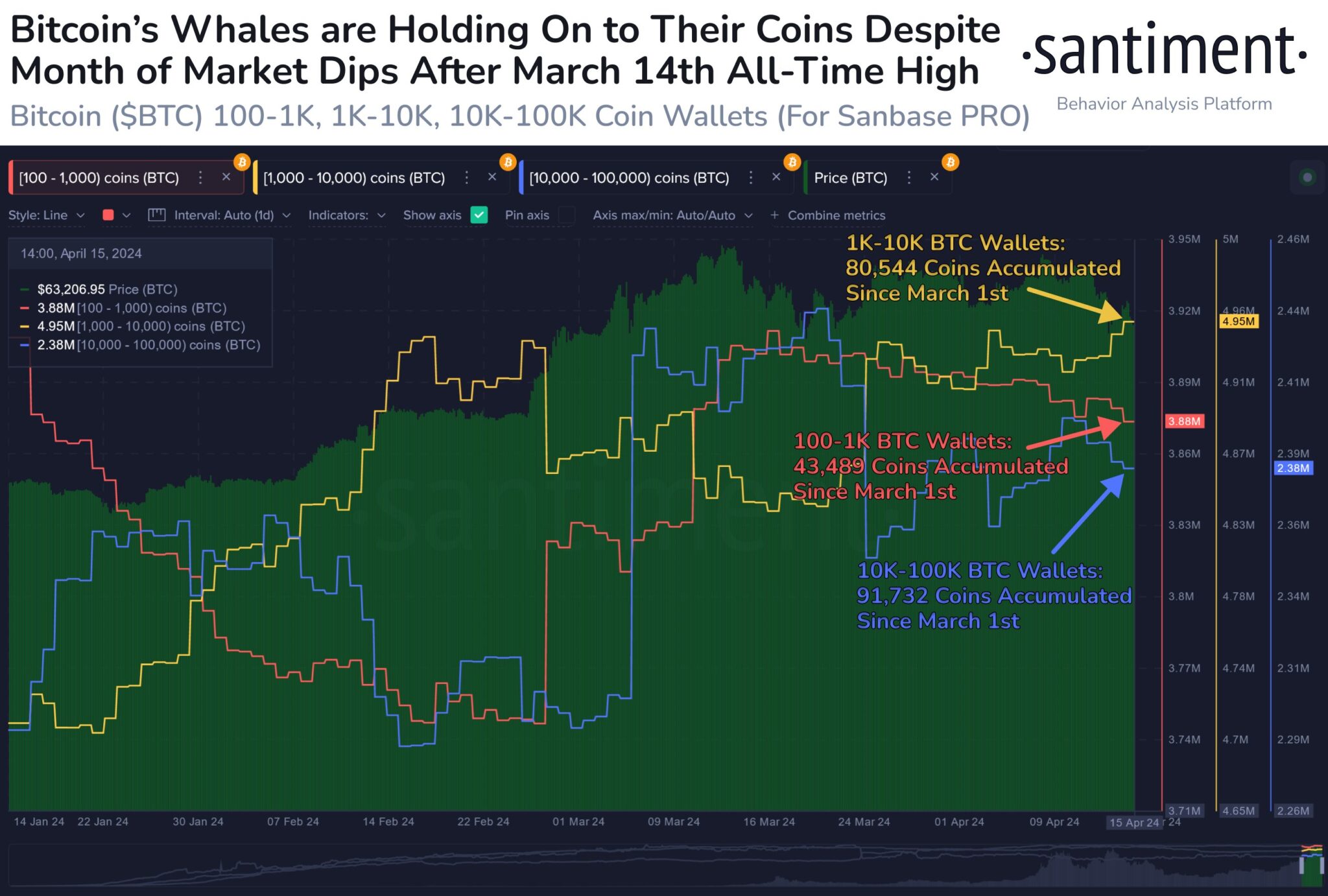

According to Santiment, a cryptocurrency intelligence tool, wallets holding between 100 to 100k BTC have acquired additional tokens in their thousands compared to previous months. The tool breaks down the transactions clearly to show how much each category has acquired.

Per the data, wallets holding between 100 to 1,000 BTC have bought a total of 43,489 tokens (worth approximately $2.75 billion). Additionally, wallets holding between 1,000 to 10,000 Bitcoins have accumulated about 80,544 tokens (worth $5.10 billion). Finally, wallets with BTC tokens between 10,000 to 100,000 have bought 91,732 coins, valued at approximately $5.80 billion. The behavior of the above group has shown resilience against the FUD spreading across the crypto market over the last few weeks.

Meanwhile, since the third week of April, investor interest in Bitcoin ETFs has dropped, with net negative outflows. The demand for Bitcoin ETFs hasn’t increased for the past four weeks. Still, even without taking into account transactions relating to ETF settlements, there is a noticeable amount of on-chain accumulating activity.

Bitcoin (BTC) price today

According to data from CoinMarketCap, Bitcoin has dropped by a significant 5% over the last 24 hours, trading at $63,409. Additionally, its market cap has been reduced by a similar amount to $1,24 trillion. However, the activities surrounding the token as shown in its 24-hours trading volume have spiked by 1.74% to $43.9 billion within this time.

As a result, the positive sentiment surrounding the crypto market, portrayed in the crypto fear & greed index, has dropped by almost ten points to ’65’ according to Alternative data. Ultimately, the global crypto market cap has declined by 5.15% to $2.29 trillion in the last 24 hours.

The post Bitcoin Whales Accumulate BTC Ahead of the Bitcoin Halving appeared first on Coinfomania.

0

0