Aptos Claims Third Spot in RWA, $50M APT Unlock Looms

0

0

Aptos APT $4.39 24h volatility: 1.3% Market cap: $2.83 B Vol. 24h: $143.64 M has cemented its position as the third-largest blockchain for real-world assets (RWA), even as a significant $50 million token unlock looms on the horizon.

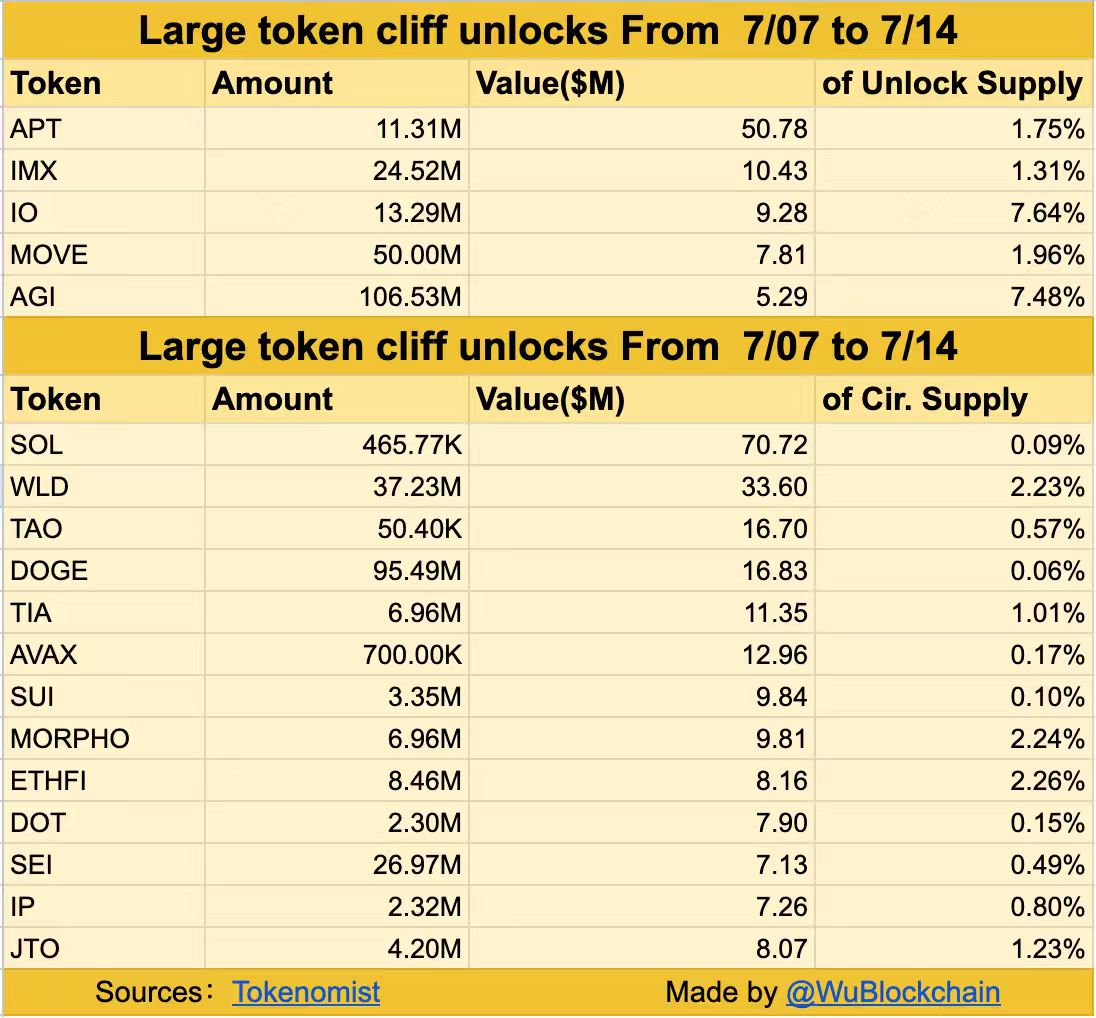

With 11.31 million APT tokens set to be released on July 12, equivalent to about 1.75% of its circulating supply, investors and ecosystem participants are watching the token’s price action closely.

Aptos Network RWA TVL increased 56.28% to $538 million in the last 30 days, becoming the third largest RWA network after Ethereum and ZKsync Era, with nearly $420 million in private credit, $86.93 million in U.S. Treasuries, and $30.72 million in institutional alternative funds.…

— Wu Blockchain (@WuBlockchain) July 8, 2025

Unlocking Growth or Unlocking Pressure?

The token unlock, worth roughly $50 million, has triggered caution in the market. Historically, unlocks tend to apply short-term downward pressure on prices due to increased supply.

However, Aptos is allocating the majority of these tokens to its community and as staking rewards. This move may mitigate selling pressure while boosting engagement.

This week is loaded with token releases. Solana is set to release $69.49 million in SOL SOL $149.3 24h volatility: 1.2% Market cap: $79.99 B Vol. 24h: $4.32 B , while Immutable X will unlock over $10 million in IMX IMX $0.41 24h volatility: 1.8% Market cap: $771.11 M Vol. 24h: $25.61 M on July 11, according to Tokenomist (formerly TokenUnlocks) data.

This Week Token Unlocks | Source: WuBlockchain

RWA Milestone: $538M and Counting

Aptos’s Total Value Locked (TVL) in real-world assets has surged 56.28% over the past 30 days, now sitting at $538 million. It trails only Ethereum and zkSync Era in this fast-growing sector.

Of that TVL, nearly $420 million is tied to private credit markets, $86.93 million in US Treasuries, and $30.72 million in institutional alternatives.

Notable institutional players like BlackRock (via its BUIDL offering), Franklin Templeton (BENJI), and the PACT Consortium’s Berkeley Square are anchoring much of this growth.

Wyoming Eyes Aptos for State Stablecoin

It is also important to note that Aptos was recently ranked the highest among more than 10 blockchain contenders for Wyoming’s state-backed stablecoin WYST.

While no final deployment has occurred yet, the Aptos blockchain earned top technical marks from the Wyoming Stable Token Commission, outscoring competitors like Sei in categories including throughput, security, finality, and vendor support.

The Wyoming Stable Token Commission has placed Aptos as the highest-scoring blockchain candidate for WYST—the first fiat-backed stablecoin issued by a U.S State—tying for 1st place with Solana.

WYST will be deployed using @LayerZero_Core. pic.twitter.com/CMUyRbs4Gq

— Aptos (@Aptos) June 20, 2025

APT Price Analysis: A Breakout in the Making?

APT is currently trading near $4.38 after months in a falling wedge pattern—typically a bullish reversal signal. The price is nearing the apex of this channel, with the $4.2–$4.3 level acting as key support.

The RSI hovers around 49.27, neutral territory, indicating potential for a breakout in either direction, but recent higher lows suggest building bullish momentum.

Meanwhile, the MACD shows convergence just below the zero line, signaling waning bearish pressure and possible upside crossover soon.

APT Daily Chart with Falling Wedge | Source: TradingView

The Fibonacci retracement levels place the next resistance zones at $5.2 (0.236) and $6.30 (0.382), while $4.00 remains the must-hold level for bulls.

If Aptos breaks above the falling wedge with strong volume, especially after the unlock, it could trigger a rally toward $5.5–$6 in the short term, with $7.8 and $9.2 as medium-term Fibonacci targets.

The post Aptos Claims Third Spot in RWA, $50M APT Unlock Looms appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.