BONK Keeps Uptrend Alive Amid Rising Bearish Sentiment

0

0

Leading meme coin Bonk (BONK) has continued to trend within an ascending channel despite the recent growth in bearish bias towards it.

An assessment of its key indicators revealed a sustained appetite for the meme coin despite the profit-taking activity of a few market participants.

Bonk Bears Put Pressure on its Price

At press time, BONK exchanged hands at $0.000034. The token’s value has rallied by 25% in the last month. This price rally led to the forming of an ascending channel, which BONK attempted to close above its upper line on May 27.

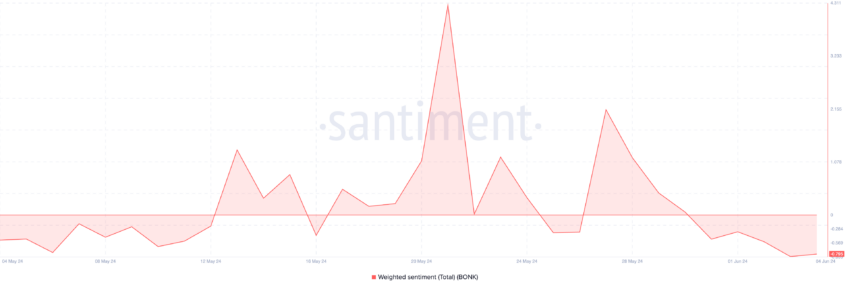

Despite the rally, some bearish activity has lingered in the BONK market. The negative weighted sentiment that BONK has recorded since May 30 highlights the bearish bias toward the altcoin. At press time, BONK’s weighted sentiment was -0.79.

Bonk Weighted Sentiment. Source: Santiment

Bonk Weighted Sentiment. Source: Santiment

When an asset’s weighted sentiment is less than zero, it indicates that the overall online conversation surrounding that asset is negative.

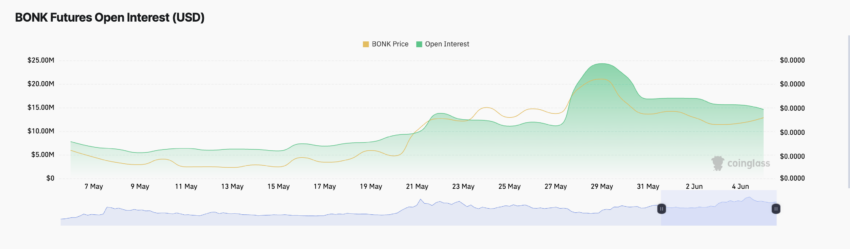

This bearish sentiment can also be gleaned in the meme coin’s futures market. Its futures open interest has declined since the beginning of June. At $14.62 million at press time, it has since dropped by 18%.

Read More: Bonk Airdrop Eligibility: Who Can Claim and How?

Bonk Open Interest. Source: Coinglass

Bonk Open Interest. Source: Coinglass

BONK’s futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it declines, it signals a drop in market activity as traders exit their trading positions without opening new ones.

It is often interpreted as a negative change in traders’ sentiment.

BONK Price Prediction: The Bulls Still Hold Momentum

While some traders have taken to selling their BONK tokens, bullish presence in the meme coin market is still significant.

Readings from its Relative Strength Index (RSI) showed that buying momentum outweighs selling pressure. As of this writing, BONK’s RSI was 62.25.

This indicator measures the momentum of an asset’s price movement. When it returns a value above 70, the asset is considered overbought and due for a correction. Conversely, an RSI below 30 is considered oversold, indicating the price may have fallen too far and could be ready for a rebound.

Also, BONK’s positive Elder-Ray Index confirms bull strength. As of this writing, the indicator rested above the zero line at 0.0000079. This indicator measures the relationship between the strength of buyers and sellers in the market.

When its value is positive, it means that bull power dominates the market.

Bonk Analysis. Source: TradingView

Bonk Analysis. Source: TradingView

If buying pressure continues to outweigh selling activity, BONK may continue its uptrend to break above the upper line of its ascending channel at $0.000045.

Read More: Best Upcoming Airdrops in 2024

Bonk Analysis. Source: TradingView

Bonk Analysis. Source: TradingView

However, if bearish sentiments increase, the token’s price may drop toward $0.000027.

0

0