Bitcoin: Here is the new king of ETFs!

0

0

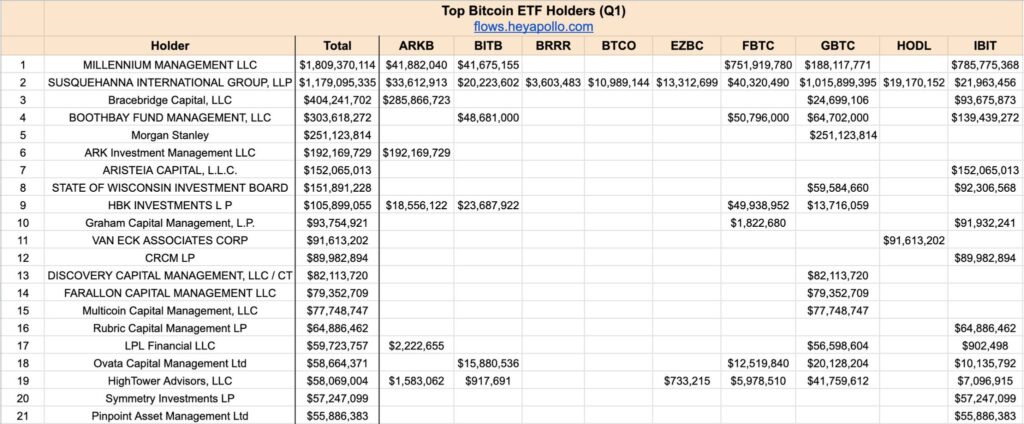

The giant Millennium makes a sensational entry into the world of Bitcoin ETFs! With no less than 2 billion dollars invested in these listed index funds, the flagship investment fund has just dethroned all its competitors. A real earthquake that could well change the game in the nascent ecosystem.

Millennium, the giant of ETFs!

The latest figures don’t lie, Millennium Management has just established itself as the new undisputed leader in Bitcoin ETF investments. Izzy Englander’s structure has indeed spread the staggering amount of 2 billion dollars across the main funds of the market. A level of diversification rarely observed so far according to experts.

Moreover, the allocation choices demonstrate a real long-term vision. The flagship BlackRock fund alone concentrates nearly 850 million dollars of exposure to BTC. But Millennium has not put all its eggs in one basket. The investment is spread across several other major players like Fidelity, Grayscale, ARK, and Bitwise.

The institutionalization of Bitcoin is underway

Beyond the colossal amount invested, this massive influx of capital into crypto ETFs has an extremely strong symbolic significance. It indeed confirms the increasingly clear breakthrough of Bitcoin in major traditional investment portfolios.

Moreover, Millennium is not an isolated case since other giants have also plunged into the gap recently. Whether it’s Elliott Capital, Apollo, or Aristeia, the participations are counted in tens of millions of dollars. In total, 12.1 billion dollars are now invested in various listed Bitcoin ETFs!

Moreover, the institutional appetite for these investment products seems far from drying up. Last Wednesday was even marked by the highest daily influx recorded since May into US Bitcoin ETFs. No less than 303 million dollars were indeed injected in one day, led by Fidelity’s Wise Origin BTC Trust (FBTC) fund, which alone captured 131 million.

Spurred by the new wave of institutionalization, Bitcoin scores a new resounding victory with Millennium’s historic investment. By massively positioning itself on dedicated ETFs, the American giant shows the way forward for the entire sector. Enough to delight the enthusiasts of a crypto ecosystem that continues to gain credibility, maturity, and attractiveness.

0

0