0

0

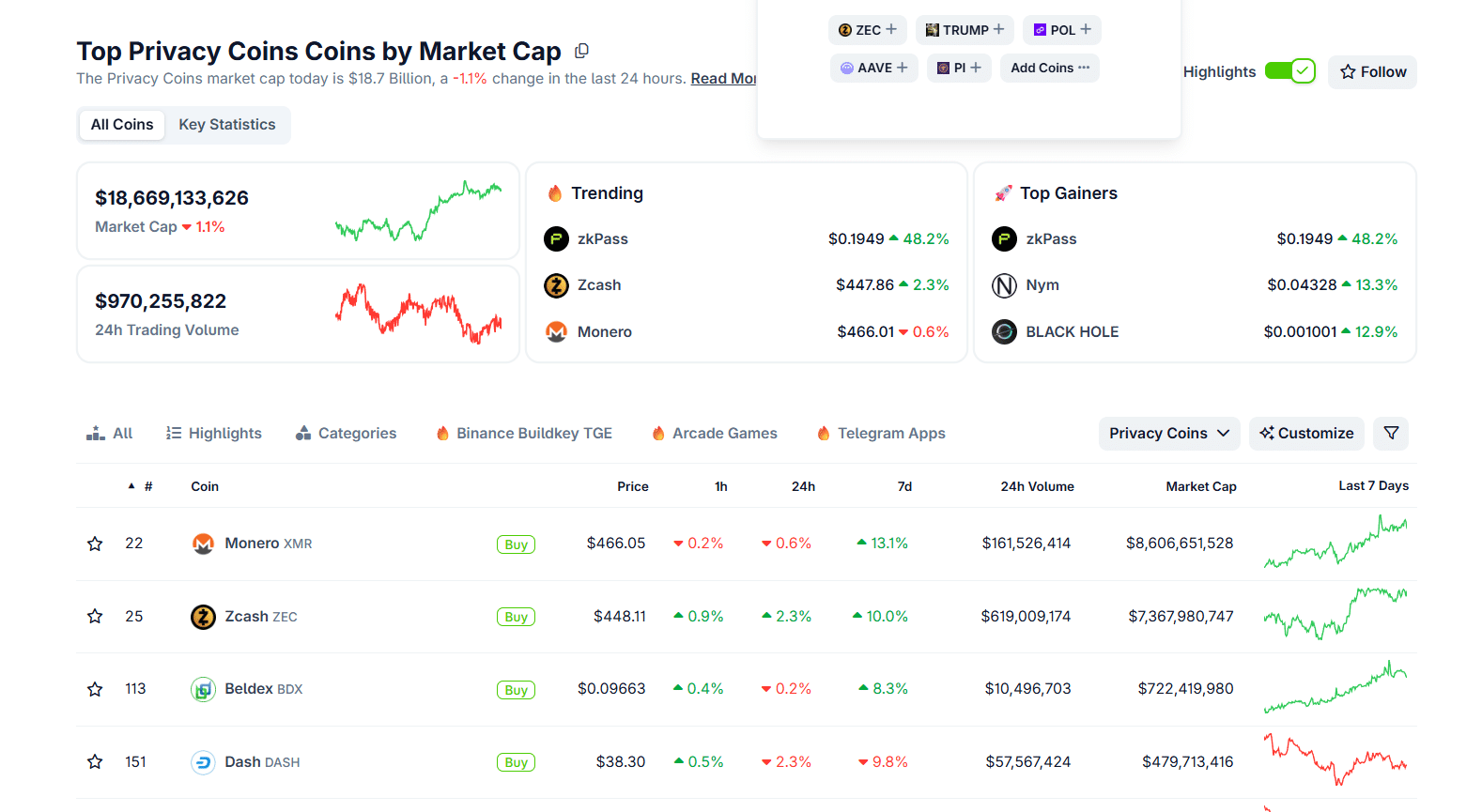

Monero (XMR) is a private and future-oriented cryptocurrency. Or is Zcash the future of money in 2026? It’s all so confusing! and sit in a dangerous middle ground heading into 2026. Each has a market cap floating between $7 to 9Bn, large enough to matter, small enough to be kneecapped by a single policy memo.

But here’s the thing I can tell you after almost a decade in this market: the mistake most investors still make is treating privacy coins as a technology shootout. That era is over. What matters now is regulatory survivability.

On that front, which privacy crypto will win 2026?

DISCOVER: 20+ Next Crypto to Explode in 2025

The EU’s new Anti-Money Laundering Regulation is drawing a hard line against anonymous crypto accounts. Exchanges operating under EU jurisdiction have little incentive to fight that battle. They delist first and ask questions later.

Essentially, the privacy narrative is in the EU’s hands in 2026.

EU ministers voted to end private communication!

Today the EU ministers approved the councils surveillance plans for Chat Control:

– Warrantless mass surveillance of all emails, chats, messengers

– Mandatory ID for everyone using social media (end of online anonymity) https://t.co/7Er1AVhrRF pic.twitter.com/gUsSxhgn0u— Yannik Schrade (

) (@yrschrade) November 26, 2025

We’ve already seen Monero pushed off major venues across Europe. If AMLR enforcement hardens as written, capital inflows from EU-based exchanges and funds could dry up entirely. For a niche sector like privacy coins, that’s existential.

Zcash, crucially, provides regulators with an off-ramp, but that may also be a red flag for EU regulators.

DISCOVER: Top 20 Crypto to Buy in 2025

So, EU FUD aside, which of these crypto privacy coins is better? Zcash supports both transparent and shielded transactions using zk-SNARKs, but the real differentiator is selective disclosure. Viewing keys allow users to remain private by default while still enabling lawful auditability when required.

That single design choice changes the conversation with regulators, institutions, and custodians.

Monero takes the opposite approach. Privacy is mandatory, and amounts, senders, and receivers are always hidden. From a user perspective, it’s elegant. From a compliance perspective, it’s radioactive.

Monero also carries reputational baggage tied to illicit usage, which Zcash, largely by circumstance, has largely avoided. Once an asset is labeled toxic, relisting becomes politically impossible.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

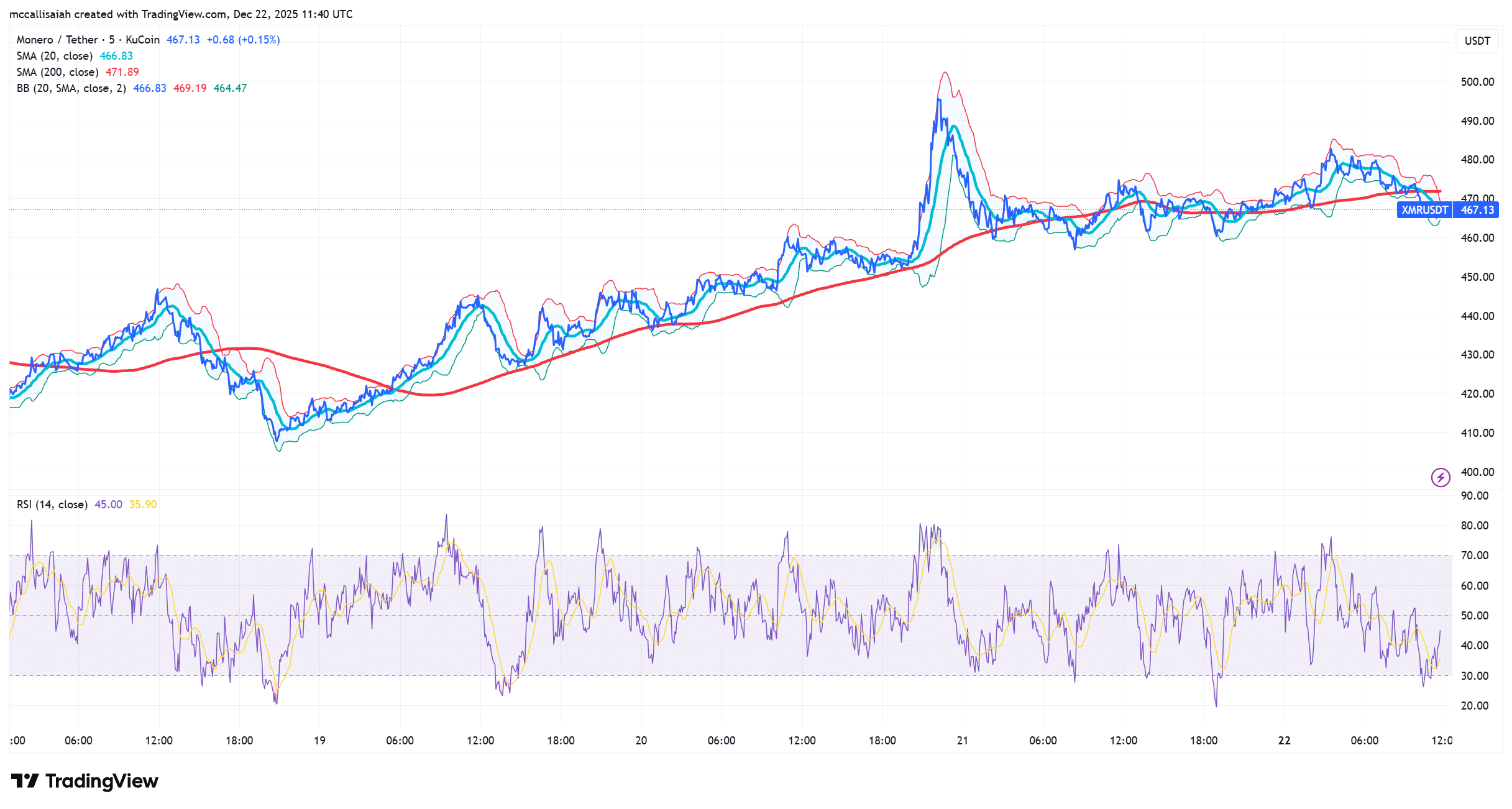

Data from CoinGecko shows both ZEC and XMR trading with high volatility relative to their size, a sign of policy-sensitive capital. Glassnode data also shows privacy coin flows remain highly reactive to regulatory headlines, not organic growth.

That’s the tell. This is no longer about adoption curves. It’s about permission to exist and Zcash has the edge here.

Zcash’s regulatory argument only works if usage follows. Shielded pool growth, real transaction volume, and institutional-grade integrations must materialize. Without that, the compliance narrative collapses.

But if privacy survives in regulated markets at all, Zcash is the one most likely to be allowed through the door in 2026. Monero may remain purer but Zcash is more likely to still be standing.

EXPLORE: Seeking a Career Change? Become a Bitcoin Bounty Hunter in Fordow, Iran

The post Monero Vs ZCash: Which Privacy Crypto Will Win in 2026? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.