ZCash Price Crashes 30% on Weekly Chart, Is Party Ending Soon?

0

0

Despite the broader crypto market recovery, privacy coin ZCash ZEC $478.7 24h volatility: 6.3% Market cap: $7.85 B Vol. 24h: $851.46 M has been on a freefall, correcting nearly 30% over the past week. As of press time, ZCash is trading at another 7.5% down, losing the crucial support at $480. Experts cite on-chain data as to what happens next for ZEC.

ZCash Price Loses Crucial Support Levels

The ZCash price party seems to be coming to an end, after today’s drop under $480. Crypto analyst Ardi reported that ZEC has fallen below its two crucial support levels: the 50-day simple moving average (SMA-50) and the $480 support zone.

As a result, ZEC will be testing its final support at the 38.2% Fibonacci retracement level. It is the same zone that helped preserve the uptrend several weeks ago. Ardi stated that multiple ZEC price closes below this level would confirm a structural downtrend and a deeper correction ahead. According to the analyst, the next target levels to watch are in the $410–$425 and $370–$380 ranges.

ZCash price breakdown | Source: Ardi

Analyst Ardi also highlighted a key two-level confirmation setup around $480. He said that a successful move back above this zone would suggest the recent breakdown may have been a liquidity sweep rather than the start of a broader downtrend.

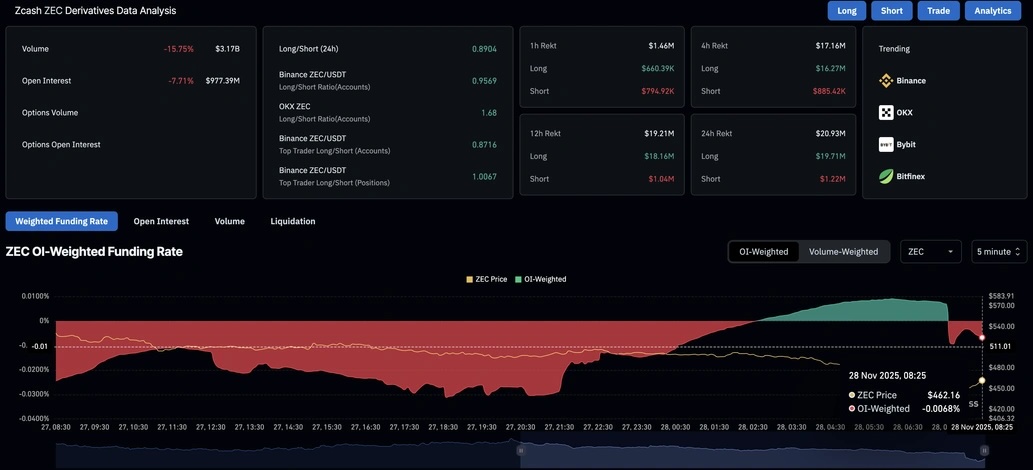

Furthermore, the CoinGlass data shows that ZEC futures open interest has dropped over 7%, to $977 million, in the past three hours. A drop in futures OI typically marks that traders are scaling back exposure, thereby highlighting signs of a potential pullback and market uncertainty.

ZCash open interest declines | Source: CoinGlass

Slowdown in ZEC Demand

Data from ZECHUB shows that surging demand for ZEC as a privacy-focused asset helped drive its nearly 1,000% rally between September and October. During the run-up, the number of shielded ZEC tokens held in the Orchard pool increased sharply, reducing circulating supply and reinforcing the upward price momentum.

Shielded ZEC Pools | Source: ZECHUB

However, the Orchard pool growth has reached its peak of 4.21 million ZEC on Nov. 4. This highlights a slowdown in demand for ZEC. If the net inflows don’t resume, it would prevent ZCash price from falling further.

Earlier this week, Grayscale said it has submitted the ZCSH Form S-3 filing, calling it a key step toward launching the first exchange-traded products (ETPs) for ZEC.

The post ZCash Price Crashes 30% on Weekly Chart, Is Party Ending Soon? appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.