Binance Drops USDT in Europe: What Are Your Alternatives?

0

0

Binance halts USDT trading in Europe, a historic decision driven by MiCA regulation. This major turning point directly impacts crypto users in the EEA and redefines the future of stablecoins on the old continent. Is this the end of USDT in Europe? What solutions are there for crypto investors?

Binance halts USDT in Europe!

The MiCA regulation, effective from December 30, 2024, establishes a regulatory framework for crypto assets within the European Union. It requires stablecoin issuers to obtain a specific authorization to operate within the EU, thereby ensuring transparency, investor protection, and financial stability.

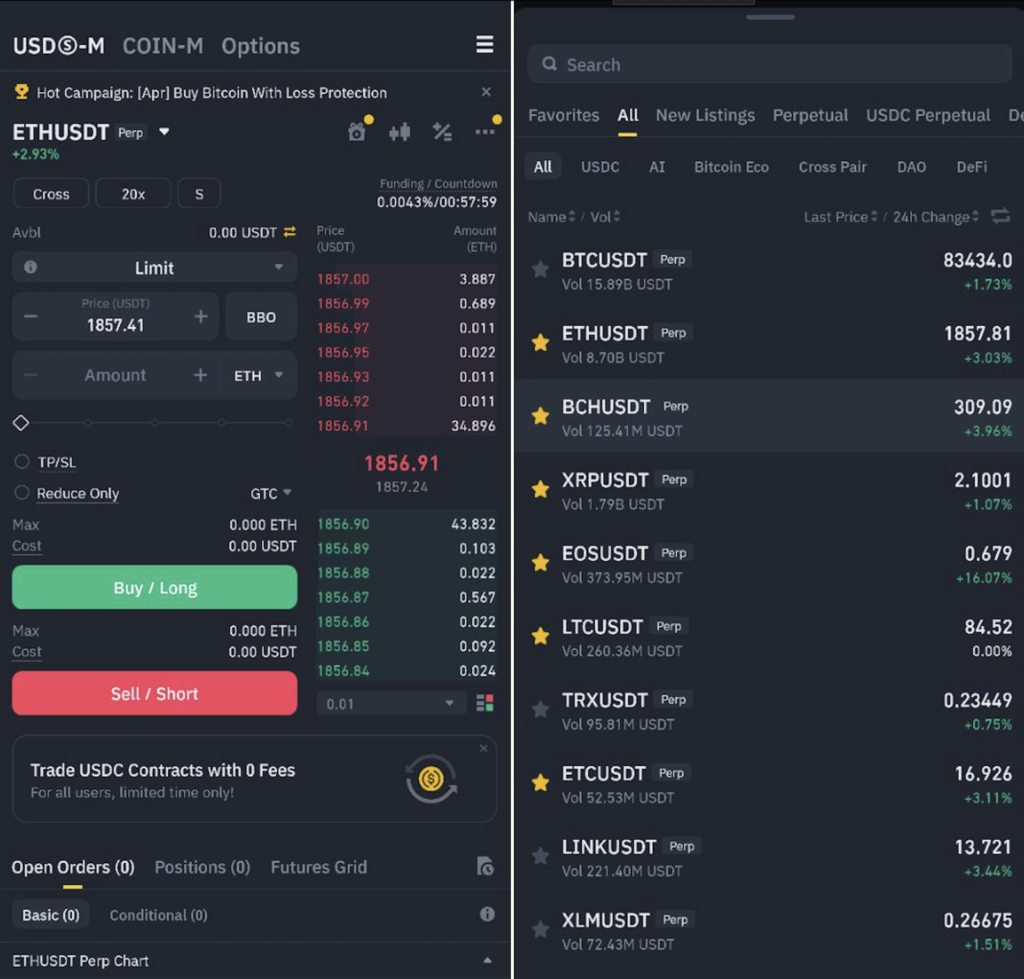

Since March 31, 2025, Binance has stopped the availability of spot trading pairs involving non-MiCA compliant stablecoins, such as USDT, DAI, and TUSD, for EEA users. Consequently, users must convert their holdings into compliant stablecoins, such as USDC or EURI, or into euros (EUR) to use them. However, Binance allows the deposit and withdrawal of these non-compliant stablecoins for perpetual trading.

Implications for European crypto users

This measure from Binance significantly impacts European traders and investors, forcing them to adapt their strategies according to the new regulations. The strict application of MiCA could even encourage some companies to turn to more favorable markets, such as the United States, where the policies toward crypto are seen as more lenient.

Moreover, despite the restrictions imposed by the MiCA regulation, some crypto platforms, such as MEXC, continue to offer USDT spot trading in Europe. These players commit to maintaining access to USDT for their European users, adapting their services to comply with the new regulatory requirements.

Is USDC the big winner?

With Binance’s halt of USDT spot trading in Europe, USDC, the main rival of Tether, emerges as the big beneficiary. Already in 2024, its weekly transaction volume had jumped to $23 billion, up from $9 billion in 2023. What will happen in 2025 with all this flow left by USDT? Furthermore, in February 2025, Dubai officially recognized USDC as an authorized crypto token within the Dubai International Financial Centre (DIFC), thus reinforcing its global adoption.

Besides Binance, Kraken has also ceased USDT trading in Europe, succumbing to MiCA regulation. Crypto users in the EEA must now navigate this new regulatory landscape by adjusting their portfolios and investment strategies to compliant stablecoins and the new regulations in effect.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.