Crypto: Ethereum Unleashes a Huge Wave of Liquidations!

0

0

Turmoil reigns again in the crypto markets, shaken by a violent financial storm. Indeed, a sudden surge in position liquidations has swept across the ecosystem in the past 24 hours. This unexpected tidal wave has brought Ethereum to the forefront, potentially marking a decisive turning point in the evolution of crypto investment trends.

Staggering Figures Galvanize Crypto Investors

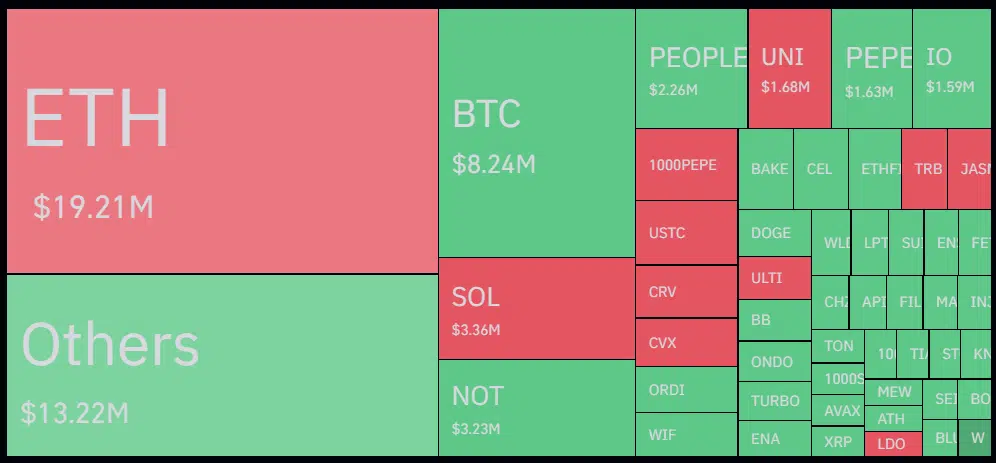

According to the data, total liquidations jumped 78.8% in one day, surpassing 75 million dollars, even as total open interest declined by 0.35%, to 66 million. In detail, 43.9 million long positions and 31.6 million short positions were liquidated.

However, it is Ethereum that dominates, with over 19 million in liquidations, including 5.6 million in longs and 13.5 million in shorts. This amount is significantly higher than Bitcoin’s, at 8.2 million. This feverish surge undeniably propels Ethereum to the forefront of the crypto scene.

A Rebalancing of Forces on the Chessboard?

The main platforms concentrate most of the movements, with Binance capturing 38.7 million in liquidations and OKX 23 million. Beyond the figures, this episode could mark a major turning point in crypto strategies. The increased volatility of Ethereum, combined with its potential, could indeed prompt many investors to reconsider their allocations.

A dynamic of capital redistribution in favor of Ethereum and promising altcoins thus seems to be emerging. This show of strength could initiate a lasting paradigm shift, where diversification and calculated risk-taking become the new watchwords.

These jolts may be only the beginnings of a profound reconfiguration of balances in the crypto universe. By taking the lead in this surge of liquidations, Ethereum appears to send a powerful signal in favor of increased diversification of investment portfolios. A new era might thus dawn, where wise risk management and the exploration of varied opportunities become the new niches for success in these turbulent markets.

0

0