Bitcoin Trades Sideways, Bitcoin Cash (BCH) & Ankr are Top Performers

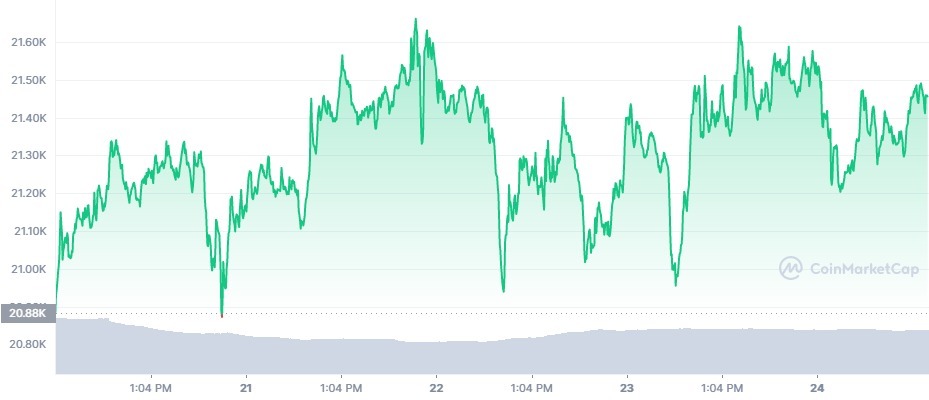

Bitcoin (BTC) looks to have recovered from its seven days of consecutive price declines and is now trading sideways. In the last three days, BTC’s price has been trading between $21,000 and $22,000, with no clear signs of breaking above the resistance.

According to data from CoinMarketCap, Bitcoin opened for trade today at $21,458, traded as low as $21,195, and then hit an interday trading high of $21,646. Stuck in the range, Bitcoin currently exchange hands at $21,450.

The 24 hours price chart for Bitcoin (BTC). Source: CoinMarketCap

Although Bitcoin has been unable to break out of its range in the last 3 days, other cryptos have been riding the bulls. Bitcoin Cash (BCH) is one of those cryptos, gaining 21% in the last 3 days to hit a weekly high of $138.12.

The 3 days price chart for Bitcoin Cash (BCH). Source: CoinMarketCap

Nexo leads the top 100 cryptos in gains, rising by as much as 11.5% in the last 24 hours. NEXO’s 25% gains in the last 3 days is fueled by the development team discussing their strategies for the forthcoming Ethereum (ETH) Merge.

Like Bitcoin, most of the crypto market is currently trading in a range before determining the direction over the next few days.

IMF Suggests a Regulatory Framework for Asia’s Growing Crypto Sector

On Monday, the International Monetary Fund (IMF) published a blog post titled ‘Crypto is More in Step With Asia’s Equities, Highlighting Need for Regulation.” The blog post highlights the increased correlation between crypto and equity markets in Asia.

The post explained the financial stability risks that digitalization of the payment system poses, although it helps foster financial inclusion and transition into a better environmentally-conscious payment method.

In the post, the IMF stated that individuals and institutional investors from India to Vietnam and Thailand had embraced crypto assets like Asia. The increasing adoption of crypto has made it essential to know the extent of crypto integration in Asia’s financial system.

The post also said the growing acceptance of crypto-related platforms and investment vehicles in the stock market and growing crypto adoption by retail and institutional investors in Asia are the key drivers of the increased interconnectedness of crypto and equity markets in Asia.

The IMF advised regulators to create unambiguous frameworks for crypto that regulate financial institutions and seek to educate and protect retail investors.

MakerDAO Pioneers First Loan Issuance Between DeFi and Regulated Financial Institution

Leading decentralized finance (DeFi) protocol, MakerDAO has announced that it has completed the “first commercial loan participation between a US Regulated Financial Institution and a decentralized digital currency.”

On Tuesday, August 23, MakerDAO announced that it is offering 100 million DAI tokens to Huntingdon Valley Bank (HVB), a community bank in Philadelphia. The first transaction gives HVB up to half of the total facility, with more capital over the next 12 months.

The collaboration began in March when MakerDAO announced that it had received a Collateral Onboarding Application from HVB, where the application is designed to increase the demand for the project’s stablecoin DAI.

The loan facility was accepted in July after garnering 87% of the votes. Through the collaboration, the stablecoin issuer can diversify its counterparty risks and generate yields from its DAI holdings via HVB’s bond managers.

This milestone only confirms the increasing involvement of financial institutions as cryptocurrencies get mainstream adoption.

Celsius Countersues KeyFi for Deceit and Gross Mismanagement of Funds

Bankrupt crypto lender, Celsius Network, has launched a countersuit against KeyFi, former staking and DeFi strategy associate and its CEO, for losing or stealing tens of millions of dollars in assets.

KeyFi had accused Celsius Network of failing to hedge investments which led to the bankruptcy of the company. KeyFi also alleged that Celsius cheated its CEO, Jason Stone, out of potentially hundreds of millions of dollars of compensation.

Going on the offensive, the Celsius Network has launched a countersuit against KeyFi and Stone. Jason Stone, who was a Celsius investment manager, was accused of losing or stealing tens of millions of dollars in assets.

In the complaint filed on Tuesday in a Manhattan court, Celsius accused Stone of falsely representing himself as a pioneer and expert in coin staking and decentralized finance (DeFi) investments.

According to the court documents, Jason Stone managed Celsius’ cryptoasset investments from August 2020 to March 2021.

China’s New Phase of CBDC Test Uses e-CNY Payment for Public Transport

The People’s Bank of China officially launched the next phase of its Central Bank Digital Currency (CBDC) pilot test programme on Tuesday. Chinese citizens can now make payments for their local buses and subways by scanning e-CNY.

Guangzhou became the first city in China to launch the pilot function of a digital RMB payment code to pay for bus rides, enabling citizens to pay for public transportation on ten transit routes in the city using the digital yuan (e-CNY) CBDC.

Passengers can pay for their rides in CBDC by downloading the e-CNY app, depositing funds and scanning the QR code found in the bus payment section to pay for their rides.

On Monday, China expanded the use of e-CNY, with Ningbo becoming the ninth city to introduce the e-CNY pilot test in its subway lines. Passengers at 125 stations can now scan and pay for their journey with e-CNY.

Although taking an anti-crypto stance, the Chinese government is rapidly expanding the utility of its e-CNY, becoming the frontliner of CBDC deployment.