Genesis Capital suspends withdrawals, citing unprecedented market turmoil

Leading crypto broker, Genesis Global Capital, has announced that it is temporarily suspending redemptions and new loan originations, becoming the latest victim of the FTX collapse.

It blamed the decision to suspend redemptions on the ‘unprecedented market turmoil’ sparked by FTX’s collapse. The firm, which has $175 million on FTX has also seen “abnormal withdrawal requests” that exceeded its liquidity.

In its third-quarter report, Genesis revealed that it had $2.8bn of “active loans” as of the end of September. The suspension has now prompted concerns about Genesis and its business partners.

Shortly after Genesis made the announcement, crypto exchange Gemini announced a temporary suspension of withdrawals on the platform, as Genesis served as its lending partner for the Earn project.

The move from Genesis is in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion.

Crypto exchange Gemini records $570 million in withdrawals in 24 hours

Leading cryptocurrency exchange Gemini is also suffering from the FTX contagion. The platform recorded more than $570 million worth of crypto withdrawals in the last 24 hours.

According to crypto and blockchain intelligence platform Nansen, Gemini has recorded $570 million in outflows compared to a mere $75 million in inflows in the last 24 hours. In the same period, the exchange’s netflows have risen to -$494.5 million.

Similarly, Arkham Intelligence reported that the digital asset balances on Gemini’s crypto wallets dropped from $2.2 billion to $1.7 billion in just 24 hours. FUD surrounding Gemini resulted in a spike in fund outflows.

The fears of users were worsened by the exchange pausing its Earn Program, which it partnered with Genesis Global Capital. Gemini paused the yield program, citing “extreme market dislocation” and “loss of industry confidence caused by the FTX implosion.”

The true effect of the FTX collapse on the crypto industry is still to be ascertained. More companies continue to announce different levels of exposure to the fiasco.

Binance to relaunch bid for Voyager Digital’s assets after FTX’s bankruptcy

As the effect of the FTX implosion engulfs firms linked with the exchange, including Voyager Digital, Binance US is now reportedly preparing to relaunch a bid for the bankrupt lending platform.

FTX’s deal to acquire the crypto lender for $1.4 billion has been canceled following the exchange’s bankruptcy filing. Voyager Digital has confirmed via its official Twitter handle that it is in talks with “several alternative bidders.”

In September, when the FTX $1.4 billion offer for Voyager’s assets was announced, Binance was involved in the bidding round but was rejected due to national security concerns.

Insider sources now claim Binance will relaunch its bid to acquire Voyager Digital as the budding process has been reopened. Voyager’s native token VGX jumped as much as 50% after reports of the Binance.US bid surfaced.

The reports follow Changpeng Zhao’s announcement that his exchange will set up an industry recovery fund to help rebuild the industry.

Trust Wallet Token (TWT) rallies through crypto crisis, gains 100% in seven days

The collapse of FTX strengthened customer distrust in centralized exchanges (CEXs). The distrust made them turn to self-custody, making decentralized exchanges (DEXs) and DeFi the winners of the FTX implosion.

Trust Wallet, a lead DEX, has been the biggest beneficiary that crypto users flocked to. Its native token, Trust Wallet Token (TWT), has spiked as a result, gaining more than 100% in the last seven days.

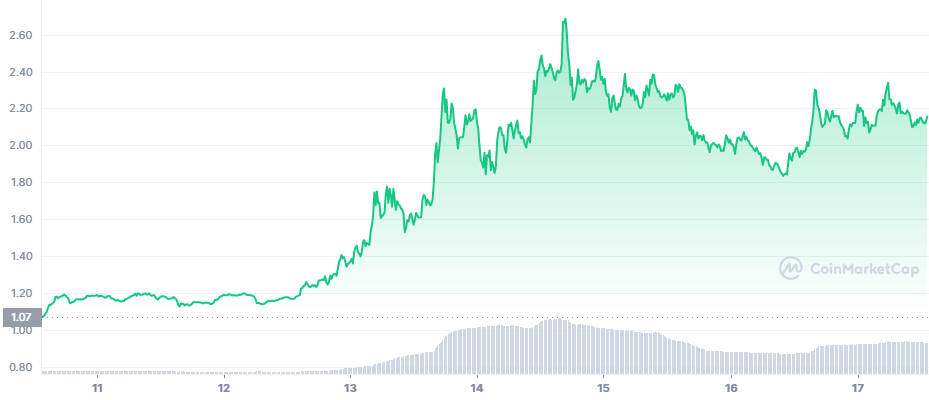

The 7-day price chart for Trust Wallet Token (TWT). Source: CoinMarketCap

TWT has been the biggest gainer in the last seven days, and today as well, gaining more than 12%. As a result of the price boost, TWT has touched a new all-time high at $2.39. Trust Wallet is now ranked as the 46th biggest crypto, with a market cap of $900 million.

While market leaders like Bitcoin (BTC) and Etherum (ETH) are down 65% and 68% since the start of the year, TWT has rallied by more than 195% year-to-date. This shows how quickly the decentralized project has grown.

The year-to-date price chart for Trust Wallet Token (TWT). Source: CoinMarketCap

The rally of the Trust Wallet Token highlights how DEXs are benefiting from the growing mistrust in CEXs.

FTX investors sue Bankman-Fried, celebrities that promoted the exchange

In the wake of the far-reaching consequences of the FTX implosion, Sam Bankman-Fried, and roughly a dozen celebrities who endorsed the exchange, have been slammed with a class action lawsuit filed by FTX users.

The lawsuit claims celebrities including basketball stars Stephen Curry and Shaquille O’Neal, the recently divorced Tom Brady and Gisele Bünchen, and tennis star Naomi Osaka “vociferously” promoted FTX.

According to the lawsuit filed by investors, the bankrupt exchange took “advantage of unsophisticated investors from across the country.” The lawsuit claims it owes American investors over US$11 billion in damages.

The lawsuit filed by attorneys from the Moskowitz Law Firm and Boies Schiller Flexner LLP, through an FTX investor, claims FTX was a “deceptive” platform that “made numerous misrepresentations and omissions.”

The lawsuit adds more legal pressure to SBF, as regulators seek to manage the effects of FTX’s implosion.