SEC Postpones Verdict on Grayscale’s Solana and Litecoin ETFs

0

0

Highlights:

- The US SEC has revealed it will not take immediate decisions on Grayscale’s Solana and Litecoin ETFs.

- The regulator said it needed more time to evaluate these applications.

- SEC raised concerns about compliance with the Securities Exchange Act of 1934.

On Tuesday, the United States Securities and Exchange Commission (SEC) postponed its verdict on Grayscale’s Solana (SOL) and Litecoin (LTC) ETFs. For Grayscale’s Solana ETF’s trust, the regulatory watchdog showed concerns about its compliance with the Securities Exchange Act of 1934. Similarly, the commission raised concerns about Grayscale’s Litecoin ETF trust meeting the minimum legal market conditions.

The SEC has delayed its decision on the Grayscale Spot Litecoin ETF, encourages interested persons to provide comments.https://t.co/IQPoYsw1Uo https://t.co/m57aXDVgP4 pic.twitter.com/eIwcnAUBMI

— Litecoin Foundation

(@LTCFoundation) May 13, 2025

The latest delay comes just a few days after the SEC postponed its decisions on several ETF applications. One recent postponement involved Canary Capital’s Litecoin ETF filing. The SEC said Nasdaq’s proposal to list the ETF might have fallen short of the regulatory requirements. Hence, it postponed its decision to June 9, while the deadline for accepting public opinions on the ETF was May 26.

In March, the SEC announced plans to postpone several ETF approvals, including applications for Grayscale’s Dogecoin (DOGE) ETF, Cardano (ADA) and XRP ETFs. Other delayed proposals were 21Shares and Canary Capital’s filings for XRP and Solana.

UPDATE:

SEC has delayed the @Grayscale Spot Solana ETF. pic.twitter.com/254Jl1mAK8

— SolanaFloor (@SolanaFloor) May 13, 2025

Litecoin and Solana’s Price Reaction to the Latest Delay

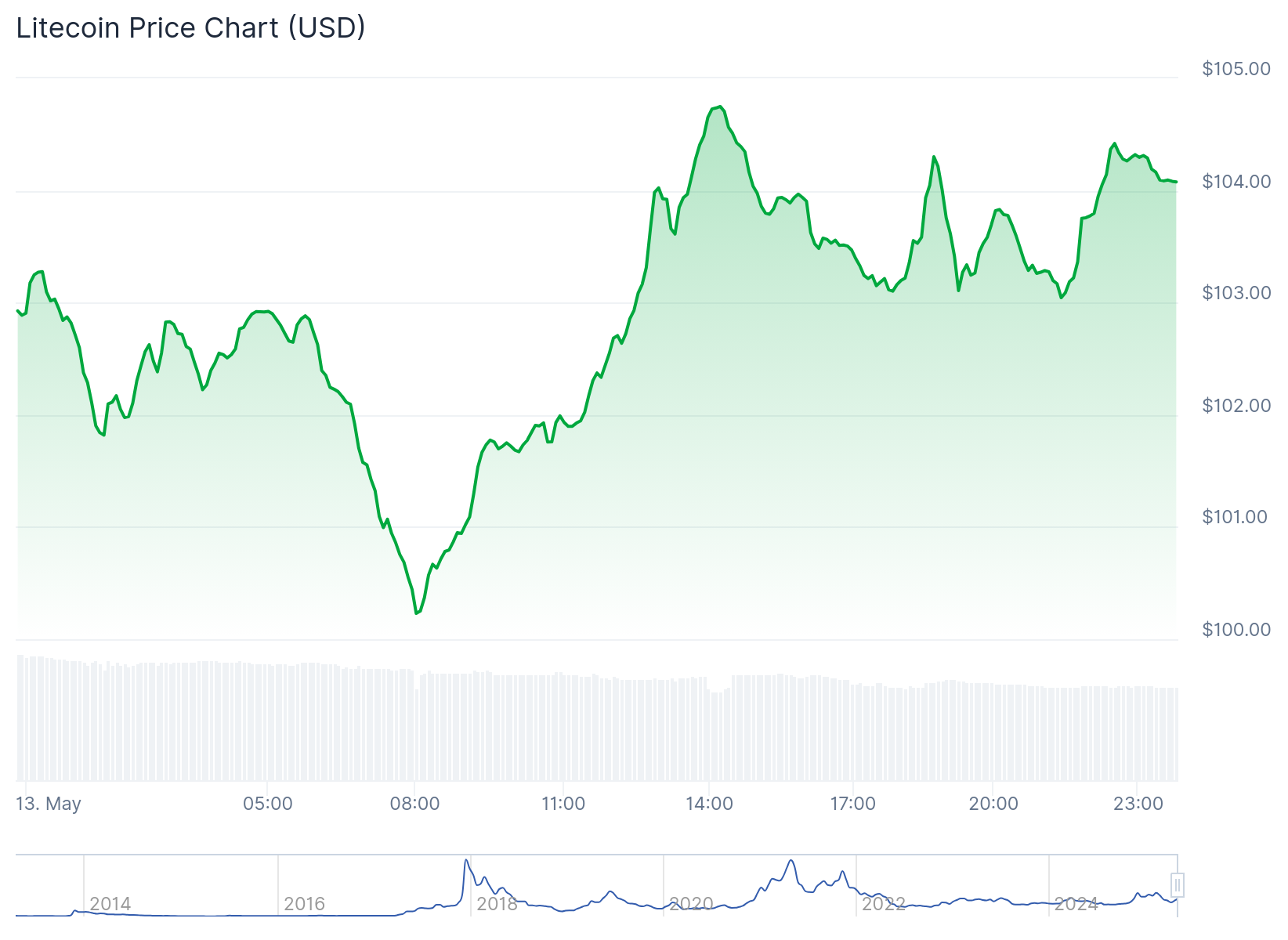

After the SEC postponed Canary Capital’s Litecoin ETF application, the token reacted by dropping by about 7%. However, LTC is currently up 2% in the past 24 hours, trading at about $104.24, according to CoinGecko data. Within a day interval, LTC fluctuated between $100.23 and $104.75, which means the ETF delay did not negatively impact its price actions.

As a result of its recent slight upswing, Litecoin’s market capitalization rose to about $7.9 billion. Similarly, SOL appreciated 7%, changing hands at about $181.63. SOL has gained about 24.3% in 7 days, 23% in 14 days, and 35.6% this month. The token is ranked the sixth most valuable cryptocurrency with a $94.35 billion market capitalization.

SEC Postpones BlackRock’s Amended Filing for In-Kind Creation

Aside from Grayscale’s Litecoin and Solana ETF approval delays, the SEC also postponed BlackRock’s updated S-1 application for in-kind creation. According to a filing made on Tuesday, the SEC is now seeking public comments on the proposal.

The agency said:

“The Commission is instituting proceedings pursuant to Section 19(b)(2)(B) of the Act9 to determine whether the proposed rule change should be approved or disapproved. Institution of proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change.”

In January, Nasdaq asked to allow in-kind redemptions for the iShares Bitcoin Trust. Last year, the ETF only allowed cash redemptions, which meant BlackRock had to sell Bitcoin to return cash to investors. The SEC preferred cash redemptions because it was easier to manage and follow rules. Allowing in-kind redemptions could make things quicker and cheaper for investors.

However, the SEC still has legal and policy concerns that need to be addressed before deciding. But the SEC still has legal questions and is not ready to decide yet. The SEC has started proceedings under Section 19(b)(2)(B) of the Exchange Act, recognizing the issue’s complexity.

The SEC has postponed its review of the Grayscale Spot SOLANA ETF, Grayscale Spot Litecoin ETF, and the iShares Bitcoin Trust’s proposed rule change for in-kind creation and redemption to allow for further assessment. https://t.co/G128IaD1CV

— Wu Blockchain (@WuBlockchain) May 13, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.