What Sets Delta Exchange Apart in the Crypto Options Market: India’s First FIU-Registered F&O Exchange

0

0

The post What Sets Delta Exchange Apart in the Crypto Options Market: India’s First FIU-Registered F&O Exchange appeared first on Coinpedia Fintech News

Delta Exchange India is India’s first FIU (the Financial Intelligence Unit of India) registered crypto F&O Exchange. In simpler words – it’s the first to be bringing crypto options and futures to the Indian audience in Bitcoin and Ethereum, while completely complying with Indian regulations.

This Indian arm of Delta Exchange retains its simple user interface and chooses to provide derivatives only in the top two, most trusted cryptocurrencies in the market. So even newcomers can be worry-free while making their crypto options trades.

What’s more, while trading with Delta Exchange India, you are not in direct possession of crypto at any point during the trade, which means you get to avoid the steep taxes that come with earning or trading ‘virtual digital assets’ in India.

So the overall takeaway is that Delta Exchange India brings several unique benefits its peers are yet to offer, and we’re going to delve into them in more detail, but first: what exactly is crypto options trading?

What are crypto options?

Crypto options are one form of crypto derivative contracts. With a crypto options contract, you can bet on the price of a crypto at a certain point of time in the future (maybe a day, a week, or a month later, for example), and agree to exchange a certain amount in accordance to your predictions at the point of expiry.

So say you expect the price of Bitcoin to go up by about $5k in a month from now – you can get into a Bitcoin options contract accordingly and agree to exchange a value based on that one month later.

There’s an added benefit to crypto options though: you are not obligated to honor this contract. If your prediction does not come to fruition, you are at liberty to let the contract expire without any money changing hands.

But there’s an upfront cost or a premium you pay when you buy a crypto options contract. So if you let the contract expire, you stand to lose only that, a small price to pay in the face of a market that goes the opposite way than what you expected.

Now that we’ve got the basics over with, it’s time to explore the specific benefits you get when you trade through Delta Exchange India.

What are the unique benefits that Delta Exchange India offers?

When you onboard Delta India and attempt to trade the crypto options they have on offer, you get a handful of unmissable advantages, namely:

- Daily, weekly, and monthly expiries in crypto options so all traders can find something that suits their trading/investing needs.

- Small lot sizes, with Bitcoin contracts starting at INR 5,000 and Ethereum contracts starting at INR 2,500 so you have an easy time getting started.

- 24×7 customer support, which is great for beginners and can help you out at any time in the day if you face any issues or want any questions answered.

- Advanced risk management techniques are employed so traders can enter larger trades with less capital, and lesser risks on top!

- You never come in direct contact with crypto when you trade on Delta Exchange India, you can only deposit INR and withdraw in the same currency. This brings a plethora of advantages:

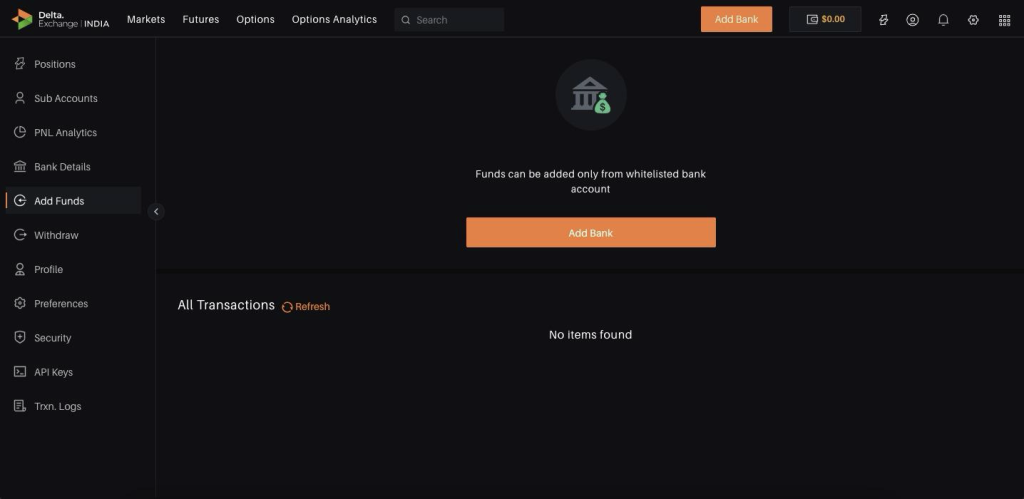

- You can make a bank transfer to deposit INR in your Delta India account. Once you create an account and add your bank details in the “Add Funds” section, it is first whitelisted by the Delta India team. Once you’re past that, you can make transfers to Delta India’s account and begin trading.

- Withdrawals can be made by simply entering your bank account details too.

- All Delta India contracts are quoted, margined, and settled in USD. The USD-INR exchange rate on the exchange is fixed, and your balance is maintained in INR, so you don’t need to concern yourself with any currency conversions.

- Since you never possess any crypto at any point in time when you trade with Delta Exchange India, you don’t need to worry about any of the taxes the Indian government imposes on crypto traders.

- Again, Delta Exchange India is registered with FIU-India, ensuring 100% compliance with the government-provided crypto guidelines.

The bottom line is: that Delta India seems to promise a stress-free, simple, and convenient crypto options and futures trading experience for the Indian audience.

Keep up with Delta Exchange India through their official website, and follow them on X and Instagram for platform updates.

0

0